.png)

Equities Gain on Fed Rate-Cut Optimism; Yen Slides Amid Japan’s Political Transition

Here’s your quick read to start the day: a chatty, no-fuss look at overnight moves, the big story, what’s on the docket, and the tickers you need to watch.

September 8, 2025 at 2:04 AM IST

GLOBAL MOOD: Mixed Risk Tone

Drivers: Fed rate cut hopes, Japan political uncertainty

Global markets showed a mixed risk tone Monday, with equities gained and the dollar weakened as weak US jobs data reinforced rate-cut bets, but Japan’s political uncertainty and lingering concerns over global debt kept investors cautious.

TODAY’S WATCHLIST

- China August trade Balance Data

- Japan Q2 GDP Data

THE BIG STORY

Japanese Prime Minister Shigeru Ishiba resigned on Sunday, triggering a period of potential policy uncertainty for the world’s fourth-largest economy. The 68-year-old leader, who had just finalised a trade deal with the United States to ease President Donald Trump’s tariffs, cited responsibility for a series of bruising election defeats.

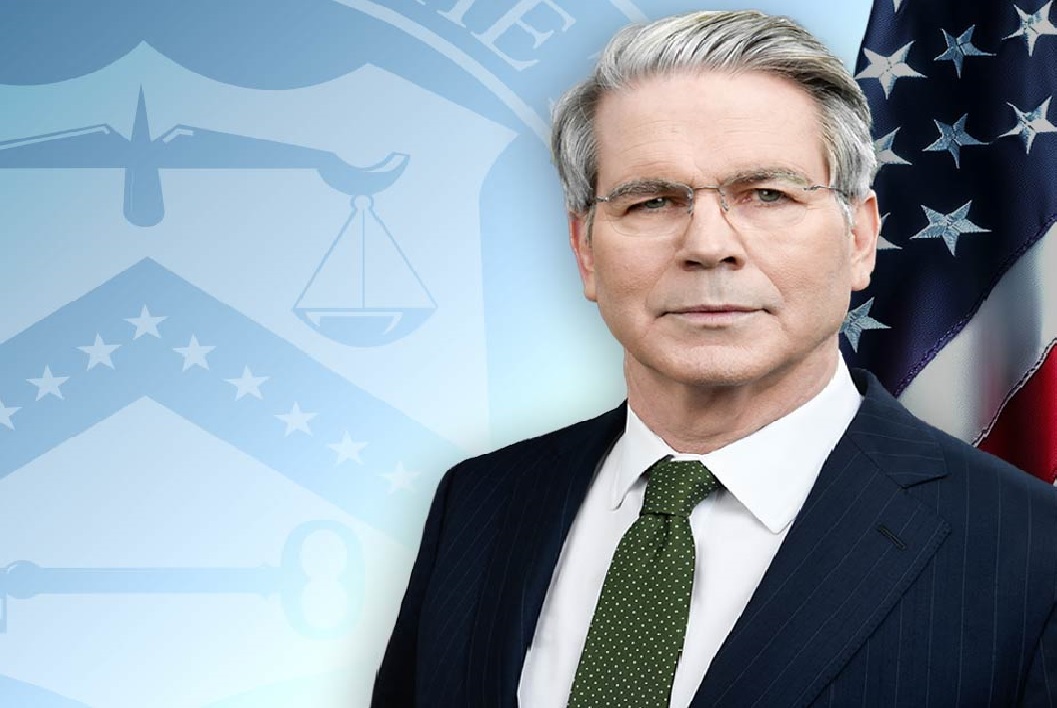

Meanwhile, US Treasury Secretary Scott Bessent called for a thorough review of the Federal Reserve, including its authority to set interest rates, as the Trump administration seeks greater oversight of the central bank. In a Wall Street Journal essay, Bessent urged an “honest, independent, nonpartisan review” covering monetary policy, regulation, communications, staffing, and research. He also recommended that the Fed delegate bank supervision to other agencies and reduce economic distortions from bond purchases outside of crisis conditions.

Data Spotlight

US job growth weakened sharply in August, with the unemployment rate climbing to 4.3%, the highest in nearly four years, underscoring a softening labour market and reinforcing expectations for a Federal Reserve rate cut later this month. The Labor Department report also showed the economy lost jobs in June for the first time in four and a half years, while the broader U-6 unemployment rate rose to 8.1% from 7.9% in July. The labour force expanded to 170.778 million, lifting the participation rate slightly to 62.3%. Economists cited factors such as tariffs, immigration restrictions, and public-sector layoffs for the slowing job growth.

Takeaway: US Labour market weakness is intensifying, strengthening the case for imminent Fed rate cuts, while broader unemployment measures show underutilized workforce remains a concern.

WHAT HAPPENED OVERNIGHT

- US Stocks ended slightly lower amid mixed economic signals

- S&P 500 bank Index fell 2.4%, with bank shares taking the biggest hit.

- Broadcom surged 9.4% after securing a $10 billion AI chip order and forecasting Q4 revenue above estimates.

- Investor sentiment weighed between economic worries from weaker job growth and optimism over potential Fed rate cuts.

- US Treasury 10-year yield hits five-month low amid Fed rate-cut bets

- US Treasury 10-year yield fell sharply to 4.10%, the lowest in five months, on signs of weakening labor market.

- Investor sentiment moved to safe assets reflects dovish outlook for the Fed.

- 30-year bonds yields dropped less, remaining higher YTD, signalling persistent inflation concerns from tariffs and expansionary fiscal policies.

- US dollar slides on weak US jobs data

- US dollar Index dropped 0.48% to 97.767, lost 0.23% for the week.

- US dollar falls sharply after weaker-than-expected jobs report.

- Dollar down 0.70% vs Japanese yen at 147.44, but still poised for second weekly gain.

- Crude oil prices drop as weak US jobs data clouds demand outlook

- Brent crude oilsettled at $65.50 a barrel down 2.2%, while WTI ended at $61.87 per barrel, down 2.5%.

- Weak US jobs data dampened energy demand expectations.

Day’s Ledger

Economic Data

- Germany July Industrial Production Data

- Germany July Trade Balance Data

- China August trade Balance Data

- Japan July Current Account Data

- Japan Q2 GDP Data

Corporate Actions

- New Delhi Television to consider fund raising

- Baid Finserv to consider fund raising

Tickers to Watch

- ACME SOLAR HOLDINGS to acquire 100% of AK Renewable Infra for ₹7.93 billion EV.

- ADANI GREEN ENERGY operationalises 87.5 MW at Khavda; total renewable capacity now 16,078 MW.

- ADANI POWER signs pact with Bhutan’s DGPC for 570 MW Wangchhu hydro project (49:51 JV).

- AUROBINDO PHARMA: US FDA issues Form 483 with 8 procedural observations post-inspection at Bachupally unit.

- BHEL signs MoU with Horizon Fuel Cell Tech for hydrogen fuel-cell locomotives; exclusive 10-year tie-up.

- HFCL overseas arm secures ₹35.8 billion export order for optical fibre cables.

- HYUNDAI MOTOR INDIA to pass full GST rate cut benefit to customers; prices down up to ₹240,000 from Sept 22.

- MAHINDRA & MAHINDRA cuts ICE SUV prices by ₹100000–160000 across Thar, Scorpio, Bolero, XUV700, Scorpio-N.

- NTPC GREEN ENERGY MoU with VOC Port to set up green hydrogen fueling station and hydrogen trucks.

- PNB HOUSING FINANCE board okays NCDs issuance up to ₹50 billion via private placement.

- SUNTECK REALTY to raise ₹50 billion via 11.76 million convertible warrants at ₹425 each.

- TATA MOTORS cut prices by up to ₹160000 on cars and SUVs, effective Sept 22.

- TIME TECHNOPLAST to acquire 74% in Ebullient Packaging; deal values EPPL at ~₹20 billion EV.

- VEDANTA wins bid for Jaiprakash Associates JAL at ₹170 billion; NPV pegged at ₹125.05 billion.

- ZYDUS LIFESCIENCES: US FDA inspection at Vadodara injectables plant ends with 4 observations, none on data integrity.

MUST READ:

- Why Indian Banks Are Piling Capital Faster Than Assets Can Keep Up

- Moody’s Warns AI Could Redefine Sovereign and Corporate Credit by 2030

- GST Overhaul Seen Adding 0.7-0.8% to GDP this Year

- India Treads With Caution After Trump Softens His Rhetoric

- US Migrant Raid Jolts South Korea, Stirs Investor Anxiety

- Trump Family Adds $1.3 Billion of Crypto Wealth in Span of Weeks

- Ban It, Bill It

See you tomorrow with another edition of The Morning Edge.

Have a great trading day.

Regulation vs. Market Growth

SEBI’s recent wave of rule changes is reshaping India’s capital markets. While the intent to protect retail investors is laudable, the pace and scope risk veering into overreach.

From weekly expiries to intraday monitoring limits, traders now face constant recalibration. Arbitrage, a cornerstone of market efficiency, risks becoming unviable. Liquidity could dry up, strategies may collapse, and innovation might stall.

Regulation must protect, but not suffocate.

Sanjay Mansabdar writes, why India needs balance, not zeal, in financial regulation.