.png)

By Madhavi Arora

Madhavi Arora is Chief Economist at Emkay Global Financial Services, where she focuses on macroeconomic research and asset allocation strategies.

October 9, 2025 at 6:48 AM IST

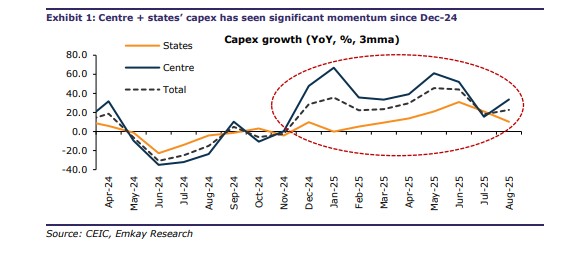

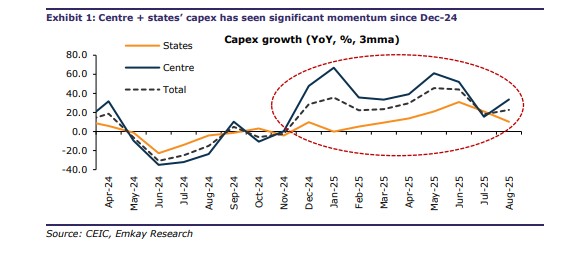

The government’s capital spending figures present a picture of robust public investment. In the first five months of 2025-26, the Centre has already spent nearly 39% of its budgeted outlay, recording a 43% year-on-year increase. State governments, too, have raised their capital expenditure by 14%, with 18 key states utilising 21% of their annual targets. At first glance, this indicates sustained fiscal momentum and efficient early-year execution. Yet the composition of this spending suggests that much of the apparent acceleration is optical rather than structural.

Part of the surge is explained by the low base effect, as capital spending was held back until late in the third quarter of 2024-25 during the general election period. Capital expenditure during April-August last year had declined by 19.5% year-on-year. Once the election-related restraint was lifted, subsequent disbursements naturally produced an outsized growth number.

Several one-off items have further inflated the headline figures. The telecom sector alone accounts for ₹179 billion of capital spending, primarily for the recapitalisation of BSNL and the BharatNet programme, reflecting a 722% increase over the previous year on a small base.

Food and Public Distribution has seen an expenditure of nearly ₹500 billion, up sharply from ₹3.3 billion a year ago, which represents a ways and means advance to the Food Corporation of India that will be returned before the year ends. Loans to states, which form part of the Centre’s capital outlay, have also grown 78%, lifting their share in total capital expenditure to about 20%, from less than 10% in 2021-22.

Excluding such one-off transfers and advances, the Centre’s core capital expenditure still shows a respectable 16% rise, compared with a budgeted increase of 5%. The underlying momentum is strongest in sectors such as Defence, where spending is up 54%, followed by Railways at 9% and Roads and Highways at 11%.

Housing and Urban Affairs is the notable laggard with a decline of 4%.

Importantly, the government has not used the ₹417 billion of placeholder capital outlay parked with the Department of Economic Affairs, suggesting that fiscal management remains measured even as spending is frontloaded.

For the states, the pattern is similar but more restrained.

Despite weak revenue mobilisation and a build-up of welfare-related expenditure, they have managed to sustain capital outlays. Over the past two years, the states achieved 88–89% of their budgeted targets, compared to a 10-year average of 80%.

Their combined capital expenditure in April–August rose 14%, supported by transfers from the Centre but tempered by their own limited revenue growth. Total receipts for the 18 states rose only 3%, partly due to delayed tax devolution, while revenue expenditure grew 8%. This imbalance has kept their fiscal deficits above 3% of GDP for three consecutive years, slightly exceeding the 3.2% budget target.

If the current trend holds, general government capital expenditure is likely to reach around 5% of GDP in 2025-26, marginally below 5.1% in the previous year and lower than the 5.4% peak in 2023-24.

The Centre may face additional constraints later in the year from slower tax revenues and the effects of income tax sops and GST rationalisation, which could necessitate trimming of non-essential or miscellaneous spending to keep the fiscal balance under control.

The overall picture is one of cautious optimism.

While public investment continues to underpin growth, the headline numbers exaggerate the underlying momentum. Much of the increase reflects temporary accounting effects rather than a structural expansion in productive capacity.

The true strength lies in the consistent, though moderate, rise in core infrastructure spending. If this steadier pace is maintained, it would strengthen fiscal credibility and reinforce the foundations of medium-term growth, even without the appearance of a spectacular surge.