.png)

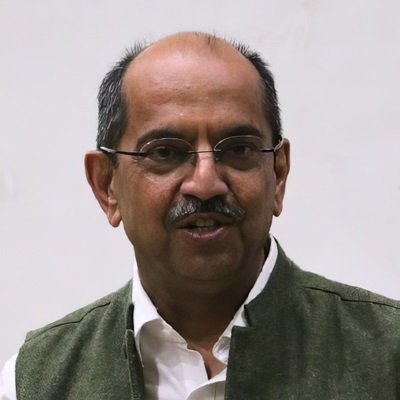

Vijay Singh Chauhan, a former IRS official, is a trade expert and Senior Visiting Fellow at Isaac Centre for Public Policy, Ashoka University.

January 1, 2026 at 4:35 AM IST

As a new year dawns, almost everyone who follows international trade, or is affected by its twists and turns, is hoping for a better tomorrow.

The year 2025 is over, but the disruption and realignment it unleashed are expected to continue to hold sway in 2026. While many expect the impact of those triggers at the American epicentre to become more visible in the months ahead, optimists envision a return to more placid times, driven perhaps by a judicious ruling by the apex court, SCOTUS, striking down the “reciprocal tariffs” under the International Emergency Economic Powers Act , or by pushback from aggrieved domestic players and trade partners.

The much-anticipated adverse consequences for the US economy have not really been visible, either in terms of slower economic growth, declining employment, or soaring inflation. At least not yet. Many international trade experts contend that they have not got their predictions wrong. They argue that the adverse effects of the exorbitant tariffs have simply been delayed and are likely to show up in 2026.

The US administration, led by President Donald Trump, considers its trade policies, which are clearly in violation of multilateral agreements, to be pragmatic decisions guided by the Make America Great Again vision. The policies aim to promote exports, while punitive import tariffs are intended to curb imports. In addition, the administration is negotiating trade deals to attract billions of dollars in foreign direct investment. In theoretical terms, this approach appears to hark back to mercantilism, an old-school economic idea discarded long ago, which envisaged maximising exports while simultaneously minimising imports to accumulate wealth, preferably in the form of gold.

However, it has not been uncommon in history for leaders to espouse old mantras, often in the name of pragmatism. To debunk such thinking, John Maynard Keynes famously observed: “Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.” The new year is expected to help differentiate between pragmatism and defunct ideas.

To draw further from theory, one can turn to Lerner’s Theorem to understand the impact of tariffs on exports. It postulates that tariffs (indeed, the punishing ones!) on imports may lead to retaliation by trading partners. While many of Washington’s trade partners have refrained from retaliation, China, the largest of them, has responded by imposing a slew of export controls on critical minerals, underscoring the urgent need for a stable international trade order.

While the year gone by witnessed moves by players such as Mexico, Vietnam, and Indonesia, showing signs of collaboration with either the US or China to guard against retaliatory actions, the new year is likely to see more such manoeuvres. High-frequency trade data shows signs of both realignment and circumvention, trends that are leading to the US Customs and Border Protection to tighten rules of origin. The rules of origin, which are integral to free trade agreements and simultaneously considered arcane by many, may become a frequently searched concept, as several countries rush in to have country-specific tariffs.

Early US trade data appears to validate the proposition that efforts to curb imports through tariffs are likely to dampen exports through channels such as resource shifts and currency appreciation, with a more definitive conclusion becoming possible this year.

At the bilateral level, with the US imposing a “reciprocal tariff” of 50% on most Indian exports, shipments from the US to India between May and October 2025 fell by 28.5%, while Indian exports to the US also weakened. With both countries facing adverse consequences from US tariffs, it is expected that the long “imminent” trade deal with the US will indeed materialise in the early part of the new year.

However, it would not be surprising if trade negotiations with the European Union are concluded before those with Washington. In the year gone by, India concluded more trade agreements, including with the UK, Oman and New Zealand, than in any previous year. It is expected that the government will push ahead to secure greater market access through additional trade agreements, effectively eliminating tariff barriers for Indian exports.

Hopefully, the government will move with equal zeal to put in place more efficient systems for Indian exporters to leverage these agreements and overcome more complex non-tariff barriers. These agreements include enabling provisions to develop such mechanisms, which will require more concerted efforts by the Ministry of Commerce and customs authorities. In this context, the recent rollback of some poorly designed Quality Control Orders, or QCOs, which were intended to curb imports but ended up hurting Indian exports, is welcome.

In exactly one month, Finance Minister Nirmala Sitharaman will present her ninth consecutive Union Budget, and all eyes will be on her to unveil the promised reforms to customs laws. It is expected that she will announce a set of reforms aimed at streamlining India’s tariff structure, promoting trade facilitation, and enabling India to secure a larger role in global value chains.

Yes, 2026 promises to be an action-packed year, with the hope that it will not be half as disruptive as the one we just bid bye to.

* Views are personal