.png)

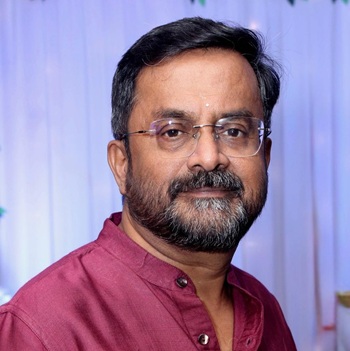

Krishnadevan is Consulting Editor at BasisPoint Insight. He has worked in the equity markets, and been a journalist at ET, AFX News, Reuters TV and Cogencis.

December 30, 2025 at 12:04 PM IST

This is one of India’s largest M&A deals in the IT sector, executed not by a cash-rich incumbent but by a mid-cap company with less capital and more to prove. Coforge is paying $1.89 billion in stock for Encora, positioning the acquisition as a leap into AI-led engineering just as generative models move from experimentation into enterprise budgets.

The timing should make investors pause before applauding the audacity. Encora is being sold as AI-native, with sales collateral claiming it was born with AI DNA. The fine print tells a more conventional story. This is a 20-year-old digital product engineering firm that pivoted into generative AI in mid-2023, barely six months after ChatGPT pushed large language models from lab curiosity into boardroom conversation.

The core question is whether Coforge has acquired scarce, hard-to-build capabilities that justify AI-era valuations, or whether it has paid tomorrow’s multiples for yesterday’s services model, dressed up in agentic jargon now common across consulting decks.

Encora was founded in 2005 as Indecomm Digital and operated for most of its life as an outsourced product development services firm. Indecomm Digital later rebranded as Encora following the merger of its subsidiaries Nearsoft and Sooryen Technologies.

Its formal generative AI practice was launched only in mid-2023, when it announced productivity gains across the software development lifecycle using large language models and prompt engineering. By 2024, it had repositioned itself as AI-native, anchored around a proprietary platform called AIVA to manage multi-agent workflows with human oversight. The pivot was decisive, and early enough to matter if early movers are rewarded.

The structure of the deal underlines how seriously Coforge is taking this bet. The transaction is all stocks. Coforge will issue 93.8 million shares to Encora sellers at ₹1,815.91 per share, an 8.5% premium to the signing-day close. A further 27.2 million shares are modelled for a qualified institutional placement to retire Encora’s term loans, while another 12.7 million shares will be issued as part of the Cigniti Technologies merger. Taken together, these transactions lift the share count from 335 million to 468.7 million. Separately, Coforge has already spent ₹20 billion in cash to acquire a 54% stake in Cigniti.

That arithmetic matters because it creates a permanently larger equity base. Local mutual funds hold close to 39% of Coforge, foreign portfolio investors over 34%, and insurance companies around 15%, taking institutional ownership to nearly 88%. The Encora transaction transfers a meaningful share of ownership to private-equity sellers and new institutional investors at a defined price. If execution falters, that price risks becoming an overhang.

Management is selling the acquisition on the comfort of earnings-per-share accretion. The projected 15% growth rate, however, is explicitly labelled illustrative rather than guidance. One-off transaction costs are excluded. About 20% of Encora’s enterprise value is assumed to sit in intangible customer relationships, amortised over 12 years and subject to a Big Four audit verdict. No interest expense is assumed for retiring Encora’s term loans, and the QIP is modelled at the same ₹1,815.91 price.

The real question is not whether Encora is a competent business. It is whether Coforge has acquired genuinely scarce capabilities that larger Indian IT firms missed, or has paid cycle-high multiples for a well-packaged rebrand of skills that many peers already possess. Tech majors such as Tata Consultancy Services, Infosys, HCL Technologies and Wipro appear to have passed on the opportunity, not for lack of capital or ambition, but because experience has taught them that integration risk often erases theoretical upside.

India’s IT majors have largely adopted a feel-the-stones AI strategy. They favour startup investments, co-innovation labs with hyperscalers, internal platforms and carefully sized acquisitions. The strategy is evolutionary rather than revolutionary, designed to limit downside if the cycle turns or AI enthusiasm cools. In Indian IT, AI adoption ultimately shows up not in demos but in pricing power, repeat contracts and margin durability.

A generous interpretation is that Coforge has acquired a delivery model that internalised AI early enough to make it default rather than additive. The harsher reading is that this remains a services business sold with product packaging. What the deal undeniably achieves is a reposition of Coforge, from a capable systems integrator to an AI-led engineering firm. That narrative has value beyond near-term earnings. It can influence client shortlists, peer benchmarking and talent attraction in a market where engineers increasingly prefer AI-first work over legacy maintenance.

If early-mover advantage in generative services translates into a durable moat, Coforge will look prescient, and the giants will be left explaining why they built when they should have bought. If growth undershoots even the illustrative projections and pricing pressure or delivery hiccups erode margins, investors will be left supporting a less flattering reality with a permanently enlarged equity base.

In corporate strategy, the line between courage and overreach is thin. Both interpretations remain live, which is precisely what makes the Coforge–Encora deal worth watching rather than merely applauding.