.png)

Operation Frontload: RBI Fires All Weapons, Then Calls For Peace

RBI unleashed a surprise rate-and-liquidity barrage, then changed stance to neutral. Was this pre-emption, or a response to unseen threats?

Groupthink is the House View of BasisPoint’s in-house columnists.

June 6, 2025 at 7:26 AM IST

They called it a rate cut, but it looked more like a Military Operation, a full-spectrum monetary assault complete with a surprise Cash Reserve Ratio detonation. In a move that will be dissected in central bank training modules for years, the Reserve Bank of India swarmed its June policy meeting with a 50-basis-point repo rate cut, a 100-basis-point CRR reduction, and a hasty retreat to a “neutral” stance. All in one go. All very calmly announced.

After two cautious 25 -basis -point salvos in February and April, the RBI climbed the escalation ladder and unleashed its full firepower. This wasn’t just easing, it was a monetary offensive. Having fired its big bazooka, it then patted itself on the back for putting it away.

The RBI’s justification was simple enough: it has “achieved victory over inflation”, food prices are soft, core is benign, and the monsoon arrived early. The CPI is now expected to average 3.7% this year, with some quarters flirting in the high twos. In short, the stars aligned for a pre-emptive strike. After all, in RBI lore, when you see a rate action tomorrow, you act today.

The RBI’s move wasn’t just pre-emptive, it was an opportunistic deployment of policy space. With inflation receding and growth tepid, the MPC decided that waiting for more data would offer little strategic value. The stance shift was not ceremonial and was simply the logical end to a sequence of easing. The central bank wrapped intent and action into a single operation, using the inflation to complete the job.

But this was not just opportunism. It was also anxiety. Because now everyone’s asking what is the RBI seeing on growth that others aren’t? Inflation has given it space, yes. But is it also seeing a hard ceiling on India’s investment cycle? Are exports slipping more than official optimism lets on? Or is this just a case of playing it safe in a world where central banks, including the Fed, are running out of excuses not to cut?

The CRR cut was the real surprise. By releasing ₹2.5 trillion of liquidity over four tranches, the RBI has added an entire monetary arm to what was already an aggressive move. It’s like launching a land, air and sea operation and then pulling back the troops mid-announcement. The shift to a neutral stance is the rhetorical equivalent of slamming the door shut after storming the room.

The problem now isn’t with the rate cut itself. It’s with the aftermath. Banks are reeling not because they didn’t expect a rate cut, but because they got a liquidity bonanza with no clear place to go. Credit demand hasn’t been held back by funding costs. It’s been held back by the absence of willing, credit-worthy borrowers, especially in an economy where capacity utilisation is only slowly inching up and global trade conditions are anything but reassuring.

That’s where the real risk lies, not in inflation, not in growth, but in mispricing. Flush with funds, and starved of organic demand, banks may once again chase shadowy credit, push into unsecured retail, or inflate asset prices. We’ve seen this movie before, and it doesn’t end well. A 50-basis-point cut makes sense when there’s a robust queue of investment-starved enterprises. Not when the economy is wondering if the growth momentum will hold past the monsoon.

Which brings us back to the RBI’s communication. It frontloaded. It attacked. Then it slipped out quietly with a neutral stance and a reminder that monetary space is limited. The central bank wants to be seen as bold but measured, supportive and vigilant. But what it has really done is emptied its chamber, then asked markets not to expect another round. That’s not forward guidance. That’s a plot twist.

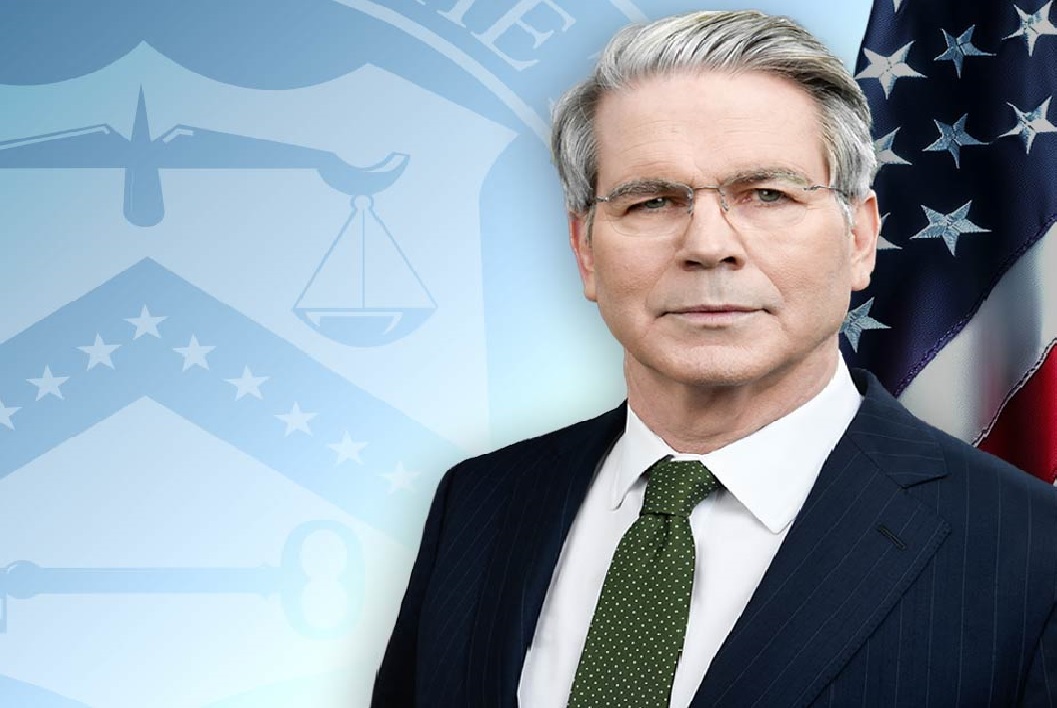

Governor Sanjay Malhotra’s RBI wants to project control on inflation, on liquidity, on growth expectations. But when you launch a full-blown operation and then signal a pause, you’re not controlling the narrative. You’re just hoping everyone else buys it.