.png)

Groupthink is the House View of BasisPoint’s in-house columnists.

June 21, 2025 at 4:23 AM IST

The minutes of the June 2025 meeting of the Reserve Bank of India’s Monetary Policy Committee offer a revealing look at a group wrestling with policy signalling, not just macroeconomic management. On the surface, the committee’s decision to cut the repo rate by 50 basis points while shifting its stance from accommodative to neutral has been explained in the post-meeting resolution. However, the minutes released on Friday reveal that the real driver was not data, but discomfort, specifically over how the easing cycle might be perceived if left unchecked.

Almost every member acknowledged that inflation had fallen faster than expected. Headline CPI at 3.2% in April is well below the 4% medium-term target, and forecasts for average inflation in 2025–2026 are now at 3.7%. Most members expect food prices to ease, commodity pressures to stabilise, and inflation expectations to anchor. On growth, however, the tone was more guarded. Members welcomed the 7.4% GDP print for January–March but noted the impact of soft private investment, slowing credit growth, and the drag from weak global trade. Demand recovery remains uneven.

On the face of it, this would appear to argue for sustained easing. And indeed, five of six members voted for a 50-basis-point cut, while Saugata Bhattacharya preferred 25 basis points. But then comes the pivot: despite backing a deeper cut, all of them also decided to abandon the accommodative stance adopted only two months ago. Why?

The most detailed explanation comes from Dr Rajiv Ranjan. He warns that pairing a 50-basis-point cut with an accommodative stance might lead financial markets to overprice the scale and continuity of rate cuts. This, he argues, could cause volatility later if the RBI needs to change course. Hence, a neutral stance is a kind of risk control, an insurance policy to preserve optionality.

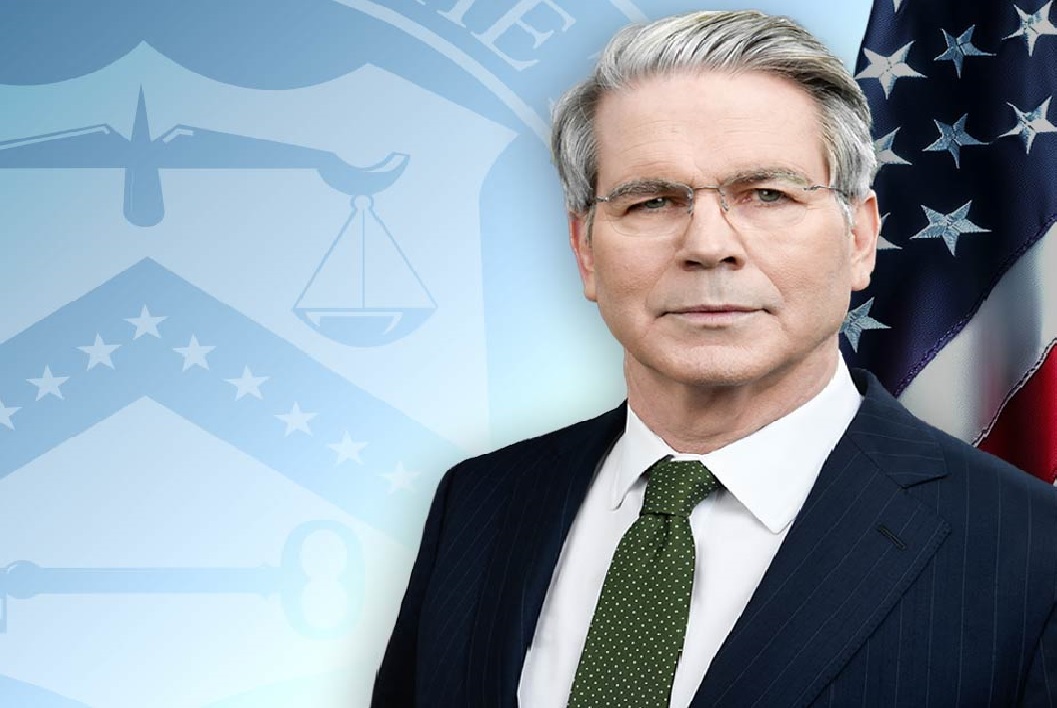

Governor Sanjay Malhotra echoes this rationale, framing the stance shift as necessary to preserve “policy space” in a world still rife with uncertainty. Others, like Dr Poonam Gupta and Prof Ram Singh, are more muted in their reasoning. While supportive of front-loaded easing, they describe the neutral stance as a pragmatic hedge against evolving risks. Dr Nagesh Kumar provides no real explanation for the shift.

Saugata Bhattacharya, for his part, remains the most cautious voice on the committee. He sticks to a smaller rate cut and flags persistent uncertainty. And yet, somewhat incongruously, he too supports the move to neutral, without articulating why a stance reversal so soon after April is now warranted.

Optics Overreach

What emerges is a portrait of a committee that believes it has room to ease but is wary of being seen as committed to a deep easing cycle. The neutral stance is less about fundamentals than optics, a message to markets not to get ahead of the RBI. The irony is that such hedging itself sowed confusion.

Most members argue that further rate cuts are likely. Yet the stance shift implies a pause, creating a split between action and guidance.

Several members, including Professor Ram Singh and Dr Nagesh Kumar, express concern that India is growing below its potential and argue that monetary policy must help push growth towards a more aspirational path. But this reasoning stretches the brief of monetary policy. It is one thing to ease financial conditions in a downturn; it is another to presume that lowering the repo rate can elevate trend growth, especially when the global economy is slowing. The belief that India must grow faster, and that monetary policy alone can achieve that outcome, is overextended.

There is no serious mention in the minutes of complementary fiscal measures, barring a passing reference by Nagesh Kumar, that they would be needed to enable sustained higher growth. Without that broader support, expecting interest rate cuts to do the heavy lifting risks placing too much faith in one instrument.

There’s also a question of coherence. If the inflation outlook justifies easing, and if transmission is still incomplete, does it make sense to withdraw the easing bias after a 100 basis point cut in four months? Especially when liquidity remains in surplus and the external outlook is uncertain?

Ultimately, the minutes reveal that the stance shift was more a communications strategy than a macroeconomic recalibration. The MPC is trying to do two things at once: send a strong pro-growth signal through front-loaded cuts, and dampen expectations of a deeper cycle. That may be tactically prudent, but it does make for a muddled message.

Markets can accept a flexible policy. What they struggle with is mixed messaging. On that count, the June minutes do little to clarify the RBI’s rate trajectory. They merely confirm that even within the committee, conviction is being traded for caution.