.png)

Mint Owl tracks markets and policy with a steady eye, offering clear analysis on the choices shaping India’s economy and financial system.

November 19, 2025 at 11:05 AM IST

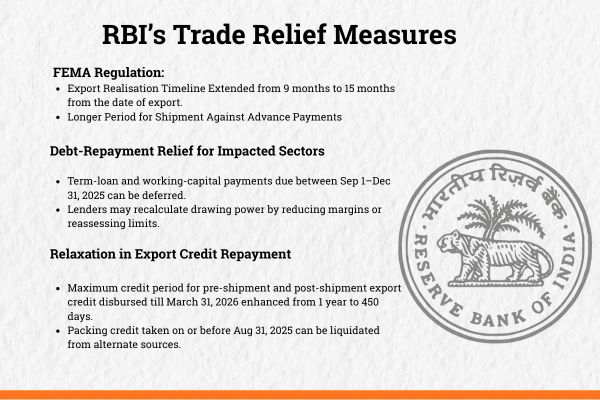

India’s central bank moved on November 14 with a package of trade relief measures designed to cushion exporters from the turbulence created by the United States’ shifting tariff stance. The announcement did not come as a surprise to those who have watched the Reserve Bank of India over the last decade, since the contours of its crisis playbook have become familiar. The institution has learnt that waiting for clarity, defining the scale of the problem, working with precise information, and intervening only with clearly bounded support yields better outcomes than sweeping forbearance.

The pattern has been consistent. The RBI does not react in haste when policy signals from major partners are in flux. It waits to see whether a trade deal is genuinely imminent, assesses the depth of the disruption, maps the sectors that face the sharpest impact, and then crafts relief that is controlled, rule-bound, and confined to those who genuinely need it. Once announced, this support comes with explicit eligibility filters, pre-set timelines, and clear reporting requirements. The monitoring is continuous and the expiry conditions are visible upfront, giving firms temporary room to restructure their plans without creating space for misuse.

This approach has been honed through repeated shocks. The COVID-19 period forced the RBI to strike a delicate balance between cushioning the economy and preventing a build-up of future stress. The moratoriums, restructuring frameworks, provisioning rules, and sunset clauses introduced then were refined through close coordination with banks and regulators. Those guardrails proved effective and left the financial system with fewer scars than earlier episodes of wide-open forbearance. By contrast, the global financial crisis response — which allowed liberal restructuring — seeded a decade of non-performing assets, recapitalisation pressures on public sector banks, failures in parts of the non-banking sector, and stress at smaller lenders. These experiences remain deeply etched in the institution’s memory.

The trade shock of 2025 has required similar vigilance. Over the year, uncertainty around US tariff policy has unsettled global trade flows and clouded India’s export outlook. President Donald Trump’s decision to walk back from early negotiations and pursue sharply higher tariffs on Indian goods, ostensibly linked to oil purchases from Russia, has weighed on sentiment and created binding risks for several sectors. Through this period, the RBI has maintained active liquidity management, kept its policy stance steady, and remained closely engaged with the government, banks, industry bodies, and exporters to understand the precise nature of the strain.

The measures unveiled in last week reflect that groundwork. They offer breathing space to affected exporters without creating an open-ended escape route. Banks are required to maintain heightened monitoring, report exposures periodically, and ensure that only those demonstrably hit by the tariff disruption receive relief. The emphasis on discipline is deliberate, since the RBI’s assessment is that the shock is significant but not systemic, and that the economy’s broader financial buffers remain intact. The central bank has also left room for adjustments to timelines or thresholds, which can be made swiftly if the information flow from institutions points to a wider or more persistent impact.

For now, the package buys time until trade negotiations regain momentum or policy clarity emerges from Washington. If the US–India impasse persists, further measures may be warranted and would likely be coordinated with fiscal actions from the government. Yet the thrust of the current response is clear. In periods of external uncertainty, the RBI prefers targeted, temporary, closely supervised support that stabilises confidence without reopening the door to future asset-quality problems. In an environment defined by trade frictions and volatile signals from major economies, that discipline remains one of India’s most valuable policy anchors.