.png)

Asia Turns Cautious Ahead of Divisive Fed Call and Rising Geopolitical Risks

Here’s your quick read to start the day: a chatty, no-fuss look at overnight moves, the big story, what’s on the docket, and the tickers you need to watch.

December 9, 2025 at 1:36 AM IST

GLOBAL MOOD: Cautiously Risk-Off

Drivers: Fed Rate Cut Bets, Ukraine Peace Deal

Asian markets leaned risk-off as investors awaited the Fed’s decision amid uncertainty over how divided policymakers are on future easing. Renewed Russian strikes in Ukraine and broader geopolitical tension further dampened sentiment, keeping regional trading defensive ahead of a pivotal week for global central bank signals.

- Reserve Bank of Australia Interest Rate Decision

THE BIG STORY

Meanwhile, geopolitical and domestic tensions added fresh uncertainty. Russian drone strikes hit the Ukrainian city of Sumy for a second time in 24 hours, triggering widespread power outages and underscoring escalating pressure on Kyiv as peace negotiations stall. In Washington, Trump criticised insurance companies as Democrats push to extend Obamacare subsidies, warning millions could lose coverage if the aid expires. He also condemned the EU’s €120 million fine on Elon Musk’s X platform, signalling rising US–EU tech friction.

Data Spotlight

US inflation expectations remained largely unchanged in November, according to the New York Fed’s Survey of Consumer Expectations. One-year-ahead inflation held at 3.2%, while both the three- and five-year horizons stayed anchored at 3.0%, signalling stable medium-term expectations. Inflation uncertainty was steady across most timeframes, easing slightly at the five-year horizon. Meanwhile, expected home price growth remained unchanged at 3.0% for the sixth straight month.

However, expectations for key household costs moved sharply higher. Consumers now anticipate notable year-ahead increases in food (5.9%), gas (4.1%), college education (8.4%), rent (8.3%), and especially medical care, which surged to 10.1%, its highest reading since 2014.

Takeaway:

WHAT HAPPENED OVERNIGHT

- US stocks slip ahead of highly anticipated Fed decision

- US stocks closed lower on Monday, with most S&P 500 sectors in the red as investors adopted a defensive stance ahead of Wednesday’s closely watched Fed policy announcement.

- Hopes for a December rate cut remain intact after last week’s data showing moderate Q3 consumer spending, but traders are bracing for signals from what could be the most divided Fed in years.

- Paramount-Skydance’s $108.4 billion bid for Warner Bros Discovery made headlines, raising WBD (+4.4%), Paramount (+9%), and lowering Netflix (-3.4%).

- The communications services sector lagged, with Alphabet (-2%+) and Meta weighing heavily on the index and dampening broader market sentiment.

- US stocks closed lower on Monday, with most S&P 500 sectors in the red as investors adopted a defensive stance ahead of Wednesday’s closely watched Fed policy announcement.

- US Treasury yields climb on cautious Fed outlook

- The 10-year US Treasury yield rose toward 4.2%, the highest since early September, as investors reassessed how aggressively the Fed will ease policy in 2026.

- While a rate cut this Wednesday is fully priced in, sticky inflation has fuelled expectations that the Fed will proceed more cautiously thereafter.

- The 30-year yield jumped to a three-month high of 4.8%, reflecting broader curve steepening.

- Last week’s modest uptick in consumer confidence, set against signs of slowing hiring, added to uncertainty over the economic path and the Fed’s reaction function.

- The 10-year US Treasury yield rose toward 4.2%, the highest since early September, as investors reassessed how aggressively the Fed will ease policy in 2026.

- US Dollar firms ahead of Fed meet

- The Dollar edged higher on Monday in volatile trading as markets positioned for a heavily anticipated Fed meeting, where a 25-bps rate cut is nearly fully priced in.

- The dollar index hovered below 99, extending a two-week decline driven by expectations of a milder easing cycle and uncertainty around the Fed’s forward guidance.

- The yen weakened broadly after a 7.6-magnitude earthquake struck northeast Japan, triggering tsunami alerts and evacuation orders, adding pressure to the already fragile currency.

- The Dollar edged higher on Monday in volatile trading as markets positioned for a heavily anticipated Fed meeting, where a 25-bps rate cut is nearly fully priced in.

- Crude oil prices drop nearly 2% as Iraq output returns

- Brent crude prices fell 1.98% to $62.49 a barrel, while WTI slipped 2% to $58.88, marking a sharp pullback to start the week.

- Prices declined after Iraq restored output at a key oilfield, bringing back production that represents roughly 0.5% of global supply, easing near-term supply concerns.

- Sentiment was further pressured as markets monitored ongoing Ukraine–Russia peace talks, which could eventually pave the way for increased Russian exports if progress is achieved.

- Brent crude prices fell 1.98% to $62.49 a barrel, while WTI slipped 2% to $58.88, marking a sharp pullback to start the week.

Day’s Ledger

ECONOMIC DATA

- US WASDE Report

- India State Bond Auction

- Dr Lalchandani Labs board to mull fund raising

- Emkay Global Financial board to mull fund raising via NCDs

- Tilak Ventures board to mull rights issue

POLICY EVENTS

- US FOMC 2-day Meeting Begins

- Australia Interest Rate Decision

- BoJ Ueda Speech

- ECB Buch Speech

- BoE Governor Bailey Speech

TICKERS TO WATCH

- INDIGO gets 24 hrs for DGCA reply as refunds hit ₹6.10 billion

- RELIANCE Group to scale solar, storage platforms; NU Energies adds capacity

- TATA signs up Intel as first major customer for $14 billion chip foray

- EDELWEISS EAAA to raise up to $1.5 bn for private credit fund ESOF IV

- DR REDDY'S signs licensing pact with Immutep to develop, market cancer drug

- Japan's JERA inks 10-year LNG export deal with TORRENT POWER from 2027

- MPC Signals Maturity as Policy Counters Shocks with Confidence

- December Cut for Inflation, a February Cut for Growth

- Why Netflix Buying Warner Matters for PVR Inox Investors

- Beyond Diplomacy: The Economic Reality of India-Russia's $100 Billion Ambition

- Parliamentary committee asks govt to remove solar power constraints

- GST 2.0 tilts scales towards ICE as EV penetration softens in November

- Parliament clears Bill to levy cess on pan masala manufacturing units

- US, India to hold bilateral trade talks on December 10-11 in Delhi

- Flight cancellations credit negative, to hit IndiGo financially: Moody's

- Thali costs drop 13% on-year, led by benign input prices: Report

- The Year of America’s Cranky Consumer

- Paramount Makes Hostile Takeover Bid for Warner After Netflix Struck Deal

See you tomorrow with another edition of The Morning Edge.

Have a great trading day

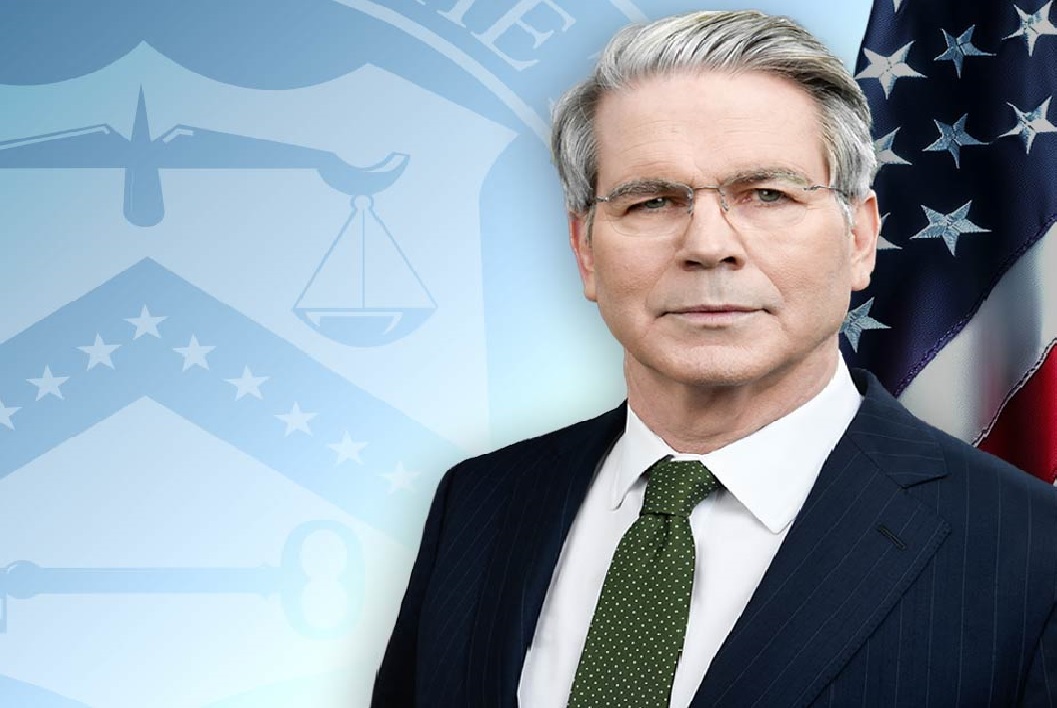

Power Without Certainty: America at a Strategic Crossroads

The newly released US National Security Strategy isn’t a declaration of confidence—it’s a revealing window into American uncertainty.

Lt Gen Syed Ata Hasnain’s (Retd) writes, a strategy caught between old assumptions of primacy and a new reality of contested power, where intelligence doesn’t guarantee strategic wisdom and alliances are increasingly transactional.