.png)

Gurumurthy, ex-central banker and a Wharton alum, managed the rupee and forex reserves, government debt and played a key role in drafting India's Financial Stability Reports.

November 6, 2025 at 7:37 AM IST

Meta’s $27 billion Hyperion financing takes the corporate design of modern firms that no longer seek to own everything they use, but to orchestrate capital, technology, and knowledge through intricate partner networks, to the next level. The deal illustrates the emerging 21st-century corporation: asset-light, networked, and financially architectural, reshaping the boundaries between ownership, control, risk, and — not least — equity and debt.

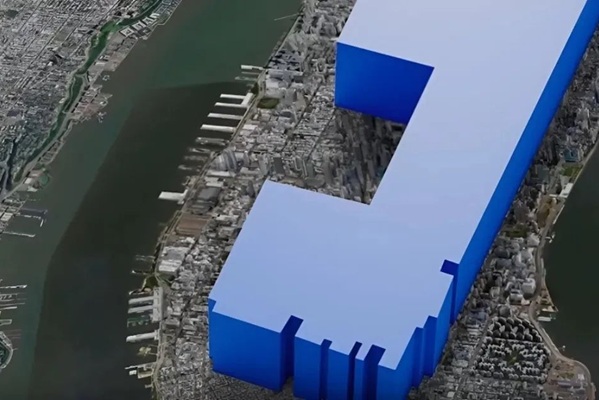

In October 2025, Meta Platforms announced it had secured around $27 billion in financing for its Hyperion data-centre project in Louisiana, the largest private-credit transaction ever by a non-financial company. Structured through a special purpose vehicle jointly owned with Blue Owl Capital, the arrangement lets Meta retain operational control while placing most of the debt within the SPV.

Under the deal, Blue Owl-managed funds hold about 80% of the Hyperion venture, with Meta retaining roughly 20%. The SPV finances construction and owns the asset, while Meta acts as principal operator and long-term tenant under lease agreements. The structure reduces the borrowing consolidated on Meta’s balance sheet, though it does not remove all obligations, a nuance crucial under accounting rules.

Meta’s announcement confirmed Morgan Stanley as lead arranger, with PIMCO and BlackRock as major investors. S&P Global Ratings assigned the debt an A+ grade (while affirming Meta’s AA- rating), noting that heavy debt on the balance sheet could depress both its rating and share performance. The notes were priced in a private 144A placement at yields near 6.5%, reflecting investor appetite for long-dated, quasi-infrastructure assets.

Beyond its headline size, the deal signals a shift in corporate finance. It aligns with John Kay’s The Corporation of the 21st Century (2024), in which firms evolve from asset-heavy hierarchies into orchestrated ecosystems powered by data, design, and partnerships.

The 21st-Century Corporation

Kay argued that modern corporations increasingly:

● Own intangibles such as brand, algorithms, IP, and data instead of heavy physical assets.

● Outsource capital-intensive operations to networks of specialist partners.

● Coordinate through contracts, not command hierarchies.

He cited emblematic examples: Apple, focused on design and brand while outsourcing nearly all manufacturing; Nike, which invests in marketing and innovation but not factories; IKEA, operating through suppliers and franchisees; and Amazon, orchestrating logistics and cloud platforms while third-party sellers handle inventory and delivery. Each embodies a shift from ownership to orchestration — from controlling things to controlling relationships, data, and knowledge.

Meta’s SPV: A Case Study in Networked Finance

Meta’s Hyperion structure mirrors these principles almost point for point.

|

Kay’s Principle |

Meta’s Execution |

|

Asset-light design |

The SPV owns the data centre, leaving Meta’s corporate balance sheet largely debt-light. |

|

Networked collaboration |

Blue Owl supplies capital; Meta contributes design, expertise, and lease guarantees. |

|

Contractual control |

Meta operates and leases the facility via long-term agreements instead of ownership. |

|

Focus on intangibles |

Value stems from AI models, platform integration, and data, not concrete and steel. |

|

Risk allocation |

Investors bear construction and financing risk; Meta bears operational and demand risk. |

Meta thus exemplifies the networked orchestrator: it controls strategic assets not through ownership, but through finely written contracts and control rights embedded in financial architecture.

Finance Reimagined

For many, “structured finance” still evokes the opacity of the pre-2008 era. Yet the Hyperion SPV belongs to a newer generation of structures that aim to redistribute risk transparently rather than conceal it.

The Hyperion bonds’ A+ rating rests on predictable lease revenues from Meta, while private-credit investors seek long-term, stable yields. Compared with pre-crisis collateralised vehicles, these instruments aim for:

● Balance-sheet efficiency instead of leverage multiplication.

● Risk transparency rather than risk transfer disguised as alchemy.

● Contractual clarity instead of off-the-books opacity.

Still, one question persists: Who truly bears the risk? Even with disclosure, large off-balance-sheet structures can test the limits of regulatory visibility.

Corporate Appeal

For global giants, this hybrid structure delivers a blend of prudence and agility:

● Credit preservation: Leverage and debt ratios remain healthy, sustaining ratings.

● Capital efficiency: Expansion continues without equity dilution.

● Risk-sharing: Construction and financing risks move to investors.

● Agility: Long-term leases convert heavy capital expenditure into predictable operating costs.

● Replicability: Once proven, the SPV template can finance other hyperscale data-centre or AI-infrastructure projects.

Meta can thus expand rapidly without inflating its balance sheet, an elegant expression of Kay’s nimble, knowledge-centric corporation.

Model Risks

The model’s brilliance comes with vulnerabilities that echo Kay’s own cautions:

● Hidden leverage: Lease liabilities may be off-balance-sheet, but remain binding obligations.

● Transparency gaps: Complex joint venture and SPV chains can obscure ultimate exposures.

● Technological obsolescence: Fast-moving AI and hardware cycles could erode data-centre values before amortisation.

● Governance asymmetry: Meta retains strategic control, while outside investors shoulder much of the construction and financing risk.

● Systemic implications: If widely copied, trillions in similar private-credit exposures could migrate beyond the direct view of regulators. (Meta allegedly has the approval of SEC for the structure).

Accounting treatment will hinge on control and residual risk tests, meaning part of Hyperion’s debt could still reappear on Meta’s books. Regulators and analysts will be watching those terms closely.

Networked Order

Meta is hardly alone. Across technology and infrastructure, networked finance is redefining corporate boundaries:

● Microsoft partners with data-centre REITs and renewable-energy developers to scale AI infrastructure.

● Amazon Web Services leases and securitises its server and logistics assets through long-term partnerships.

● Alphabet co-invests in renewable-powered data-centre ventures with energy and infrastructure funds.

The pattern is unmistakable: corporations are coordinating ecosystems of financiers, builders, and operators rather than expanding vertically. Ownership gives way to orchestration; balance-sheet heft gives way to design.

Owning Less

Meta’s Hyperion venture is a blueprint for the twenty-first-century corporation — one that:

● Owns less but controls more.

● Leverages capital without consolidating it.

● Coordinates ecosystems instead of commanding hierarchies.

Structured finance, once a byword for opacity, has become a strategic enabler of agility and scale. Whether this truly enhances resilience or merely redistributes risk remains uncertain.

What is certain is that Meta’s approach — grounded in partnership, financial engineering, and the management of intangibles — confirms John Kay’s argument. The modern corporation no longer thrives by owning everything it touches; it thrives by designing the flows of capital, technology, and trust that make ownership optional. Hence the skewed US stock market, dominated by cash-rich, asset-light, idea-driven firms that push debt and assets to others.