.png)

The Wine and the Wallet: A Psychologist's Guide to Not Dying of Thirst

We clutch our money like a full glass, terrified of spilling. But the market rewards those who pour. Dāna and Aparigraha are practical tools that eliminate anomalies.

Kirti Tarang Pande is a psychologist, researcher, and brand strategist specialising in the intersection of mental health, societal resilience, and organisational behaviour.

November 5, 2025 at 7:42 AM IST

Markets don’t fail because humans are irrational; they fail because we cling too tightly. We’ve been sold the lie that greed is the engine of capitalism, but what if its most potent fuel is actually generosity? What if the problem isn’t a lack of self-interest but an overdose of self? The truth is, altruism doesn’t just make us good; it performs a kind of economic hygiene, scrubbing away the emotional grime that clouds judgment and stalls progress.

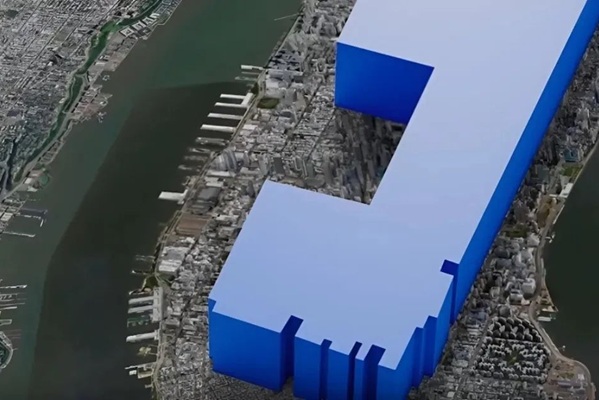

We are a world dying of thirst, clutching full bottles. We admire the vintage wine—its years of heritage, its rich colour, its potential for warmth and connection—but we cannot bear to pour a glass. To drink is to deplete; to share is to lose. So we sit, wallet fat and throat dry, in a self-imposed drought. This is the silent tragedy of the endowment effect, the psychological flaw where we overvalue what we own simply because it’s ours. We fall in love with the bottle and forget the purpose of the drink.

My grandfather often told me, “Always do good to others, because even the opposite of भला (good) is लाभ (auspicious profit).” His was a world where pouring from your cup didn’t mean less for you, but more for everyone. But then came school, and with it, cynicism. I read Khushwant Singh’s The Mark of Vishnu, where a boy’s attempt to save a cobra ends in his death. The moral seemed brutal: goodness punishes the good. I worried my yogic grandfather’s wisdom was too gentle for a Machiavellian world—a beautifully naive, Kantian fantasy. Yet I held onto his moral math, hoping it wasn’t a delusion. Years later, I discovered that science had vindicated him. Altruism, it turns out, is not a moral luxury; it’s a practical necessity for a smarter market.

The core of this discovery lies in a concept known as the endowment effect. Forget the academic jargon; think of it as capitalism’s emotional hoarding instinct. We fall in love with what we own, inflating its value simply because it’s ours. This isn't a rational calculation; it’s a primal clutch of possession. It’s why a dealer refuses to cut prices on unsold inventory, why an entrepreneur overvalues a failing startup, and why a farmer cannot put a price on land that is his identity. This instinct creates a chasm between what we’re willing to pay and what we demand to sell, gumming up the gears of exchange. We demand a king's ransom to part with our bottle but offer only pennies for another's. This isn't rational markets at work; it’s emotional gridlock.

Emotional Economics

This led to a question: What if we could learn to pour? What if we could loosen our grip? What if giving—the simple, profound act of altruism—could dissolve this attachment?

Experiments revealed a stunning correlation: when people performed small acts of generosity before valuing an item, the irrational gap between their buying and selling prices dramatically shrank. The more they gave, the less they were enslaved by what they owned. True altruism is the art of giving without gripping—a kind of emotional physics that teaches the mind to loosen its fist. The implication is profound: generous people trade more. They capture surplus, move resources, and drive markets toward their natural state of efficiency. Greed builds markets, but generosity sustains them.

This insight should force us to overhaul the "greed is good" catechism. Generous people aren’t chumps; they are the market’s most rational actors. Their prosocial preferences don't distort outcomes; they stabilise them. They see value clearly, unclouded by the ego’s desperate need not to lose. This isn't just a warm feeling; it's a cognitive advantage. What if the real market distortion isn’t government interference but human ego disguised as rational choice?

For an economy like India’s—perpetually balancing explosive growth with deep-rooted fairness—this is more than theory; it’s a blueprint. Our economic landscape is littered with the hidden costs of the endowment effect. We are a culture where relationships and pride are entwined with value, where possession is often confused with purpose. Now imagine softening that attachment—a cultural shift where a rupee given feels less like a rupee lost and more like a rupee set free. The act of giving reframes ownership from a state of possession to one of participation. For India, this reframing could unleash a wave of economic motion, unlocking assets and ideas frozen by emotional baggage.

Corporate India, perpetually torn between the cold logic of shareholder capitalism and the warm pull of collectivist values, should take note. This isn’t a call for philanthropy; it’s a strategy for cognitive precision. Behavioural research shows that when people act altruistically, they don’t just feel good—they think more clearly. A CEO who normalises generosity—by sharing credit, rewarding fairness, encouraging collaboration—isn’t promoting soft values; they’re engineering a superior operating system. They dismantle the territoriality that blocks innovation and the bias that inflates valuations. Altruism isn't kindness—it’s cognitive hygiene.

Our policymakers have a role to play, too. Our economic frameworks tirelessly reward saving and risk-taking but merely tolerate generosity. Tax incentives for giving exist, but they function as compliance rituals, not behavioural nudges. We’ve spent decades taxing generosity as softness. Maybe it’s time the state stopped rewarding greed and started subsidising grace. Imagine if digital platforms integrated micro-giving by default, or if public campaigns reframed charity not as moral exhibition but as economic efficiency: share value to create value.

The logic even extends to the frantic pulses of the stock market. An investor’s greatest enemy is emotion—the agony of holding a losing stock out of pride, or selling a winner too early out of fear. The altruistic investor, studies suggest, is less prone to these costly errors. The mindset of empathetic detachment that underlies generosity is, in fact, the very thing efficient markets have been missing. Empathy doesn’t cloud judgment; it calms it.

Western economists may treat this as a novel discovery, but India has practiced this psychological logic for centuries. Our traditions of dāna (charitable giving), seva (selfless service), and aparigraha (non-hoarding) were not just spiritual tenets; they were the world’s first behavioural designs for rational exchange. They trained individuals to engage without clinging, to participate without becoming prisoners of possession. My grandfather didn’t speak in equations, but his wisdom was building the first behavioural markets. Modern capitalism is only now discovering what our spiritual systems always knew: emotional freedom is the foundation of rational action.

As India stands at a crossroads of unprecedented opportunity and glaring inequality, capitalism must evolve. The invisible infrastructure of efficiency is emotional coherence. Just as clean data produces sharper analytics, clean motives produce smarter decisions. If altruistic behaviour quiets the chaos of human valuation, then promoting it is not moral charity—it’s essential economic maintenance.

Markets are psychological before they are financial. Efficiency emerges not from perfect competition but from imperfect humans learning to see value clearly. Structured altruism—nudged by policy, modeled by leaders, embedded in culture—can help Indian capitalism transcend its attachment traps. It replaces zero-sum competition with generative cooperation, proving that letting go can be the ultimate form of gain.

My grandfather didn’t speak the language of economics. But he knew what markets are only now remembering—that in the true, compounding arithmetic of life, भला and लाभ were never opposites; they were, and always will be, the same brilliant calculation.

So the next time you find yourself clutching—an asset, an idea, a grudge—ask yourself: Am I preserving the wine, or dying of thirst? The most rational thing you can do in a dog-eat-dog world is pour your neighbour a drink. The market, it turns out, will reward you for it.