.png)

Ajay Srivastava, founder of Global Trade Research Initiative, is an ex-Indian Trade Service officer with expertise in WTO and FTA negotiations.

December 2, 2025 at 3:52 PM IST

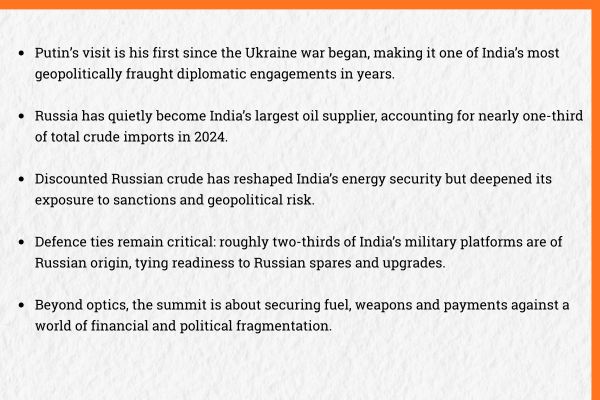

When President Vladimir Putin lands in New Delhi on December 4–5 for the 23rd India–Russia Annual Summit, it will be his first visit in nearly four years and one of the most politically-charged encounters India has hosted since Russia’s invasion of Ukraine. He is scheduled to meet Prime Minister Narendra Modi and attend a state banquet hosted by the President of India.

The timing could hardly be more delicate. New Delhi is under steady pressure from Washington over its purchase of Russian crude oil and to open its markets to US goods and defence sales.

This is not a courtesy call or a sentimental revival of Cold War ties. It is a high-stakes working visit shaped by necessity: to lock in energy security, stabilise defence supply lines and keep bilateral trade functioning under the weight of Western sanctions.

The Three Pillars

Russia has become India’s largest crude oil supplier, accounting for as much as 30–35% of total oil imports, turning discounted crude into the foundation of the partnership.

Defence forms the second pillar. Russia continues to supply and service a majority of India’s frontline platforms—fighter jets, submarines, tanks and air defence systems—and talks continue on maintenance support and future acquisitions.

The third pillar is diplomatic coordination through multilaterals including BRICS, the Shanghai Cooperation Organisation, and the Eastern Economic Forum, alongside cooperation in nuclear power, space exploration, fertilizers and connectivity.

Even as India deepens relations with Washington, Brussels and Tokyo, it treats Moscow as essential to its strategic autonomy.

Discussion Board

In energy, New Delhi is expected to pursue long-term crude contracts with Non US sanctioned Russian firms like Lukoil and Roseneft, revival of Indian investments in Russian energy projects, and advancement of nuclear cooperation beyond Kudankulam. Cooperation in critical minerals, manufacturing and maritime connectivity linking India with Russia’s Far East may also be discussed.

Likely Outcomes

Scenario One: A Managed Upgrade - The most likely outcome is a cautious strengthening of existing ties. India could secure firm timelines on defence deliveries, maintenance contracts, and technology upgrades for aircraft, tanks and submarines. Russia, in turn, may lock in long-term energy commitments—including revived Indian equity in LNG fields, multi-year crude supply agreements, and accelerated nuclear plant construction. The two countries may also formalize a new payment framework using the dirham or integrate Russia’s SPFS system with India’s RuPay network. This scenario stabilizes the relationship without significantly raising diplomatic costs.

Scenario Two: Strategic Deepening -

History explains the resilience of the partnership. During the Cold War, the United States backed Pakistan and deployed the USS Enterprise during the 1971 war. The Soviet Union responded with weapons support and diplomatic shielding at the United Nations. Moscow stood by India after its 1962 war with China, provided repeated diplomatic backing over Kashmir, and remained a defence partner after India’s 1998 nuclear tests brought Western sanctions. Over decades, Russia transferred strategic technologies the West withheld. Even today, about 60–70% of India’s military platforms remain of Russian origin. The partnership was built in conflict, not commerce.

India-Russia Trade

The export basket is narrow and skewed toward a few industrial and chemical items: machinery ($367.8 million), pharmaceuticals ($246 million) and organic chemicals ($165.8 million) together account for most of the value in the first half of FY26. Consumer-oriented and high-visibility categories remain marginal: smartphones ($75.9 million), Vannamei shrimp ($75.7 million), meat ($63 million) and garments at just $20.94 million underscore India’s limited penetration in Russia’s retail markets and electronics value chains despite geopolitical churn.

On the import side, dependence on Russian energy and commodities continues unabated. India’s imports stood at $63.2 billion in 2024-24 and inched up to $63.8 billion in 2024-25; in April–September 2025 alone imports were $31.2 billion. Petroleum dominate overwhelmingly, led by crude oil ($23.1 billion) and petroleum products ($2.5 billion), followed by coal ($1.9 billion). Strategic inputs such as fertilisers ($1.3 billion) and food oils—sunflower seed oil ($633 million)—remain significant, while diamonds ($202 million) add to the non-energy bill.

The result is a structurally asymmetric relationship: India relies on Russia for energy security and inputs, while struggling to scale value-added exports—leaving the bilateral trade equation lopsided and vulnerable to shocks in global commodity prices.

|

India’s Crude Oil Imports-$ Billion |

||||

|

Year |

Import Oil from Russia |

Import Oil from World |

Share of Russian oil in India oil imports (%) |

Imports total from Russia |

|

2017 |

1.3 |

82.1 |

1.6 |

8.0 |

|

2018 |

1.2 |

114.7 |

1.1 |

6.8 |

|

2019 |

1.5 |

101.9 |

1.4 |

6.2 |

|

2020 |

0.9 |

64.6 |

1.4 |

5.9 |

|

2021 |

2.3 |

106.4 |

2.2 |

8.7 |

|

2022 |

25.5 |

173.5 |

14.7 |

40.6 |

|

2023 |

48.6 |

140.4 |

34.6 |

67.1 |

|

2024 |

52.7 |

141.5 |

37.3 |

67.2 |

|

2025(Jan-Sep) |

33.5 |

105.3 |

31.8 |

45.3 |

India’s oil trade with Russia has undergone a dramatic transformation since the Ukraine war. Till 2021, Russia was a marginal supplier, with annual crude imports rarely crossing $2–3 billion and accounting for barely 1–2% of India’s oil basket. That changed overnight in 2022, when imports surged to $25.5 billion and Russia’s share jumped to nearly 15% of India’s crude oil imports as sanctions diverted Russian barrels toward Asia at steep discounts.

The real leap came in 2023, when imports nearly doubled to $48.6 billion, pushing Russia’s share to 34.6%—making it India’s single largest oil supplier, ahead of traditional Gulf partners. In 2024, imports rose further to $52.7 billion, taking Russia’s share to an extraordinary 37.3% of total crude imports. In just three years, Russia moved from the fringes of India’s energy map to its centre, reshaping India’s energy security strategy and pulling New Delhi deeper into the geopolitics of global oil sanctions.

Sanctions have forced financial improvisation. After Russia was partially removed from SWIFT, payments shifted to a multi-currency system: dirhams (60–65%), rupees (25–30%), and yuan (5–10%). Rupees parked in special Indian accounts—estimated at ₹600 billion—are largely unusable. Russia now prefers settlement via the UAE dirham, which it can spend or convert freely. Yuan is used occasionally. The system works—but it is unstable and politically vulnerable.

Putin’s visit is not a nostalgic return to Cold War diplomacy. It is a negotiation over risk, supply chains and economic insulation. A modest outcome will secure oil and defence; an ambitious one will reshape regional economics. The visit is ultimately not about choosing sides—but about managing dependence in a fractured world.