.png)

Gurumurthy, ex-central banker and a Wharton alum, managed the rupee and forex reserves, government debt and played a key role in drafting India's Financial Stability Reports.

November 17, 2025 at 6:11 AM IST

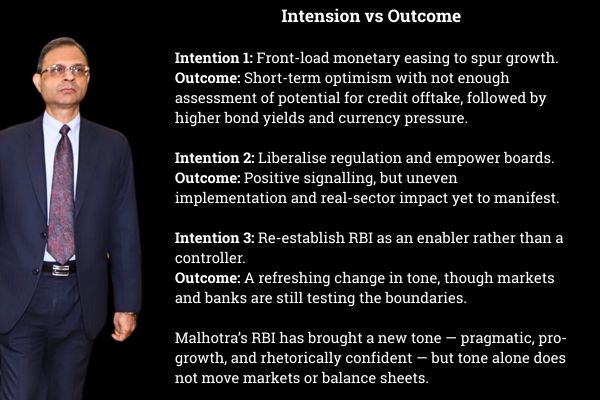

Almost a year into his tenure, RBI Governor Sanjay Malhotra has made Mint Street sound fresher, bolder and, at times, more human. His speeches read like essays, his policies like experiments. He has challenged the old orthodoxy of “stability above all,” even as he vouches for financial stability, choosing instead to front-load growth, loosen regulatory binds, and trust the judgment of India’s bankers.

It’s been an eventful debut — one that was intellectually ambitious, but viewed by sceptics as occasionally over-zealous, and at times carries a sense of subtle contradictions. But in a climate where even the best intentions are dissected with relentless scrutiny, no figure, however well-meaning, can fully escape criticism.

June Gamble

Malhotra’s defining moment came in June 2025, when he chose to go big and early. The RBI slashed the repo rate aggressively and paired it with a steep CRR cut, flooding the system with liquidity. The message was clear: India’s central bank would not wait for global cues to back domestic growth.

It was a bold, front-loaded move meant to rekindle investment sentiment. But the rate markets responded with their own mind. With the RBI seen as having fired its best shot, expectations of further rate cuts vanished, and government bond yields ironically rose.

The result: instead of catalysing credit, the cut ended up flattening rate expectations, having taken away any trading interest in interest rate products. The only sustained interest then was from banks chasing higher yields in state development loans, aided by the Held-to-Maturity, or HTM, buffer. Investment money drifted away from the Centre’s bonds to the states’ paper. What was meant as a growth stimulus morphed into a yield-seeking detour.

It was a reminder that monetary activism, like all fine art, depends on timing and that sentiment can be as volatile as liquidity. It was also a reminder of why the separation of debt management from the central bank never happened, and the coordination of subtle monetary and fiscal policies embedded in RBI’s operations has been vindicated.

When credit demand is muted, and government expenditure is the key to economic performance, the monetary policy (both through rates and liquidity) should move in tandem with the government borrowing programme.

Central banking orthodoxy may take an objection but so be it!

Reformer Within

The October 2025 package allowed banks greater latitude in financing mergers and acquisitions, relaxed exposure norms for IPO and capital-market funding and clarified operational freedom for subsidiaries. The intent was unmistakable: empower boards, not micromanage them.

At a major banking conclave, Malhotra framed it crisply:

“No regulator can, or should, substitute for boardroom judgment, especially in a diverse country such as ours. Each case, each loan, each deposit, each transaction is different… We need to allow the regulated entities to take decisions based on merits of each case, rather than prescribing a one-size-fits-all rule. This will enable regulated entities to experiment and innovate, learn and improve.”

It was a message rarely heard from an Indian central banker.

Freedom, But Not License

Where the RBI should step back is clear. It has no business running banks’ P&Ls, second-guessing pricing decisions, or micromanaging operational judgment. Over-regulation breeds fear and dulls innovation.

But where the RBI must step in is equally vital.

Macro-prudential oversight cannot be outsourced to boards. When the system as a whole starts leaning too heavily into one segment — say, retail credit — or synchronises exposures to a particular asset class, it’s no longer a board issue. It’s a systemic one.

That distinction is crucial. Regulators should keep away from the boardroom, but never from the balcony, the vantage point from which they can see contagion risks before individual boards can; the fallacy of composition.

Indeed, the need for that oversight is underscored by history. The collapse of YES Bank and recent governance questions at IndusInd Bank showed what happens when boards fail to check excesses or chase short-term gains. Board autonomy without regulatory vigilance risks repeating old mistakes under new rhetoric.

Malhotra’s challenge, therefore, is not to decide whether the RBI should trust boards, but how much, and under what guardrails.

Credit Where Due

How else could Indian banks catapult into global rankings?

Equally, his defence of regulatory humility, the idea that the RBI should “safeguard, not stifle”, is intellectually honest. By kicking off the Regulatory Review process to revisit rules every few years, he showed a long-term institutional mindset.

But Malhotra must now temper idealism with sequencing. Front-loading rate cuts before fiscal or structural levers were aligned have shown how good intentions can misfire.

Similarly, banking liberalisation without ensuring governance discipline can invite familiar pitfalls. After all, RBI’s credibility depends not only on boldness but also on balance, the ability to course-correct quickly when markets react unpredictably.

In that context, one aspect that warrants greater clarity — assuming supervision is an extension of regulation, even if functionally distinct — is the need to recognise that regulation must internalise supervision. In other words, whenever regulatory norms are relaxed, supervisory capacity must be recalibrated to align with the broader risk landscape that such relaxation creates for the industry.

Epilogue

It was a small, almost charming eccentricity, but may also be revealing. He seems to understand that in policymaking, as in literature, no story ends neatly. Every conclusion invites a sequel. Every reform needs a revision. Every success carries an asterisk.

And that’s where he stands now - between bold reform and fragile outcome, between deregulation and oversight, between freedom and friction.

Maybe it is time he had measured his pace, letting policy catch up with vision and letting governance maturity justify autonomy. He then could be remembered as the governor who taught the RBI to breathe a little freer.

His own “epilogue” should not end up reading like an unfinished chapter, eloquent, ambitious, but still waiting for the perfect balance between trust and control.