.png)

By Mint Owl

Mint Owl tracks markets and policy with a steady eye, offering clear analysis on the choices shaping India’s economy and financial system.

October 8, 2025 at 7:22 AM IST

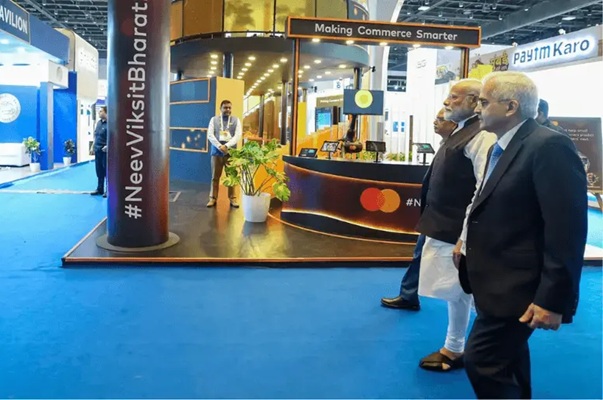

As the Global Fintech Fest unfolds in Mumbai this week, it is hard to miss the spectacle. The route from the airport to Bandra-Kurla Complex is lined with hoardings, while full-page advertisements in national dailies feature a parade of dignitaries led by Prime Minister Narendra Modi for this week’s three-day event.

What began as a focused industry forum has grown into a large-format global event. In its early years, the presence of the Reserve Bank of India governor was the central draw, and discussions revolved around digital inclusion, payments architecture, and regulatory frameworks. The atmosphere was one of experimentation and genuine policy dialogue.

Now, the tone has changed. The Prime Minister’s participation has given the event political visibility and international weight. Ministers, senior bureaucrats, and global regulators are part of the line-up, underlining fintech’s growing importance in India’s economic narrative. Yet this expanded profile also hints at a shift in purpose—from an innovation-led gathering to a high-visibility policy showcase.

Optics over Ideas

A walk through the exhibition halls this week confirms how that purpose has blurred. Banks, insurers, and legacy financial firms dominate the space once defined by start-ups and tech pioneers. Many stalls exist for photo opportunities, often repackaging old announcements as new “launches.” The National Payments Corporation of India, for instance, commands a large share of attention, presenting incremental upgrades with stage theatrics and scripted demos.

The programming reflects the same drift. A quick glance at LinkedIn shows hundreds of attendees declaring themselves moderators or speakers, often in side sessions tucked away from the main stage. Conversations that once centred on innovation, interoperability, and inclusion now compete with panels on geopolitics, trade, and leadership: worthy topics, but far removed from fintech’s creative frontier.

Refocus, Renew

Global events of similar stature—whether in Singapore, Dubai, or London—balance visibility with substance through sharper curation and a consistent focus on breakthrough ideas. GFF enjoys unmatched policy attention and scale. What it now needs is a deliberate effort to restore its original ethos: enabling collaboration, invention, and problem-solving rather than performance and promotion.

The growing prominence of the fest is a marker of success, yet it also carries responsibility. The more it becomes a stage for institutional branding, the less it speaks to the entrepreneurs and technologists who gave India its fintech edge. Organisers should remember that the credibility of GFF lies not in who attends, but in what new ideas and partnerships emerge from it.

Fintech thrives on disruption, not choreography. For GFF to remain a true global benchmark, it must return to being a marketplace of ideas rather than a gallery of faces.