.png)

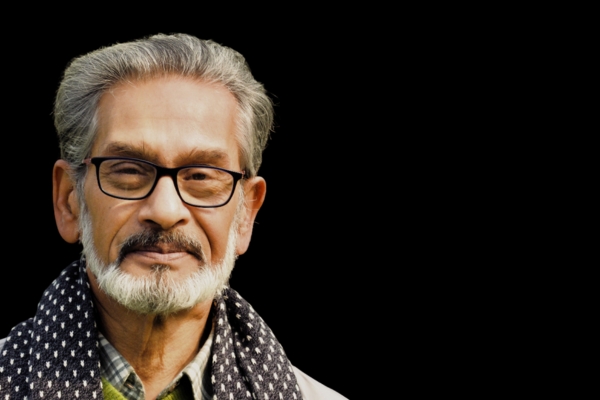

Rajesh Mahapatra, ex-Editor of PTI, has deep experience in political and economic journalism, shaping media coverage of key events.

March 2, 2025 at 12:32 PM IST

India’s economic growth is steady, but is it truly sustainable? The latest GDP estimates for 2024-25, at 6.5%, indicate resilience, but they also highlight a deeper problem—growth today is driven more by public investment than private demand. Without stronger household consumption and a revival of the small business sector, India’s economic expansion will remain fragile and imbalanced, says former chief statistician Pronab Sen.

For years, policymakers have focused on supply-side interventions, incentivising investment through production-linked incentives, infrastructure expansion, and easier credit conditions. While these policies have supported overall growth, they have failed to unlock the true driver of a thriving economy: domestic consumption. Private Final Consumption Expenditure is estimated to grow 7.6% in 2024-25, an improvement from 5.6% the previous year, but still short of pre-pandemic levels.

Much of the optimism surrounding India’s economic trajectory is driven by headline GDP numbers, which do not fully capture the underlying weaknesses in household spending. A closer look at the data reveals a troubling reality: private consumption remains subdued, and businesses are reluctant to invest in expanding capacity, said Sen, who served as an advisor to the erstwhile Planning Commission for more than two decades.

The manufacturing sector, often seen as the backbone of industrialised economies, is also struggling to maintain momentum. While it posted double-digit growth in 2023-24, the most recent quarter saw it slow to just 3.5%. The reason? The post-COVID recovery has been highly uneven.

Large corporates have expanded their market share at the expense of smaller businesses, which continue to face difficulties in securing credit and restarting production, Sen told Basis Point Sen in an exclusive interview.

Here are the edited excerpts from the interview:

GDP Growth, Consumption and Investment

A key takeaway from Sen’s insights is the shift in the composition of economic growth. Traditionally, investment and private consumption serve as the dual engines of expansion. However, the current economic cycle tells a different story. While GDP estimates have been revised upwards, consumption growth alone does not fully explain the economy’s momentum. More importantly, investments can not be the primary driver of growth, suggesting that India’s ability to maintain its 6.5% trajectory over the next few years will largely depend on sustaining existing demand rather than generating new investment cycles.

The revised GDP numbers also indicate that household consumption has improved, but remains below pre-pandemic levels. A stronger consumption cycle could accelerate India’s recovery, but persistent challenges, particularly in rural areas, are holding back stronger demand. Investment, which should ideally complement and reinforce consumption-driven growth, has yet to emerge as a leading force. This is a concerning trend, as a consumption-heavy economy without adequate investment risks stagnation in productivity and employment generation.

Agriculture A Bright Spot, But Is It Sustainable?

Among the sectors contributing to GDP growth, agriculture stands out with impressive gains. The sector’s growth has become stronger from 2.8% last year to an estimated 4.6% this year, adding 3.4 percentage points to the overall economic expansion. This robust performance has helped counterbalance the slowdown in manufacturing and has had positive spillover effects on rural incomes and consumption. However, Dr. Sen expressed concerns about whether this growth in agriculture is sustainable in the long run.

One of the key risks facing the sector is climate variability. As weather patterns become more unpredictable, particularly with extreme heat affecting the rabi harvest, agricultural output may face downward pressure in future quarters. If this occurs, rural incomes could suffer, negatively impacting household spending and demand for goods and services in non-agricultural sectors. This underscores the urgent need for agricultural resilience policies, including better irrigation infrastructure, climate-adaptive farming techniques, and crop insurance expansion.

Manufacturing in Need of Revival

While agriculture has performed well, manufacturing has struggled to sustain its growth momentum. After experiencing double-digit growth in 2023-24, the sector slowed sharply in the second half of 2024, with revised figures showing just 2.1% growth in the July-September quarter. The October-December quarter brought only a modest improvement to 3.5%, and full-year estimates suggest that manufacturing may only grow by 4.3%, a steep decline from approximately 12% growth in the previous fiscal year.

This stark slowdown raises concerns about the underlying health of the manufacturing sector, particularly for small and medium enterprises (SMEs). According to Dr. Sen, much of the growth seen in 2023-24 was driven by large corporations expanding their market share at the expense of MSMEs. The COVID-19 pandemic disproportionately impacted smaller manufacturers, many of whom struggled to restart production and access necessary investments.

Despite these challenges, revised GDP estimates hint at a silver lining. Unlisted firms, which often represent a large share of small and medium enterprises, may have performed better than expected, suggesting that employment conditions in the sector could be more stable than initially believed. However, for manufacturing to fully regain its strength, significant financial and structural hurdles must be addressed.

Liquidity Constraints vs Interest Rates

One of the most pressing challenges facing the Indian economy today is liquidity constraints. Sen argues that liquidity shortages are a bigger issue than high interest rates, as money supply growth has fallen below the historical average of 11-12%. This tightening of liquidity affects all areas of the economy, but small businesses and cash-dependent enterprises suffer the most.

A key concern is that banks continue to favour personal loans over production loans, making it difficult for manufacturers—especially MSMEs—to secure funding for expansion. While reducing the Cash Reserve Ratio could help increase the availability of credit, Dr. Sen believes that it would not address the broader money supply issue. Additionally, rising government bond yields have increased borrowing costs, making fixed investments less attractive.

RBI’s Imperative: Navigating Growth and Inflation

A repo rate two percentage points above the inflation rate is a reasonable target, given India’s capital shortages, Sen argued. But even with stable interest rates, the key challenge remains liquidity. Without greater credit availability, the economy will struggle to sustain its current momentum.

To address these liquidity concerns, he suggests that the RBI should prioritise injecting more cash into the system through open market operations while maintaining a steady repo rate. He also argues that the ideal repo rate should remain around 2 percentage points above the inflation rate, considering India’s ongoing capital shortage.

On the issue of inflation, Sen acknowledged that rising inflation is inevitable as economic growth picks up momentum. With inflation hovering near 6%, policymakers must strike a delicate balance between promoting investments and containing price pressures. However, he dismissed concerns about stagflation, pointing out that investment figures remain stable and indicate a sustained growth rate of 6% to 6.5% in the near term.

MSMEs in India’s Growth Strategy

A crucial takeaway from the interview is the indispensable role of MSMEs in driving long-term economic growth. In developed economies, MSMEs account for a significant share of manufacturing output, offering advantages such as greater flexibility, innovation, and responsiveness to market shifts. However, in India, post-pandemic growth has been unequally distributed, with large corporations recovering much faster than smaller enterprises.

To ensure inclusive growth, policymakers must recognize and address the disproportionate impact of COVID-19 on MSMEs. Sen suggests that while initiatives such as government-backed working capital loan guarantees are helpful, they are not sufficient to foster new entrepreneurship. Instead, he advocates for a more proactive role from the government, potentially acting as a venture capitalist for the non-IT sector.

Way Forward

India’s economic growth remains on stable footing, but structural challenges persist. While 6.5% growth is sustainable, unlocking higher and more inclusive expansion requires focused policy interventions. The missing demand engine—household consumption and MSME-led growth—must be reignited.

India’s ambition to become a high-income economy by 2047 requires a significant shift in economic policy. A per capita income of $13,500 by then will necessitate 8% average annual GDP growth, while a more ambitious target of $25,000 per capita income would require an almost unrealistic 14% growth rate. These figures highlight the urgent need for demand-driven expansion rather than an overreliance on government-led investment.