.png)

Asian Markets Edge Higher as Wall Street Rally Sparks Cautious Optimism

Here’s your quick read to start the day: a chatty, no-fuss look at overnight moves, the big story, what’s on the docket, and the tickers you need to watch.

September 23, 2025 at 1:44 AM IST

GLOBAL MOOD: Risk-on

Drivers: Fed Rate Cuts, Monetary Policy Divergence, Tech & AI Gains

Asian stocks opened modestly higher, echoing Wall Street’s tech-led rally. Sentiment stayed cautiously risk-on as investors priced in further Fed easing, though persistent inflation worries and mixed policy signals capped enthusiasm.

TODAY’S WATCHLIST

- Fed Chair Powell Speech

THE BIG STORY

Fed Governor Stephen Miran has reignited debate within the Federal Reserve, arguing on Monday that monetary policy is already "well into restrictive territory" and that further aggressive rate cuts are necessary to prevent the US job market from deteriorating. His stance follows last week’s quarter-point rate cut, the Fed’s first since December, and underscores the debate between focusing on jobs and inflation concerns. Miran, who dissented during last week’s vote calling for a larger half-point reduction, warns that without additional easing, the labour market could face undue stress as hiring slows and layoffs increase.

However, several regional Fed presidents have pushed back against Miran’s more dovish outlook. St. Louis Fed President Alberto Musalem emphasised that with inflation still above the 2% target, there is limited room for further cuts, while Atlanta Fed President Raphael Bostic stressed that inflation risks continue to outweigh labour market concerns. Cleveland Fed President Beth Hammack also urged caution, noting that policy is not yet overly restrictive and that premature easing could stoke inflation.

The divergence in views underscores a broader uncertainty among policymakers about balancing the softening labour market with persistent inflation pressures remains the Fed’s most pressing challenge, and markets will be watching closely for signals from upcoming meetings.

Data Spotlight

Euro zone consumers have adjusted their spending patterns in response to anticipated US tariffs, shifting away from American products and curbing discretionary purchases, according to a European Central Bank study released on Monday. Euro Area consumer confidence improved to -14.9 in September 2025, up from -15.5 in August and surpassing market expectations of -15.3. The stronger sentiment was supported by lower borrowing costs and easing inflation in recent months. Across the EU, consumer sentiment also rose, increasing 0.5 points to -14.3.

Takeaway: Consumer confidence in the Euro zone and EU is gradually improving, aided by lower borrowing costs and moderating inflation, but trade and fiscal uncertainties continue to pose risks to spending.

WHAT HAPPENED OVERNIGHT

- US stocks surge for third consecutive record close

- All three major indexes closed at record highs for a third straight session.

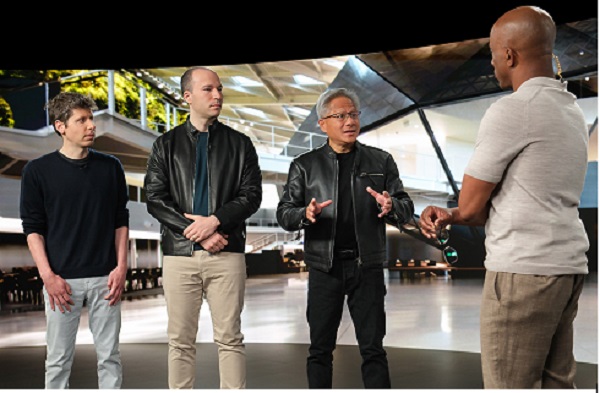

- Nvidia surged 3.9% after announcing up to $100 billion investment in OpenAI and supplying chips for its data centres.

- Apple rose 4.3% following a target price upgrade from Wedbush on strong iPhone 17 demand.

- Tesla gained 1.9%, helping tech sector lead S&P 500 with 1.7% increase.

- All three major indexes closed at record highs for a third straight session.

- US Treasury yields up marginally ahead of Fed comments

- Yield on the 10-year US Treasury rose 1.3 bps to 4.152%, near a three-week high.

- The 2-year note yield rose 2.5 bps to 3.607%, tracking near-term Fed expectations.

- Investors awaited remarks from Fed officials, including Chair Powell, for policy signals.

- Yield on the 10-year US Treasury rose 1.3 bps to 4.152%, near a three-week high.

- US Dollar index falls as investors eye Fed commentary

- The US dollar index slipped below 97.5, ending a three-day winning streak.

- Traders awaited comments from Fed officials for guidance on the policy outlook.

- St. Louis Fed President Musalem said rates are “between modestly restrictive and neutral” with limited room for further cuts.

- The US dollar index slipped below 97.5, ending a three-day winning streak.

- Crude oil prices slip slightly amid oversupply concerns

- Brent crude oil settled 11 cents lower at $66.57 a barrel.

- Market worries over oversupply outweighed geopolitical tensions in Russia and the Middle East.

- Brent has traded in a $65.50–$69 range since early August.

- Brent crude oil settled 11 cents lower at $66.57 a barrel.

Economic Data

- Australia Sep Flash PMI

- Euro Sep Flash PMI

- India Sep Flash PMI

- Singapore Aug Inflation Rate

- UK Sep Flash PMI

- US Sep Flash PMI

Corporate Actions

- Brand Concepts to consider fund raising

- Harshil Agrotech to consider fund raising

- Sudarshan Chemical earnings

Policy Events

- BoC Kozicki Speech

- Fed Bowman Speech

- Fed Bostic Speech

- Fed Chair Powell Speech

- ECB Cipollone Speech

Tickers to Watch

- ADANI GROUP adds ₹1.16 trillion in market value, its biggest gain in 10 months

- ALKEM LABORATORIES launches biosimilar Pertuza injection in India for breast cancer

- BRIGADE GROUP to co-develop residential project in south Bengaluru

- CONCORD BIOTECH looks to domestic and other markets to offset US tariff risks

- GLENMARK PHARMA board to meet Friday to consider interim dividend for FY26

- INDUSIND BANK appoints Viral Damania as chief financial officer

- KEC INTERNATIONAL wins ₹32.43 billion orders from UAE and the Americas

- TATA INVESTMENT CORP sets Oct 14 as record date for 10-for-1 stock split

Must Read

- Three RBI executive directors in race to succeed deputy governor Rao

- Temasek seeks to acquire minority stake in Nash Industries for $120-150 million

- Core sector hits 13-month high of 6.3% in August on low base effect

- AI adoption in banks must balance innovation with risk: RBI Dy Guv

- Second half market borrowing to remain unchanged: CEA

- GST reforms can boost India's GDP by 0.8%, says Petroleum Minister Hardeep Singh Puri

- Fed’s Bostic Sees Little Reason to Cut Rates Further for Now

- India's pension regulator plans to widen investment options for better returns

- CareEdge Ratings forecasts 17–20% fall in diamond exports in FY26

- Nvidia to invest up to $100 billion in OpenAI

See you tomorrow with another edition of The Morning Edge.

Have a great trading day.

H-1B Visa Clampdown Puts Spotlight on India’s Innovation Deficit

Sharmila Kantha writes, the shock H1B visa fee hike is not just about lost opportunities abroad. It’s a wake-up call for India: build stronger R&D, deepen skills in AI, robotics, and advanced manufacturing, and create pathways for innovation at home.

The real test is whether India can shift from being a talent exporter to becoming a hub of global tech leadership.