.png)

The Yen Carry Trade, a Piano and Trump’s World View

From the Plaza Accord to the yen carry trade, Japan’s monetary history shaped global finance—and helped forge Trump’s tariff-driven worldview rooted in 1980s economic anxieties.

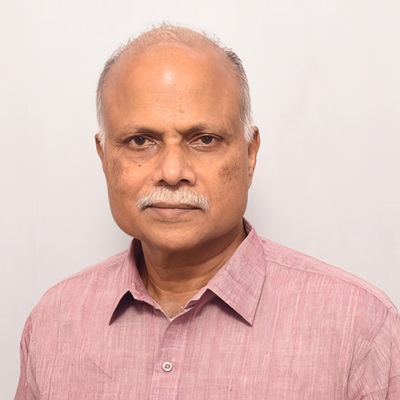

T.K. Arun, ex-Economic Times editor, is a columnist known for incisive analysis of economic and policy matters.

December 31, 2025 at 7:32 AM IST

When the Bank of Japan raises its policy rate to 0.75%, that unsettles global finance, accustomed as the world is to borrowing ultra-cheap in yen and investing in assets denominated in other currencies, the yields in whose economies are significantly higher than in Japan.

The yield on 10-year government bonds is 2% in Japan. “Japan’s real policy interest rate is by far at the lowest level globally,” one of the nine members of the policy setting Board of the Bank of Japan is reported to have said, according to the summary of discussions released on Monday, 29 December. This is expected to signal further rate increases in Japan.

Persistently low Japanese interest rates have a link that few recall to President Donald Trump’s dislike of America’s trade partners running up huge trade surpluses vis-à-vis the US, and his obsession with tariffs as the shield against being ripped off by other countries.

After the US nuked Hiroshima and Nagasaki, and Japan surrendered, ending World War II, the US occupied Japan, rewrote its Constitution, restricting defence spending. The US offered Japan its defence umbrella and relatively open access to the huge, and fast-growing US economy. Unconstrained by the need to spend on national security and with assured access to the US and other western markets, Japan became the first of the celebrated Asian miracle economies.

As America reeled from the two oil shocks of the 1970s and high inflation, Jimmy Carter appointed Paul Volcker as chairman of the US Fed, with the mandate to squeeze inflation out of the system. This, Volcker did, with the backing of President Reagan, who succeeded Carter, raising rates as high as 20% and triggering a recession in the US. As the dollar strengthened against the yen and other currencies, in the wake of such aggressive rate hikes, the Japanese yen, already undervalued, by most estimates, turned into an aggressive tool of export competitiveness. Japanese trade surpluses spiked, as did those of Germany, France and Britain, vis-à-vis the US.

In 1985, the US leveraged its geopolitical heft — all of them depended on US military might to secure themselves in the Cold War — to force all these trade partners to intervene in the currency market to weaken the dollar and strengthen their own currencies, in the so-called Plaza Accord. The Japanese yen rose from 240 to the dollar to 130 relatively fast, and to 120 to the dollar by 1987.

What would happen if the rupee suddenly strengthened from 90 to the dollar to 45 to the dollar? Imports would halve in price, and flood the domestic market, unless checked by tariffs or other measures. In any case, domestic prices would crash, destroy profitability. At the same time, it would create room for sharp cuts in interest rates, without fear of setting off a price spiral.

To ward off recession, the Japanese adopted extremely loose monetary policy, slashing the cost of money. Japanese companies borrowed big, and with the help of an overvalued yen — the Japanese dubbed it the Endaka — that made foreign assets cheap from a Japanese perspective, began an acquisition spree, particularly in the US.

Sony acquired CBS Records, which housed household names such as Michael Jackson, Bruce Springsteen, Barbra Streisand, Billy Joel, and Bob Dylan. Sony also acquired Columbia Pictures, major Hollywood studio. Mitsubishi purchased the Rockefeller Centre, Firestone purchased Bridgestone Tire and Rubber. Matsushita (Panasonic) acquired MCA Inc (Universal Studios).

Japanese automakers built factories in the US, with an eye on reducing trade friction. Japanese banks bought into Wall Street firms.

Japanese companies bought into real estate, not only office blocks but also golf resorts. To Trump, a burgeoning real estate manager, this felt personal. Then, Trump lost a bidding war for the piano from the movie Casablanca to a collector from Japan. Trump has referred to this loss in TV interviews.

As early as in 1987, Trump issued an advertisement in major newspapers, The New York Times, The Washington Post and The Boston Globe, styled as an open letter, in which he attacked what he considered to be the US policy of rolling over when Japan took advantage of what he deemed US generosity in taking care of its national security, including protection of their shipping lanes carrying oil from the Middle East, and ripped off the US. He advocated across-the-board tariffs on Japanese goods, and making Japan pay for the cost of US military expenditure on securing their interests.

Trump articulated these views on national TV, on Larry King Live and the Oprah Winfrey Show. You can’t sell American goods in Japan, he said, while they sell all kinds of stuff in the US.

As it so happened, many Japanese foreign acquisitions later unravelled, and the strong yen and interest rate cuts without the risk of inflation hit the Japanese economy much harder than they did the rest of the world. These fuelled a domestic asset price boom, both in stocks and real estate, so huge that the bubble had to burst. When it did, in 1991, the Japanese economy commenced what has come to be called Japan’s lost decades.

Ever since then, Japan has adopted expansive monetary and fiscal policies to kickstart growth, the rates going negative and Japan effecting its first policy rate hike in 2024. This led to the yen carry trade.

Japan has grown at a compound growth rate of 0.6% since then. However, the Japanese population growth rate had shrunk to 0.4% even as early as in 1991, and began to decline over 2008-10. Therefore, the per capita income continued to rise in Japan, during its lost decades as well.

Japan remains an export powerhouse, churning out not only cutting-edge technology products but also cultural icons. Japanese computer games and gaming consoles pervade the lives of the young. Japanese manga and anime rule the imagination of young people around the world. Sure, Pokémon has competition, but the black, skull-and-crossed bones flag from the long-running Manga series One Piece served as the mascot for Gen Z political protesters from Nepal to Madagascar.

The late 1980s, when the strong yen had made Japan loom large over the American economic horizon like Godzilla risen from the deep, shaped Trump’s worldview: the world laughed at the US, even as it provided global security at its own expense. Never mind if the strong yen was the creation of American arm-twisting.

Now, as President, Trump gives free rein to his ill-informed view of the world formed in the 1980s.