.png)

Schrodinger’s Ceasefire: War Rooms, Newsrooms, Courtrooms

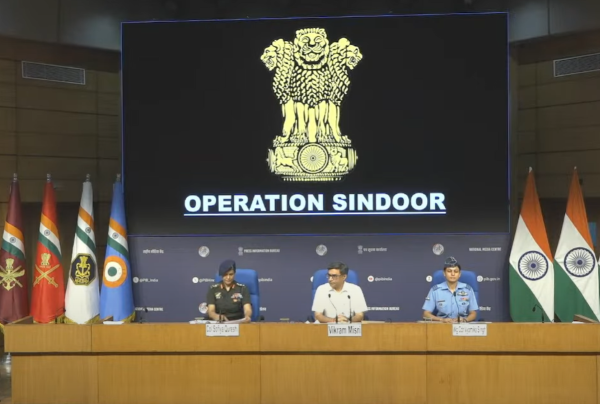

India straddles war and optics as claims of ceasefire, or agreeing not to fire, blur, drones buzz, markets hold firm, and newsrooms turn conflict into clickbait theatre.

Phynix is a seasoned journalist who revels in playful, unconventional narration, blending quirky storytelling with measured, precise editing. Her work embodies a dual mastery of creative flair and steadfast rigor.

May 11, 2025 at 2:47 PM IST

Dear Insighter,

Imagine, for a moment, that the Line of Control is a box. Inside it: a ceasefire. Or not. We don't know—until we open the lid. Except that the lid is always ajar, the cat always twitching, and everyone’s watching it with trigger in the other hand.

All week, Indian government told its citizens the cat is alive. India dominated. India retaliated with precision. And then came Donald Trump’s announcement of a ceasefire. The box was yanked open, and suddenly, things looked even murkier somehow. The Indian government clarified: the US didn’t broker anything. Not even four hours later, Pakistani drones were shot down over Srinagar and Gujarat. So is the ceasefire on, or not?

Depends whom you ask, and when.

India’s message: It is no more a game of cat and mouse.

While the nation remained tense, television studios became a theatre of conflict. Anchors danced for every drone diffused, and doctored clips went viral. Indian newsrooms turned a deadly crisis into a memeable moment. This was journalism by jingoism. The real casualties? Credibility and conscience.

But beyond the circus of TV-infotainment a more complex battlefield—one defined not just by bombs, but by rules, strategy, perception, and unintended consequences.

BasisPoint Insight highlighted how Indian officials swiftly rejected Pakistan’s claims of military success, releasing satellite imagery to show that Indian Air Force stations remained unscathed. Pakistan’s hybrid warfare—cyber ops, drone swarms, info-meddling—was met with defiance and fact-checking. This wasn’t just war, it was a reputational audit.

And the audit extends to doctrine itself. India seems to be moving from reaction to recalibration: strike clean and hard. If past doctrine was governed by ambiguity, this one is governed by resolve. But doctrines don’t come free. As Mahendra Ved writes, the economic costs of even a short-lived conflict are steep. Capital, once earmarked for productivity and infra, is now quietly migrating toward defence.

Which brings us to subtler weapons. JB Mohapatra argues that India should begin waging an economic cold war through tax protocols. Suspending financial information exchange, choking the arteries of terror finance, and isolating Pakistan via OECD frameworks may not make for dramatic news footage, but they hurt where it counts. In the age of invisible war, a spreadsheet can sting more than a missile.

The strength, then, lies in calibrated escalation. Brahma Chellaney writes that India’s upper hand gives it the power to dictate the tempo. But this leverage is fragile, especially when resting on old treaties like the Indus Waters agreement.

And yet, war today is not just about wins; it’s about the story of the win. Saibal Dasgupta observes how India’s real play may lie in the global optics game. With states like UAE and Saudi Arabia refusing to back Pakistan unequivocally, Delhi is scripting its narrative carefully: calculated, secular, and sovereign.

Markets, interestingly, seem to have bought the story. Srinath Sridharan notes that Indian markets held firm, signalling investor confidence not just in macroeconomic fundamentals, but in the maturity of India’s strategic restraint. For global funds, this is the kind of calculated aggression that inspires rather than alarms. But markets are capricious oracles. As Krishnadevan V warns, calm is not clarity. High valuations, thin earnings, and the psychological cost of prolonged military tension are all coiled beneath the index like a spring.

Theatre, it seems, is contagious. IndusInd Bank’s executives’ abrupt exits laid bare compliance failures—a systemic warning the RBI can’t ignore. SBI’s corporate lending slumped as prepayments masked weak demand. Richard Fargose calls it a crack in India’s investment engine. But the real drama unfolded in courtrooms.

The Supreme Court’s Bhushan Power ruling ripped open old wounds, threatening the IBC’s fragile finality. Sachin Malhotra calls it a reckoning, while Shruti Mahajan defends the court’s purge of flawed processes. Rule of law, she insists, trumps liquidation logic. Srinath Sridharan warns, marry legalism to commerce, or the Code collapses. But a JSW setback could be an Indigo Paints win, notes Krishnadevan V. Credibility, not capital, tips scales.

The RBI, meanwhile, continues to clutch jargon like a talisman. Abheek Barua scoffs: retire the cryptic “stance”, speak plainly. Clarity, not ambiguity, steers markets. But clarity is scarce since small savings rates still defy logic, muting policy transmission. The government clings to administered rates, a relic in a liberalised world.

Sectoral storms are also brewing. Coal India, steady on paper, faces triple threats: energy transition, captive miners, crashing global prices. Dev Chandrasekhar asks: adapt or fade? HUL, once a margin moat, retreats into volume trenches. Krishnadevan V calls it surrender—legacy brands outflanked by nimble rivals like Mamaearth.

But the tremors aren’t confined to boardrooms. Trump’s AI-generated papal selfies and Canadian kingmaking blur reality. TK Arun warns: uncertainty, not inventory, throttles the US economy. Recession looms, warns Goldman Sachs.

Trade wars twist again. Ajay Srivastava dissects asymmetric FTAs as UK firms gain footholds in Indian tenders while Indian MSMEs, outgunned abroad, cling to protected turf. The US has painted India's tariffs as the cause of its trade deficit, demanding India buy more American goods and ease regulations. Srivastava argues India must push back, noting that the overall economic balance favors America when accounting for arms sales, corporate profits, and educational spending.

And just when you think the week couldn’t be more surreal, there’s this literary footnote. R. Gurumurthy chronicles how a ₹72.5 million pre-order for a still-unpublished book by India’s ex-IMF executive Krishnamurthy Subramanian could raise more questions than copies.

So here we are: with a dead-alive ceasefire, a fragile bankruptcy framework, banks in distress, legacy companies fighting for relevance, and global trade tensions rising. Schrodinger would be proud. Or petrified. Who knows?

Until next week. Keep the lid half-open.

Yours truly,

Phynix

Also Read

- Why India Is Right To Challenge EU's Carbon Border Tax – Srinath Sridharan

- Are Tech Broligarchs The New Global Rulers? – Srinath Sridharan

- Prepare For The Global Euro – Hélène Rey

- Offscript Weekly: The World Feels Heavier – Ranjana Chauhan

- Trump Tariff On Foreign Films: The Reel Trouble Has Just Begun – Vijay Chauhan

- The Pakistan-Taliban Divorce Gets Messy – Shashi Tharoor