.png)

Krishnadevan is Consulting Editor at BasisPoint Insight. He has worked in the equity markets, and been a journalist at ET, AFX News, Reuters TV and Cogencis.

November 12, 2025 at 4:28 PM IST

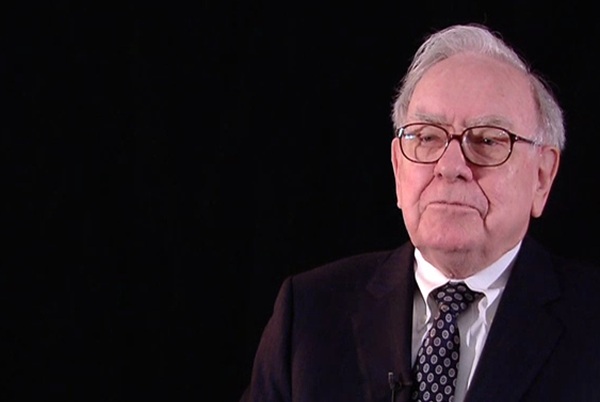

Letting go is an act of leadership, not loss. No one demonstrated this better than Warren Buffett in his final letter as Chairman and CEO of Berkshire Hathaway. When the Oracle of Omaha decided to go quiet, as the British would say, he offered not just a changing of the guard but a masterclass in measured succession. Buffett resisted the urge to anoint a dynasty and, more crucially, steered clear of ruling from the grave.

In Indian business culture, many promoters often view relinquishing control as sacrilege.

The tendency to clutch power long after professional tenure has ended is both common and costly. There are such instances in some of the most storied of Indian companies. Buffett’s approach serves as a mirror, a motive, and a megaphone. He made it clear that true legacy is not built on endless control, but on sound institutional scaffolding. Permanence lies not in perpetual presence, but in continuity that is structured, professional, and principled.

Buffett’s parting words, ‘ruling from the grave does not have a great record, and I have never had an urge to do so’, should sound in Indian boardrooms like a siren.

Many Indian companies, especially those shaped by sprawling family networks, have a history of patriarchs scripting every move after their own exits. They do this through complex legal structures, perpetual trusts, and letters of intent from a faded past. The end result is a system that stifles successors, ossifies organisations, and places a permanent premium on nostalgia at the expense of renewal.

It is here that institutional investors cannot remain mere bystanders.

They should act as stewards to a company’s leadership by decisive action, not detached observation. Major shareholders, including mutual funds, insurance companies, pension funds and foreign portfolio investors must demand clear, credible succession plans from companies. Transparency in succession is imperative; it is essential to ensuring that new leadership is empowered and not encumbered by the past. This will require agitation and advocacy on the part of institutional shareholders. Inside the company, the Nominations and Remuneration Committee too can play a significant role.

It is not enough to know who is next, as the real test is whether a company thrives with a new hand on the wheel, truly independent and unencumbered by yesteryear’s shadow.

Letting go responsibly means creating a culture in which transition is normalised, not exceptional. Change is discussed, not delayed. The emphasis is on professionalised process, board independence, and ensuring that the business does not revolve around the brilliance of one individual, but draws vitality from the capacity of many.

The true value in Buffett’s sign-off lies in his confidence, not just his humility.

He has built successors with the spirit and skill to act when tomorrow’s world overtakes today’s script. His trust is not in structures designed to survive him, but in people empowered to surpass him when needed.

For corporate India the lesson is simple. To outlive the founder, the firm must first outgrow the founder’s ego. Founders and pater familias must ignore the urge to rule from the grave, and create the runway for the next generation. Institutions that allow for renewal endure, especially when their architects have the wisdom to step back, stand aside, and let the sun shine on new leaders.

More significant is that Buffett does not shy away from the flaws in the system. In closing, Buffett admits that rewards can be random, and sometimes tainted by venality.

For all leaders, it is wise to remember that no market, boardroom, or nation distributes opportunity in perfect proportion to merit. This fact makes it even more important to choose one’s heroes wisely and to emulate their best qualities. Buffett reminds us, the truest dividend a legacy can pay is one governed by trust and guided by those in the present, not by the ghosts of glories past.