.png)

Krishnadevan is Editorial Director at BasisPoint Insight. He has worked in the equity markets, and been a journalist at ET, AFX News, Reuters TV and Cogencis.

June 4, 2025 at 11:04 AM IST

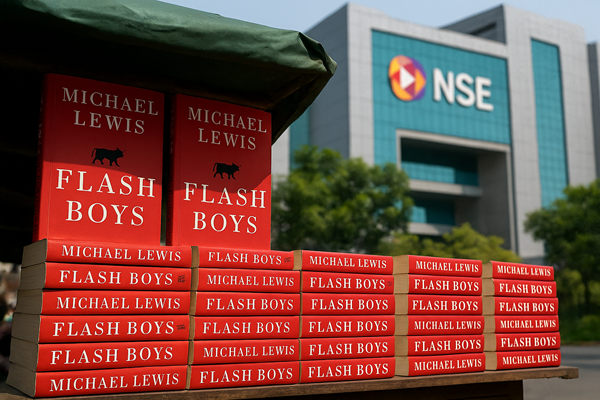

The Indian equity market is in the midst of a technological transformation, one that is redrawing the boundaries of access, speed, and strategy for all participants. Trading data for April from the National Stock Exchange of India offers a clear view of this shift.

Colocation now commands a record 38.8% share of trading turnover. Algorithmic strategies account for a staggering 57% of trades, and the once-dominant CTCL/NEAT terminal has been relegated to a mere 25.8%, or less than half its share a decade ago.

This is not just a plumbing upgrade. It is a complete realignment of market power, risk, and opportunity, especially for India’s growing base of investors.

Colocation, the practice of placing trading systems physically adjacent to exchange servers, has long been the preserve of high-frequency and institutional traders. Its 55-basis-point jump in April alone underscores a simple truth: speed is now a decisive edge.

When milliseconds can determine the difference between profit and loss, the ability to execute trades with minimal latency is no longer a luxury but a necessity for active traders.

Latency—the lag between an order and execution—can make or break a trade. Lower latency helps an order to be processed faster, which can be crucial for traders who rely on speed.

For the regular investor, however, the implications are nuanced. The retail segment, by and large, does not operate at the velocity or volume where colocation delivers outsized benefits. For long-term investors, the microsecond advantage is largely irrelevant. Investment returns, in their case, are driven by asset selection and discipline, not by shaving fractions of a second off order execution.

It means traders dabbling in intraday or momentum strategies are increasingly competing in an arena where institutional players with colocation have a structural edge.

Algorithmic Trading

The rise of algorithmic trading was even more pronounced. In April, algorithms accounted for 57% of all trades on the NSE, cementing their status as the market’s dominant force. This has brought tangible benefits like tighter spreads, deeper liquidity, and more efficient price discovery.

But for retail investors, algorithms are both a lifeline and a landmine.

On one hand, brokers and fintech platforms are democratising access to algorithmic tools, allowing individuals to automate strategies, reduce emotional bias, and participate in sophisticated trading approaches once reserved for institutions.

On the other, the complexity and opacity of these systems introduce new risks. Poorly-constructed algorithms can amplify losses, and the prevalence of automated trading increases the risk of sudden, sharp market moves or flash crashes that can catch participants off guard.

Such flash moves can trigger stop-losses in seconds—only to rebound faster, leaving investors dizzy and drained.

The data also signals a growing gap in market knowledge and preparedness. While algorithmic trading offers efficiency, it demands a level of technical literacy and risk management that many retail investors have yet to acquire. Algorithms can be a powerful ally, but only for those who invest the time to understand and control them.

Terminal Death

Perhaps the most symbolic shift is the decline of the CTCL/NEAT terminal. Once the backbone of retail trading, its share plummeted from 63% in 2014-15 to a three-month low of 25.8% in April. In its place, digital and mobile platforms are surging, with mobile trading alone now accounting for 20.8% of turnover. In fact, NSE data shows a monthly gain of 107 basis points.

This transition is democratising access to the market, lowering barriers for new investors, and making trading as simple as tapping a screen. But it also comes with new behavioural risks. The convenience of mobile trading has been shown to encourage overtrading and impulsive decision-making, often to the detriment of long-term returns.

The data from April shows while participation is broadening, the concentration of turnover remains high, and most retail activity is still clustered in smaller trade sizes and the most liquid stocks.

The convergence of colocation, algorithmic dominance, and the decline of traditional terminals marks a new era for Indian equity markets.

Technology has made India’s markets faster, but also more fragile. The risk of flash crashes is no longer hypothetical. For investors, the edge now lies not just in speed, but in staying informed, disciplined, and cautious. In this regime, clarity and common sense are the best safeguards against market shocks.