.png)

Sohini Ghosh is an independent financial journalist.

November 7, 2025 at 12:16 PM IST

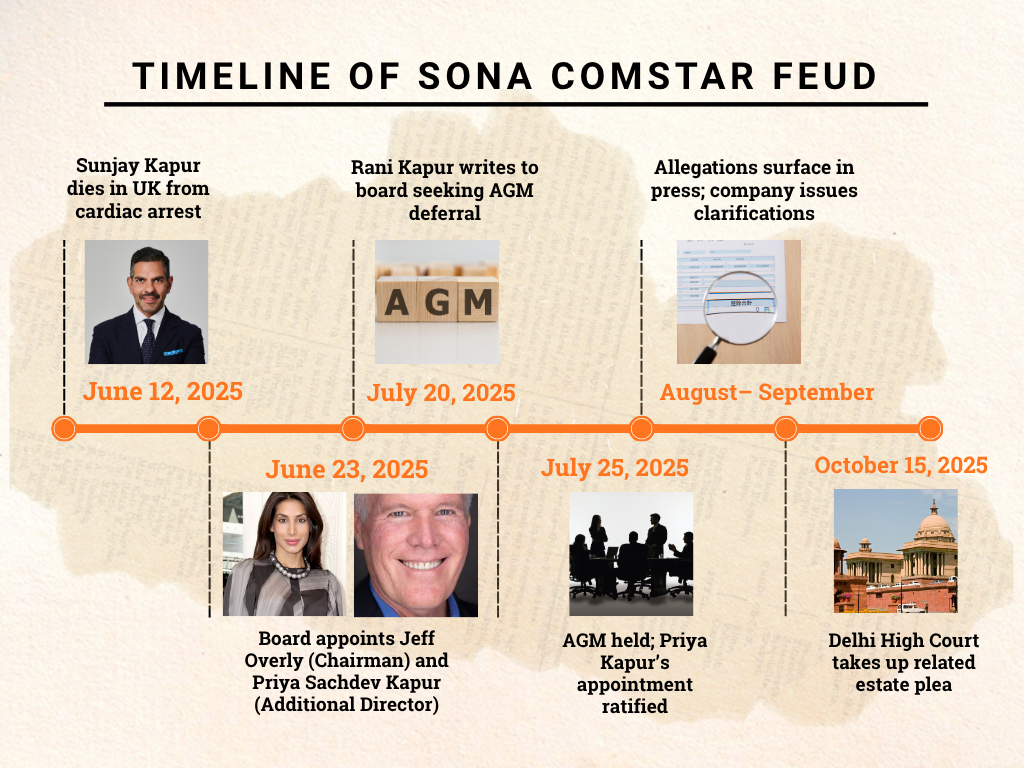

On June 12, 2025, Sunjay J Kapur, the man who led Sona Comstar through its global transformation, died suddenly at 53 after suffering a medical emergency during a polo match in the United Kingdom. His death stunned India’s corporate world.

Kapur had been seen as a calm, strategic leader who had turned Sona Comstar from a precision gear manufacturer into a ₹300-billion auto component major powering India’s electric vehicle story.

But before markets could absorb the loss, a quieter story began unfolding. What started as family mourning soon became a corporate governance test: a series of letters, board decisions, and legal disputes that would reshape the conversation around succession in one of India’s most well-known engineering companies.

Industrial Origins

What began in 1995 as a small joint venture between India’s Sona Group and Japan’s Mitsubishi Materials Corporation would, three decades later, evolve into one of India’s most respected auto component manufacturers: Sona Comstar.

Then known as Sona Okegawa Precision Forgings, the company introduced warm forging technology to India, setting benchmarks in precision gear manufacturing. Through the 1990s and 2000s, it expanded from Gurugram to Chennai and Pune, becoming a trusted supplier to global automakers.

A defining moment came in 2008 when Sona acquired ThyssenKrupp’s precision forging business, including BLW, a German pioneer of warm forging. The acquisition gave Sona both technological depth and access to Europe’s engineering ecosystem. By 2013, the company rebranded as Sona BLW Precision Forgings, signalling its evolution from a parts manufacturer to a technology-led engineering firm.

The next big leap came in 2019 with the acquisition of Comstar Automotive Technologies, a Chennai-based specialist in starter motors and alternators. The merger of mechanical precision and electrical innovation gave birth to the brand Sona Comstar.

Under Kapur’s leadership, Sona Comstar became one of the few Indian component makers with a truly global footprint, operating 12 manufacturing plants, 3 Engineering Capability Centre, 5 R&D centres and 1 Tool and Die Shop.

By 2022, it had produced 100,000 traction motors, cementing its place in the EV ecosystem. The next two years brought expansion into new mobility sectors — a majority stake in Serbian sensor firm NOVELIC in 2023, and a 2024 agreement to acquire Escorts Kubota’s Railway Equipment Division.

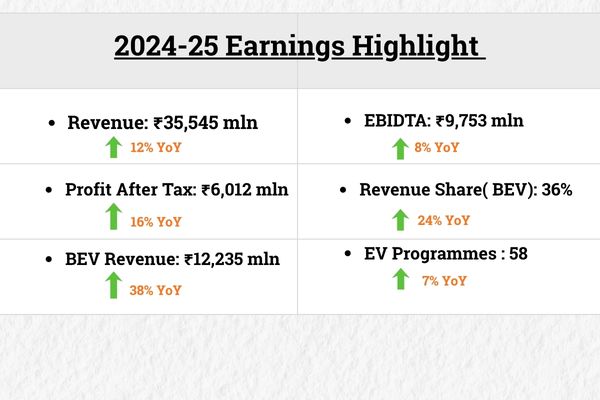

In 2024-25, As per the company’s annual report, it continued to build on this momentum, reporting healthy growth supported by steady global demand. Its push into electrification proved pivotal, with electric-drivetrain products strengthening their contribution to overall performance.

Expanding EV programmes and a growing share of battery-electric components reinforced Sona Comstar’s position as a key supplier to next-generation mobility platforms worldwide.

From its modest beginnings to a ₹300-billion listed enterprise, Sona Comstar’s rise mirrors the evolution of India’s auto component industry itself.

Family Fractures

Kapur’s sudden death set off a bitter struggle within the family over control and inheritance of the sprawling Sona Group empire.

Barely a month after his passing, his mother, Rani Kapur, wrote to the company’s board asking that the Annual General Meeting scheduled for July 25 be deferred. In her letter, she claimed she had been pressured into signing documents related to family trusts and shareholdings soon after her son’s death, and sought clarity before any corporate actions were taken, as reported by Mint.

Following founder Surinder Kapur’s death, Sunjay had taken charge as Managing Director, while Rani became Chairperson and sole beneficiary of her late husband’s estate. In her latest correspondence, she claimed to be the largest shareholder in the Sona Group, including Sona BLW. The company, however, asserted that Rani Kapur had not been a shareholder since 2019 and that there was no legal basis to postpone the AGM.

The meeting went ahead as planned. Sunjay’s wife, Priya Sachdev Kapur, was appointed as a Non-Executive Director and later elected as Chairperson of the board. While the company maintained that all actions were in compliance with governance norms, Rani Kapur’s letter exposed a family rift that quickly became a matter of public and legal scrutiny.

Trust Dispute

At the core of the dispute lies a complex network of Kapur family trusts, which collectively hold about 28.02% of Sona Comstar’s promoter stake. These trusts were designed to manage ownership across generations, with beneficiaries reportedly including Sunjay’s children from his first marriage to actor Karisma Kapoor, and his daughter with Priya Sachdev Kapur.

After Sunjay’s death, questions surfaced about who controlled these trusts, how beneficiary rights were divided, and who exercised voting authority over the promoter group’s holdings.

Rani Kapur alleged she had been misled about documents she had signed, while representatives of Priya Kapur denied any wrongdoing, stating that ownership structures had long been settled and transparent.

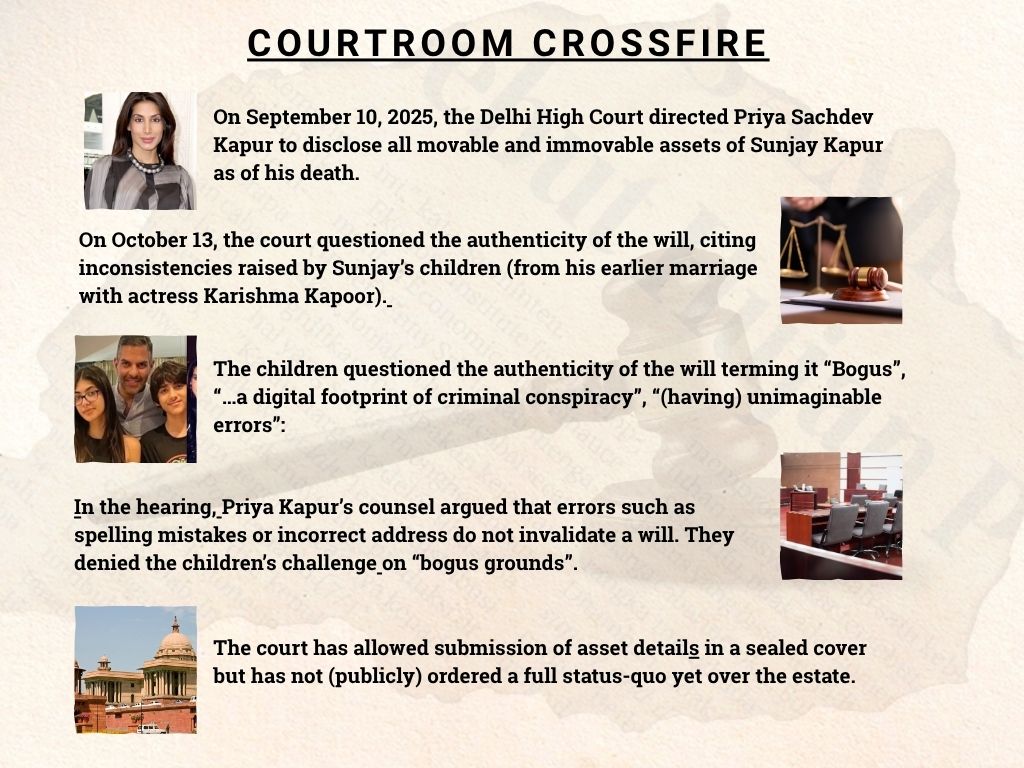

The conflict deepened when Priya Kapur submitted to the Delhi High Court a will allegedly executed by Sunjay in March 2025, bequeathing his entire estate to her. His children from his first marriage challenged the document as forged or manipulated. By August 2025, reports indicated that the feud was on the verge of moving to court. By October 2025, the Delhi High Court had begun hearing the probate plea that could decide ownership and control of the family’s holdings.

Governance Lens

In Indian corporations, family legacy and governance coexist uneasily. The integrity of capital markets relies not only on performance but also on transparency, accountability, and ethical clarity.

Throughout the dispute, Sona Comstar maintained that the matter was personal and did not affect operations. Its disclosures reiterated that the board, independent directors, and audit committees functioned normally. Financial results showed no disruption.

Yet markets price perception as much as profit. Following the media coverage, the company’s shares slipped modestly, reflecting uncertainty about control at the top.

Promoter families have built some of India’s most successful enterprises, shaping industries and creating long-term value. When that legacy aligns with strong governance, it becomes a competitive advantage and a source of confidence for investors and employees alike. But when personal interests blur into corporate decisions, credibility erodes faster than balance sheets can recover.

Wider Pattern

The Sona Comstar episode joins a growing list of succession disputes in India Inc — from Kirloskar to Bajaj to Zee.

The pattern is strikingly similar: a sudden death or leadership vacuum, family dynamics spilling into the boardroom, investors searching for reassurance between carefully worded statements.

What makes this case distinct is that it is not about fraud or mismanagement. It is about the collision of emotion, inheritance, and governance, and how even well-run companies can find themselves vulnerable when personal and professional boundaries blur.

India’s corporate law has modernised faster than family governance. Wills exist; governance frameworks rarely do. The result is an institutional gap between how wealth is passed on and how control is exercised.

Lessons in Governance

For a company admired for its professionalism, the episode is a reminder that good governance also means clarity in succession. Governance is not only about audits and disclosures but about preparedness — particularly for unplanned transitions.

As Indian enterprises mature and attract global investors, the line between private family affairs and public company responsibilities becomes thinner. Transparency, even in sensitive times, is no longer optional.

Sona Comstar’s next challenge may not be engineering precision but family alignment. If it succeeds, it could offer Indian companies a vital lesson in managing grief, governance, and growth together.

Because the true test of leadership is not how smoothly a business runs in life. It is how clearly it endures after loss.