.png)

Yield Scribe is a bond trader with a macro lens and a habit of writing between trades. He follows cycles, rates, and the long arc of monetary intent.

May 19, 2025 at 3:26 AM IST

“What the wise man does in the beginning, the fool does in the end.” – Warren Buffett.

But what if this is just the beginning of the end of one cycle and the start of another? Now imagine compressing it into a three-month timeframe with extreme swings.

What if market cycles are self-correcting in a non-linear manner? By the time the entire market believes in one narrative, it turns sharply to another and that too with such ferocity that a fool in one becomes a genius in the other.

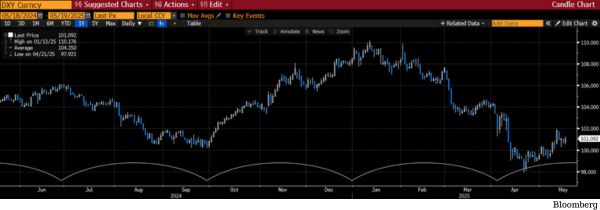

Between September 2024 and November 2024 when Trump won, the narrative of US exceptionalism was on a tear. This narrative was so strong that DXY, the dollar index, went to 110 in January 2025 from 100 in September 2024. If we look at chart below, we can see clearly that each cycle is hardly of three months.

Wild Swings

From January 2025 to April 2025, when Trump’s tariff tantrums started in earnest, DXY went into a tailspin until it reached about 98. And now, another cycle has started from April as Trump tones down his tariff talks. This cycle is still evolving. The China tariff rolldown was an event waiting to happen because the cycle was about to change. In hindsight, the event served as the trigger for DXY’s relief rally—but the setup was already in place.

One look at the ranges for these three-month cycles and one will be naïve not to admit these represent high standard deviation moves rarely seen in typical monthly data.

Every three months, the last nine months' cycles have reversed materially. DXY has gone between 110 and 98 every three months for the last six months. As an investor or even as a strategist, it teaches us how minuscule we are in the entire scheme of events.

While we mortals might try to intellectually explain these cycles, the fact is that we now live in a world where actions and reactions happen in real time, multi-fold. Greed and fear get exaggerated to such an extent that even firm convictions are shaken amid such wide trading ranges.

Algo Dominance

But algorithmic models don’t have emotions. They search for repetitive patterns and keep on trading in that direction till the momentum fades and a new momentum appears. And then trade on it in another direction till this momentum fades and another one appears.

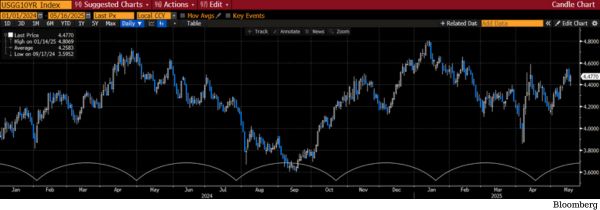

One can look at markets trying to predict Fed cutting rates. In the past 15 months, it is almost eight times markets have predicted Fed will cut rates by 150-200 bps in the next one year. But every time, markets fail, and they come back to this narrative with a vengeance sooner than later. It’s as if the markets believe in the tail wagging the dog. So, the 10-year UST yield has moved between 3.90% and 4.90% for the last 15 months with every cycle of three months and peak to bottom range of 50 bps. (see chart below)

But why are market cycles getting smaller and wilder at extremes. Is it a reflection of modern short human attention spans, rapid technological advancements and instant gratification needs of the current human psyche? Or is it just algorithmic models riding momentum till the end of the world and then a swift reversal to the other side, perhaps wilder? We don’t know yet. Perhaps it is a mix of both.

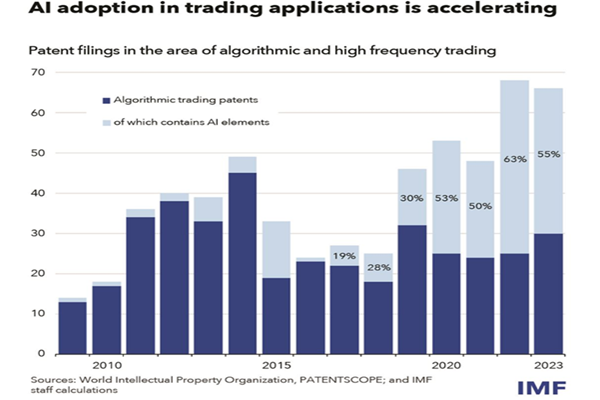

Is a shorter market cycle more efficient or more volatile? This is another issue facing regulators globally. Quantitative trading strategies start from being efficient but then end up making markets more volatile in stress events. But one can’t deny the rise in size as well as depth of these strategies. (see chart below)

New innovations in quantitative strategies are leading to high-frequency trading at another level. Investment portfolios of billion of dollars are rebalanced in a matter of seconds in liquid markets of US equities and bonds. In a faster reacting market, the sum of these quantitative strategies is in one direction till the direction reverses and then the cycle continues.

As strategists, traders and economists use more of “ceteris paribus”, we should remember Lord Krishna’s words: “The only thing constant about time is that it will change.”

Ten years ago, in 2015, the world's fastest supercomputer was the Tianhe-2, reaching a peak speed of 33.86 petaflops (33.86 * 10^15 floating-point operations per second). Currently, the world’s fastest computer at Lawrence Livermore National Laboratory in the US has a peak speed of 1,742 petaflops. Hence, it is not a surprise that market cycles, have become hardly three months now from five years in 2015. That tells you where we are headed in future. Philosophically, these short market cycles bring a sense of earthiness to the minds of strongly opinionated intellectual class.

Lord Buddha rightly said: “Everything is changeable, everything appears and disappears; there is no blissful peace until one passes beyond the agony of life and death.”