.png)

Groupthink is the House View of BasisPoint’s in-house columnists.

August 12, 2025 at 4:39 PM IST

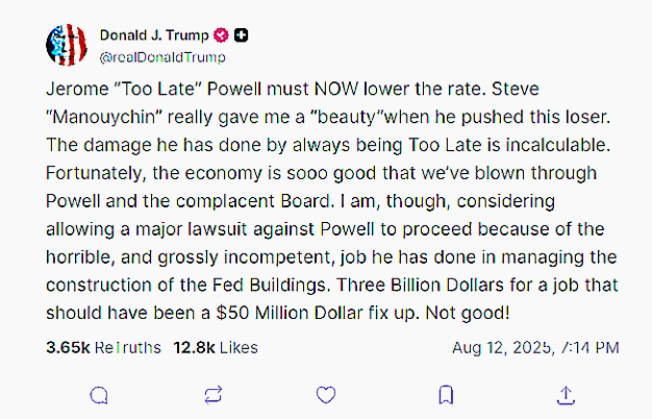

Jerome Powell did not sign up to be America’s most reluctant facilities manager. Yet somehow, thanks to Donald Trump, the man in charge of the US Federal Reserve now finds himself accused of botching the construction and upkeep of Fed buildings.

On paper, the complaint is about bricks and mortar. In reality, it is about interest rates. Trump wants them lower, and he wants them soon. The lawsuit threat over building management is simply the latest flourish in a long-running campaign to turn the Fed into another lever of presidential policy.

This is not new territory for Powell. During Trump’s first term, he absorbed a steady barrage of public demands for rate cuts, often in language that sounded like it had been lifted from a street-corner negotiation. This time, the script is the same, but the prop list has expanded to include HVAC systems and floor plans. It is politics as a home renovation reality show, the economy the house.

The trouble is, Powell has reasons for holding the line. Inflation has eased but not vanished. The labour market still has a pulse. Cut rates too soon, and prices could heat up again. Wait too long, and growth could stall. It is the kind of balancing act that keeps central bankers awake at night and politicians pacing in daylight.

Trump, of course, sees it differently. For him, monetary policy is a loyalty test. Lower rates, and the president can claim to have rescued the economy. Hold steady, and you are suddenly the man who cannot keep his own offices in shape. It is clever framing — absurd, but clever.

Powell’s defence has been to stay unruffled. No sharp retorts, no public sulking. Just the slow, careful cadence of a central banker explaining why economic data, not political calendars, guide his hand. It worked last time by making the noise fade into the background.

Yet the stakes are higher now. If the Fed bends visibly to political threats, it will dent its credibility far beyond US borders. Markets, investors, and other central banks treat that independence as a given. Lose it, and you cannot simply win it back with another press conference.

Still, the building angle will not go away quickly. A lawsuit over office renovations is easier to understand than a quarrel over the neutral rate. It gives television something to film and social media something to meme. And in the Trump universe, that is often the point.

The coming months will show whether Powell’s patience can outlast the theatrics. If growth steadies and inflation stays tame, his quiet defiance will look like wisdom. If the numbers turn, the pressure will come not just from the White House but from every corner of the economy.

For now, the Fed chair’s best move is the one he has already chosen — keep the focus on the work, not the noise. After all, the interest rate corridor is not a catwalk. And the Fed’s most important building is the one that does not appear in any architectural drawings: the wall between policy and politics.