.png)

By Sohini Ghosh

Sohini Ghosh is an independent financial journalist.

October 9, 2025 at 6:34 AM IST

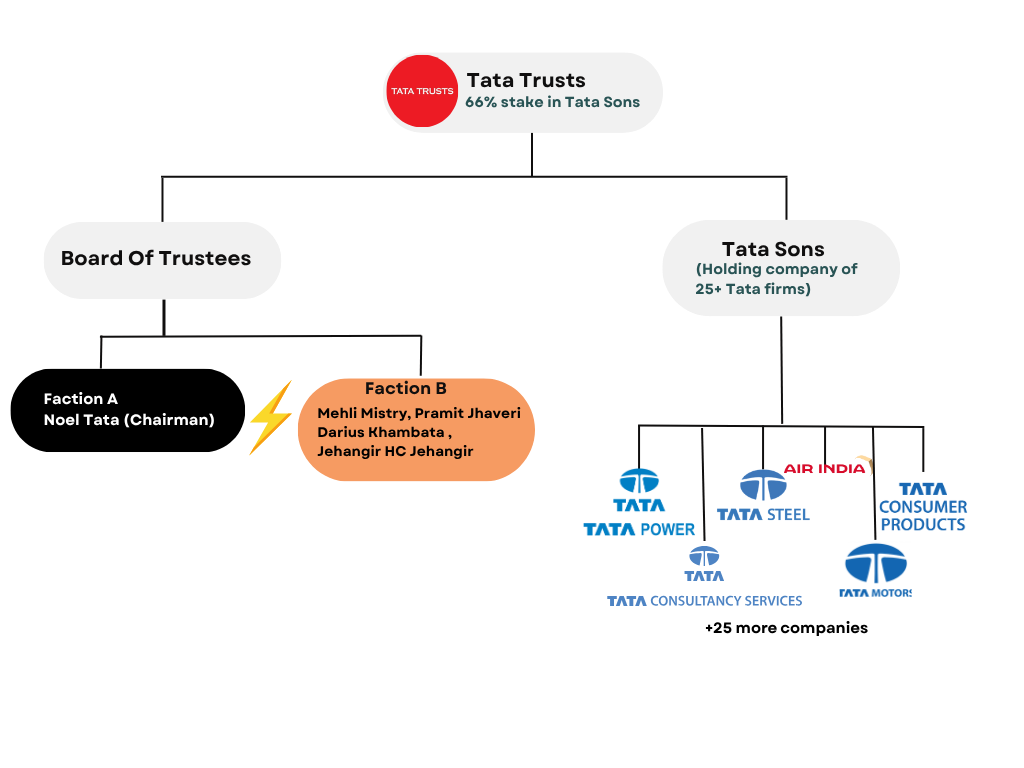

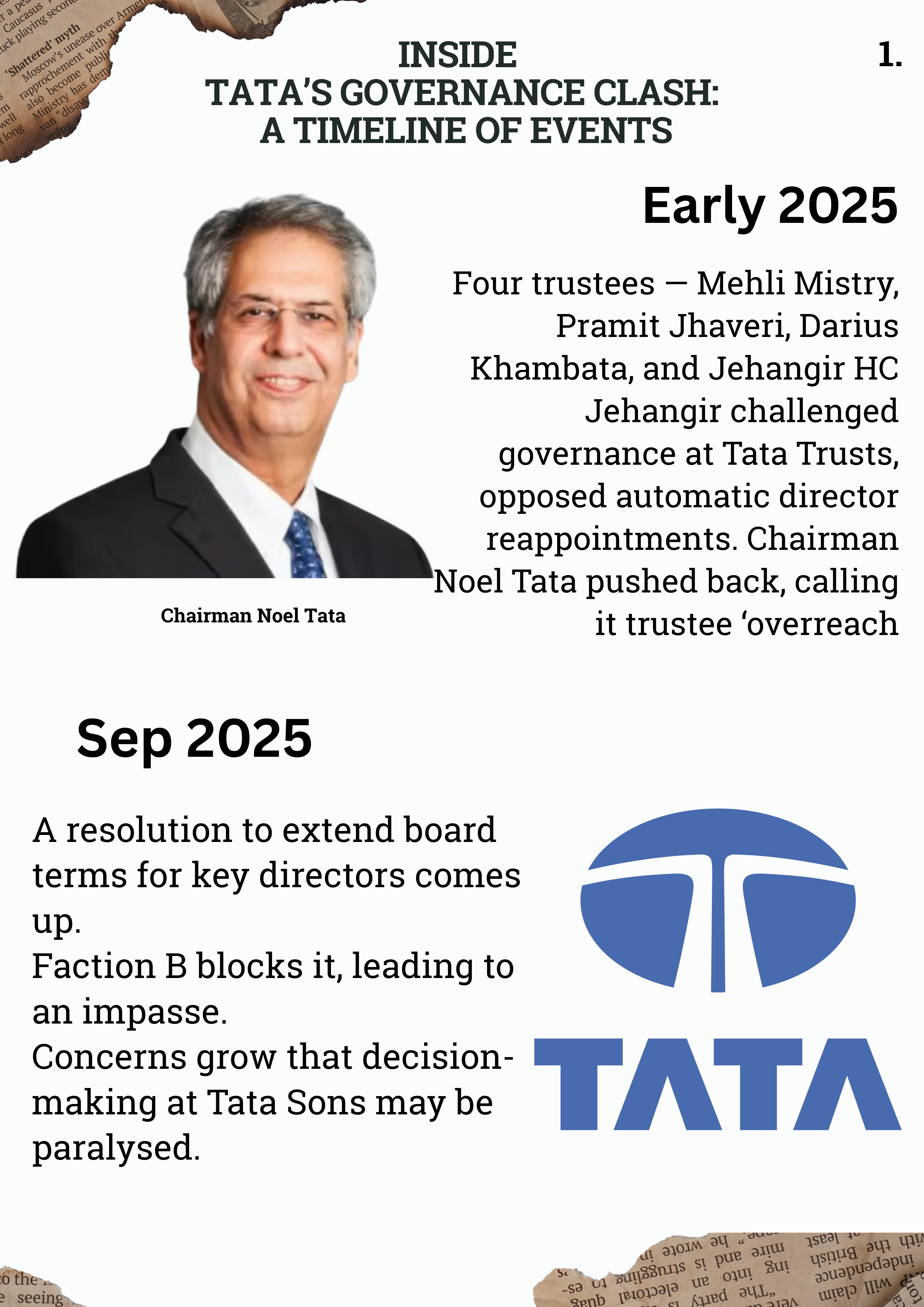

A reported rift inside Tata Trusts, the powerful body that owns 66% of Tata Sons, the promoter of Tata group of companies, has snowballed into a rare governance crisis—one serious enough to draw attention from New Delhi’s highest offices. Reports suggest that Home Minister Amit Shah and Finance Minister Nirmala Sitharaman have nudged the group’s leadership to restore order.

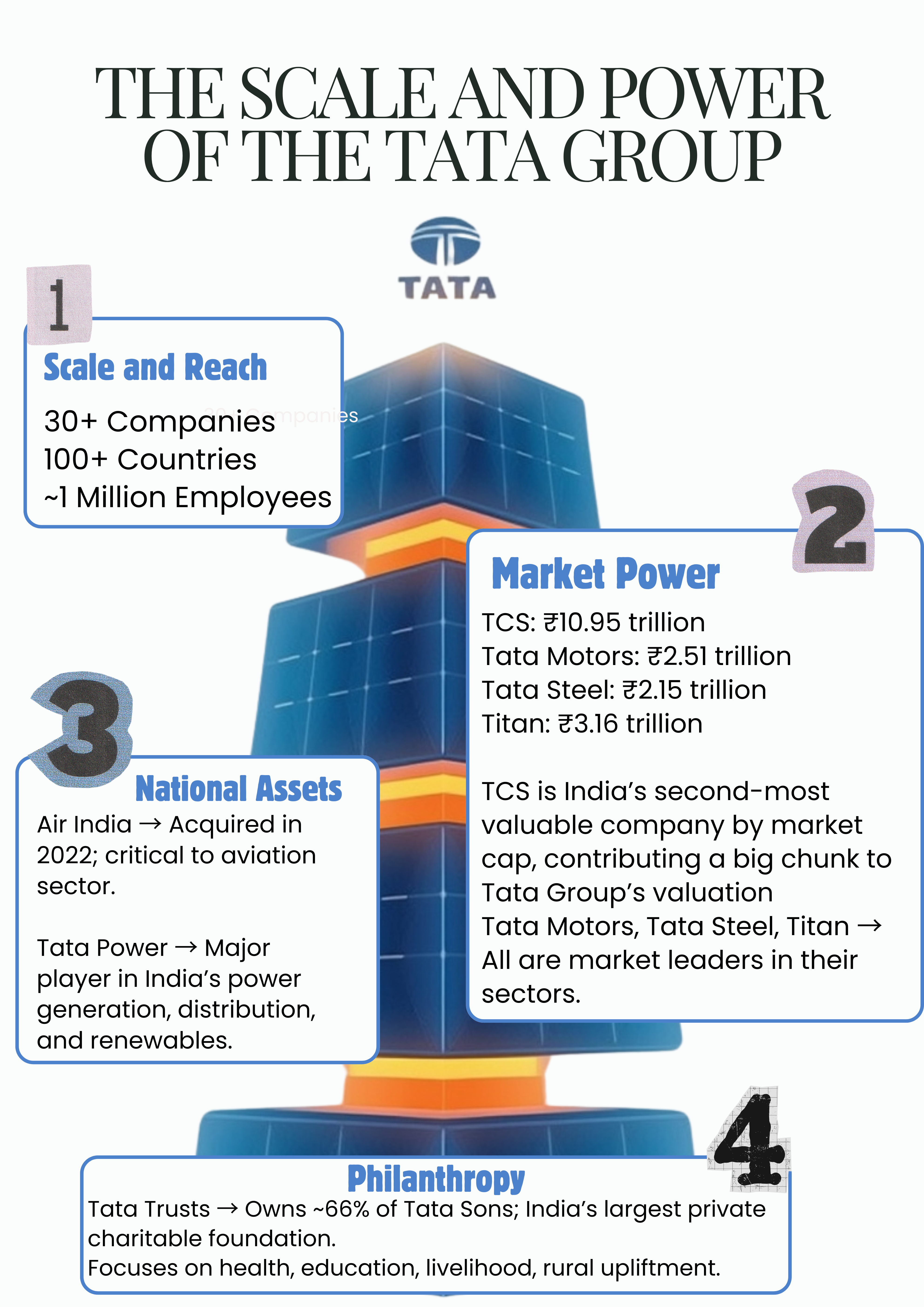

This isn’t routine politics; it’s a reflection of the Tata Group’s weight in India’s economic fabric. With a 150-year legacy and businesses spanning from salt to semiconductors, the Tatas are not just a conglomerate—they are a proxy for corporate credibility itself.

At the heart of the crisis lies a power struggle inside Tata Trusts. According to reports, four trustees—Darius Khambata, Jehangir HC Jehangir, Pramit Jhaveri, and Mehli Mistry—are alleged to have overstepped their oversight mandate, operating as a “super board” seeking greater influence over Tata Sons’ strategic decisions. Chairman Noel Tata is said to have pushed back, terming it “overreach.” The tension peaked in September when a board resolution was blocked, stalling key decisions and forcing the issue into the open.

As reported by The Economic Times, quoting sources, the government has stressed the need to restore stability, expecting the dispute to be resolved quietly within the Trusts while warning that any escalation could disrupt Tata Sons—India’s most valuable conglomerate; and reverberate across its vast network of companies

The Centre’s involvement, while informal, underscores a broader anxiety: when the house that built India Inc wobbles, the tremor travels through markets, investors, and public confidence alike.

This isn’t the first time shareholders of Tata Sons have been divided. A few years ago, Chairman Cyrus Mistry had a bitter fallout with Ratan Tata, leading to one of India’s most high-profile corporate battles — a boardroom dispute that was ultimately settled by court.

The Securities and Exchange Board of India and the Ministry of Corporate Affairs were also then reported to have been closely monitoring the situation. Also, Tatas are said to have lobbied with government-controlled LIC to ensure victory in the various boardroom battles that followed.

Why Tata Matters

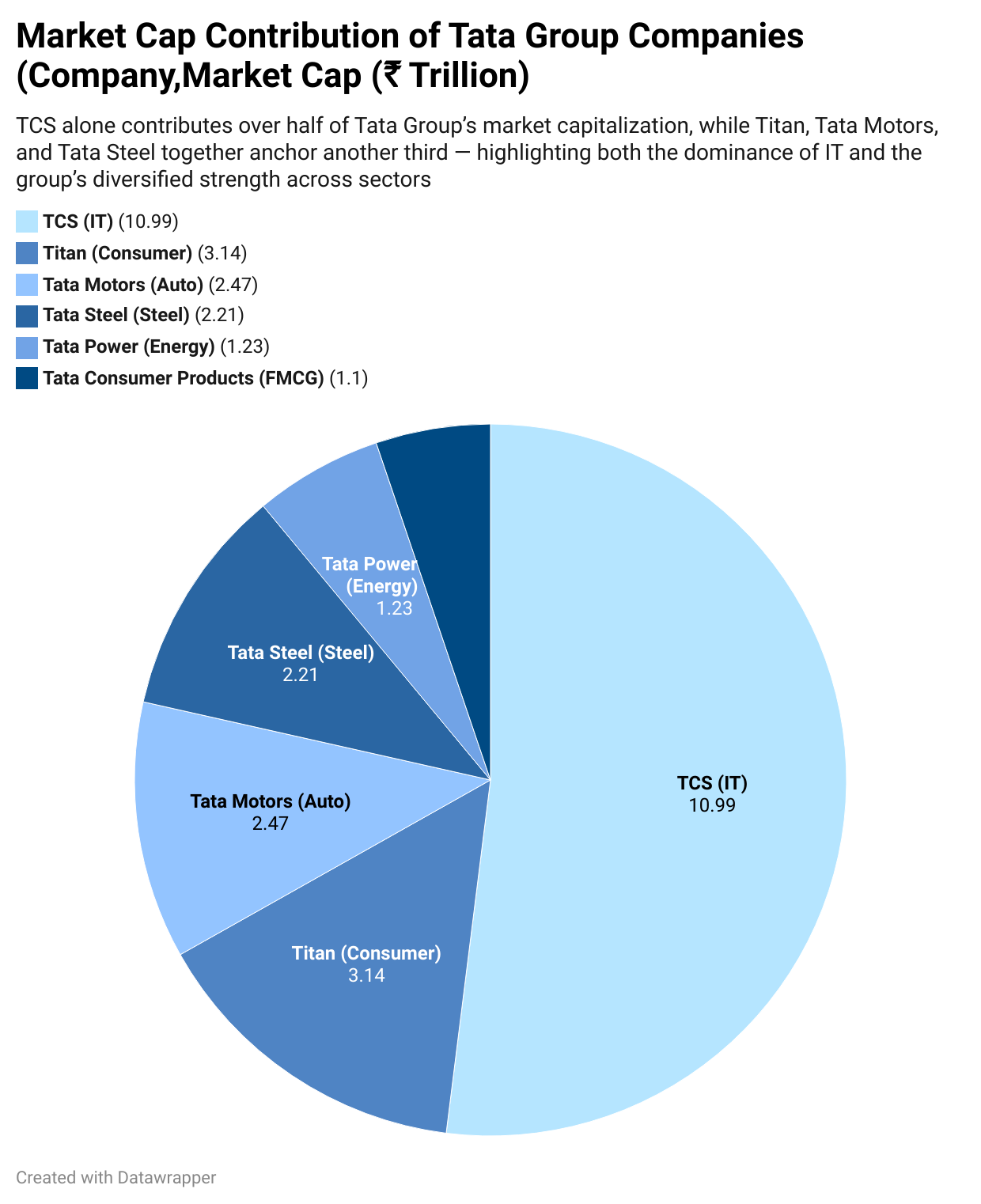

The reason the government intervened is simple: the Tata Group is too important to falter. The Tata universe spans 29 listed companies with a combined market capitalisation exceeding ₹28 trillion, alongside over 90 unlisted entities operating across sectors from steel and automobiles to aviation, hospitality, and digital services.

This ecosystem employs over 935,000 people worldwide, touches the lives of millions through direct shareholding and mutual fund exposure, and carries a near 11% weight in the benchmark Nifty 50 index. Any governance wobble here will weigh on market sentiment.

Why does the Government Care About a Corporate Dispute?

The government’s concern rests on three pillars: market stability, regulatory compliance, and Tata’s symbolic role in India’s economy. The fear that this can create a cascading effect where disturbances at the parent can trigger valuation uncertainty, governance questions, and investor nervousness. Minority shareholders, who collectively own nearly 60% of the free float in flagship entities like TCS and Titan Industries, deserve clarity on whether their boards remain insulated from holding company frictions.

Sources close to the Tata Group have been quoted in multiple media reports as saying that the government is monitoring developments amid fears that the tussle could spill over into the functioning of Tata Sons and the broader conglomerate, cited India Today in its report.

What’s at Risk

If the conflict persists, the risks will extend far beyond boardrooms.

Allowing family battles to spill into company boardrooms would jeopardise not just a brand but also amount to an abdication of fiduciary responsibility — something wholly out of step with the Tata name.