.png)

Self-Interest, Sentiment, and the Fine Print

STT hike stole headlines, but Budget 2026’s real story lies in quiet reforms, capital focus, and a deeper push for trust-based execution and implementation tracking.

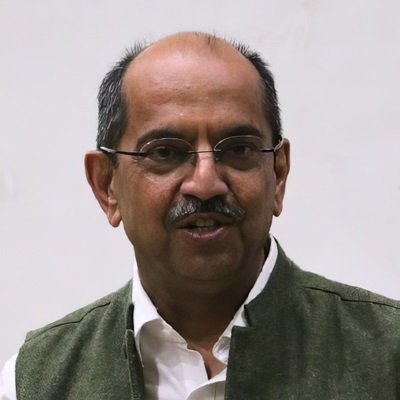

Vijay Singh Chauhan, a former IRS official, is a trade expert and Senior Visiting Fellow at Isaac Centre for Public Policy, Ashoka University.

February 2, 2026 at 3:51 AM IST

Self-interest is perhaps the most common lens that is used by people to assess a public policy pronouncement. Careful reading of the Budgets of the Union Government of the world’s largest democracy, and more so the speech of the Finance Minister, over the years, therefore, seem like diligent exercise aimed at addressing the interests and aspirations of diverse category of her citizens. To every keen observer of the Indian Budget, it is evident that some groups are more demanding and more expressive in their disappointment in case their demands are either not met or their interests hurt.

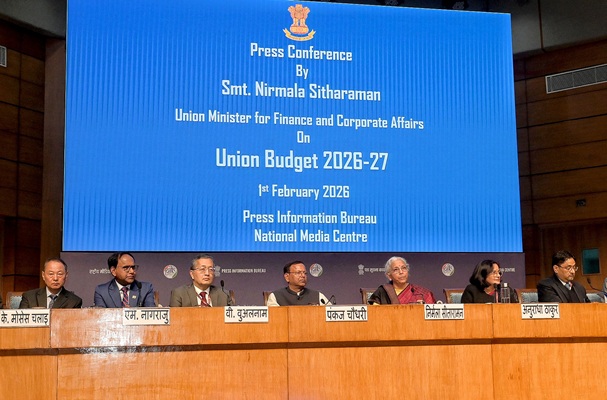

In the Budget presented on Sunday, Finance Minister Nirmala Sitharaman expectedly refrained from carrying out large scale changes in the income tax rates, even as she announced some measures to ease the compliance burden, which included extended timelines for return filing, simplified TDS provisions, reduced penalty for procedural defaults. However, the announcement of hike in the Securities Transaction Tax on derivatives, particularly futures (from 0.02% to 0.05%) and options premium (from 0.1% to 0.15%), aimed at dampening speculative volatility, ended up dampening the market sentiment first. As a result, the Nifty fell 495 points or about 2% and BSE Sensex declined 1547 points or about 1.8%.

The disappointment over the lack of relief in the income tax rates, and huge drop in the personal investment portfolio of the large middle class due to the market crash showed up in the opinion polls being run by the news portals, judging the Union Budget to be “average”. The near real time assessment of the Budget has traditionally been influenced by the Part B of the Speech, which covers the Government’s tax proposals. However, not many will disagree that it is unfair to judge a Budget simply based on its tax proposals, and a careful consideration of the detailed announcements in Part A of the Budget speech is essential.

This part of the speech combined references to long term vision of Viksit Bharat@2047 along with many sector, region or beneficiary-specific schemes. There was focus on employment generation, supporting manufacturing sector, including labour intensive sectors like textiles and sports goods, and strategic and frontier sectors such as rare earth, semi-conductors, and bio-pharma. Plans for revival of 200 legacy industrial clusters were announced along with those for creating champion MSMEs. Similar attention was paid to employment generation and growth of the services sector, with very specific plans for tourism, and more specific medical tourism, and trekking routes. There was a recognition to enhance focus on the Purvodaya region, which has a lot of catching up to do. With the award of the Sixteenth Finance Commission guiding the inter se share of states in the unchanged 41% vertical share of taxable pool for the states, a more detailed analysis would be required to ascertain whether this region will be able to bridge the gap with the western and southern regions of the country during the five years award period.

The Finance Minister referred to many more schemes and proposals in her speech, and even more are to be found in the detailed Expenditure Budget documents that were presented along with the constitutionally mandated Annual Financial Statement, Finance Bill and the Demand for Grants. Many of these schemes and proposals are continuation or modification of earlier schemes intended to achieve similar goals, with some new schemes announced as well, giving a feeling of statement of serious intent. While fiscal experts have long highlighted the significant gap between intent and delivery, and between outlays and outcome of these schemes having multi-year lifespan, everyone recognises that in such matters “devil lies in the details.”

Recognising these challenges and to improve fiscal outcomes, Government presents three significant documents as part of the Budget. Detailed scheme-wise allocation for the next year, as also the actual expenditure in the previous year, revised estimates for the current year are presented in reader friendly manner in the Expenditure Budget. Another document entitled “Implementation of Budget Announcements” tracks the implementation of announcements made in the previous Budget, and the third is entitled “Output-Outcome Monitoring Framework.” It is important to go beyond the Budget speech for a more balanced assessment of the Budget.

Of these three documents, the one tracking the implementation of Budget announcement is most insightful. Thus, the document presented with the Budget yesterday provides the implementation status of each of the paras of the Budget speech for 2005-26. A plain reading of the document highlights two serious concerns: first, many of those announcements have not been fully, or sometimes even partially implemented; and second, the implementation status is reported department-wise, completely negating the “whole of government approach” that has been acknowledged as best practice for impactful fiscal expenditure or government programmes.

My professional self-interest lens had me focussed on the announcements relating to customs reforms, which also included some significant announcement, besides the regular tweaking of product-specific tariff rates to address the felt needs of specific industry or priority sector. The focus of Authorised Economic Operator programme is perhaps most noteworthy, since this trust-based scheme is a global best practice that recognises the fundamental importance of trust in guiding economic reforms. The second important reform is to bring flexibility to the SEZ scheme, which is reflective of the policy agility that must guide India’s response to the uncertain international trade environment.

The Budget, thus, includes many schemes and policies that are expected to strengthen the “fiscal plumbing” and if implemented in timely manner and tracked diligently till completion, they are expected to deliver impactful outputs and outcomes, fully justifying the budgetary outlays.