.png)

Dr. Srinath Sridharan is a Corporate Advisor & Independent Director on Corporate Boards. He is the author of ‘Family and Dhanda’.

April 23, 2025 at 5:55 AM IST

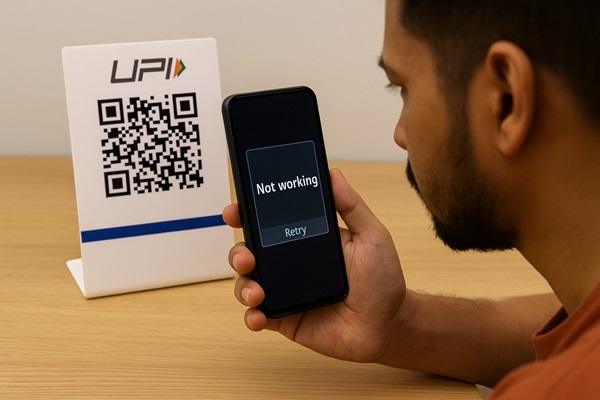

The recent outages experienced across India’s Unified Payments Interface network are more than momentary glitches—they are instructive stress tests of our digital financial infrastructure.

As India celebrates the scale and speed of UPI adoption—over 180 billion transactions processed last year—these milestones must also prompt a critical question: how can we embed resilience into systems that are now foundational to our daily economic life?

UPI’s success has been transformative, but concentration within any digital architecture—even one as trusted as this—creates systemic risk. The National Payments Corporation of India operates the bulk of retail digital payments infrastructure in the country, including UPI, Bharat BillPay, and RuPay. While NPCI’s design and governance structure has served the country exceptionally well, the sheer scale of its operations underscores the fragility of a single-point failure.

This is no indictment of NPCI’s competence—it has scaled one of the most sophisticated payment architectures in the world. But its very success now demands that we widen the base. This is not a commentary on capacity; it is a recognition of the responsibility to build a resilient framework as India becomes more digitally entrenched. Resilience, redundancy, and risk distribution are not post-facto fixes; they must be preconditions to scale.

Systemic Safeguards

The Reserve Bank of India’s earlier move to explore a New Umbrella Entity framework was grounded in this understanding. Although it was set aside in 2023 due to a lack of “truly innovative” proposals, the core objective of the NUE was about engineering institutional redundancy, building systemic buffers, and fostering healthy competition. These goals remain valid, if not urgent, especially in an age where cyber threats are pervasive and sophisticated.

According to the Indian Computer Emergency Response Team, over 1.5 million cyber incidents are reported annually. When a 30-minute outage can paralyse commerce, redundancy becomes non-negotiable.

The deadline extension for Third-Party App Providers to comply with a 30% market share cap until 2026 only delays addressing concentration risks. Currently, PhonePe and Google Pay together account for more than 80% of UPI transactions. A duopoly is not ideal in any market, least of all in digital payments. Delaying diversification, whether infrastructural or market-based, pushes risk into the future and increases our exposure to potential shock events.

India must now define Critical Digital Infrastructure in policy and regulation. Power grids, water supply systems, and telecom networks are subject to stringent standards and fallback protocols—why not digital payments? Embedding UPI and allied systems under a formal CDI framework would enforce higher thresholds for continuity planning, independent audits, cybersecurity readiness, and multi-layered incident response mechanisms.

A Public Utility Payments Resilience Fund—akin to climate resilience or public health emergency funds—could catalyse long-term investments in redundancy systems, cybersecurity upgrades, regional backup nodes, and alternative rails. A sovereign or regulated corpus would address areas where market incentives may underperform, particularly in funding capacity-building for offline payment modes, rural coverage, or edge computing capabilities.

While infrastructure is one axis of resilience, institutional architecture is another. One of the critiques of the initial NUE submissions was the homogeneity in ownership structures, often replicating existing concentration patterns.

A reimagined NUE framework must prioritise consortia spanning banks, cooperative institutions, fintechs, and regulated technology players—diversifying governance models and embedding safeguards. It should also be explicitly guided by policy mandates around continuity, redundancy, and risk dispersion—not just market share.

Policy must frame it not as a competitor to NPCI, but as a complementary rail with a multi-stakeholder infrastructure that diffuses control, distributes risk, and ensures uninterrupted service.

Critics will cite costs and complexity, but redundancy is cheaper than systemic collapse in digital public goods. The answer to scale is not singularity; it is modularity. India should now reimagine the NUE not as a marketplace innovation experiment—but as an investment in building consumer trust, and as its digital resilience strategy.

As the world’s most scaled real-time payment network, UPI has redefined speed. Now, India must redefine security. The next phase of growth hinges not on how many transactions we process, but on how seamlessly we survive the inevitable breach, outage, or attack.