.png)

Rupee on a Leash: RBI’s Dictated Depreciation Strategy

The rupee’s path is less about macro forces and more about RBI’s silent hand, steering it lower while guarding stability with tight control.

By V Thiagarajan

Venkat Thiagarajan is a currency market veteran.

September 14, 2025 at 6:33 AM IST

In the decades following Richard Cooper’s 1971 lecture at Princeton, most currency crises followed a predictable script. Central banks financed large fiscal imbalances, defended fixed exchange rates, ran down reserves, and eventually devalued, often under the watch of the IMF or World Bank. By the mid-1990s, the “corners hypothesis” dominated thinking: only fully fixed or fully floating regimes could withstand shocks.

In practice, most countries experimented with arrangements in between, layering controls, interventions, and buffers. India itself endured a balance-of-payments crisis in 1991, devalued the rupee, and shifted towards a market-determined exchange rate. For nearly two decades, this flexible but credible framework allowed the rupee to mirror global dollar cycles, attract capital, and accommodate leveraged private borrowing.

That era now looks distant. In recent years, India’s exchange rate stance has taken on a unique character: the trajectory of the rupee is dictated less by macroeconomic fundamentals than by the Reserve Bank of India’s implicit hand. Domestic and global variables still matter, but their weight has been diluted. The RBI’s stance at any given moment has become the overriding force.

This divergence is not unique to India. Other emerging markets, including Indonesia, Brazil, and Turkey, have experimented with managed regimes that rely on heavy central bank involvement. What distinguishes India is the consistency and subtlety of its approach: interventions are calibrated not to shock, but to slowly nudge the rupee weaker while keeping intraday volatility tight. The result is a pattern of depreciation that looks orderly but feels orchestrated.

Twin Objectives, Hidden Costs

The strategy worked in the narrow sense. Volatility was curbed, and reserves swelled to record levels. But there was a trade-off. Persistent intervention eroded exchange rate flexibility and credibility. Breaks in the rupee’s levels were forced, not guided. Predictable one-way bets emerged, ironically created by the central bank’s own actions.

This dictated depreciation has come at a cost to private sector investment, capital inflows, and the central bank’s credibility.

The taper tantrum is particularly instructive. In 2013, India’s rupee lost nearly 20% of its value in a few months as global investors fled. The RBI responded by raising short-term interest rates, tightening capital controls, and drawing on reserves. That experience seared the lesson that reserves are the ultimate shield. Since then, every bout of global uncertainty has been met with intervention, reinforcing the belief that stability trumps flexibility. Yet the lingering effect has been to dull the market’s ability to discover fair value for the rupee.

Policy Without Clarity

The rhetoric suits all seasons, but the underlying practice is more complex.

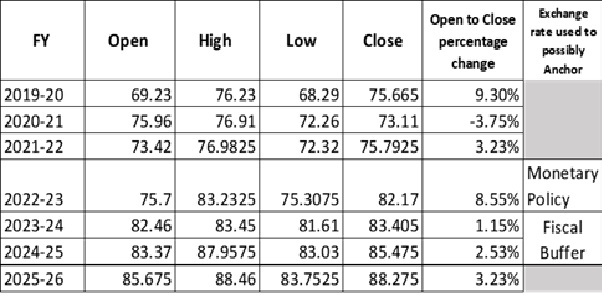

At times, the rupee has been deployed as a monetary policy anchor, with the RBI defending its value instead of hiking rates. At other times, depreciation has served as a fiscal buffer, boosting nominal revenues for the government. The absence of transparency forces markets to reverse-engineer policy by watching the RBI’s actions in the forex market, and by parsing the monthly RBI Bulletin, which details spot and forward activity.

The last 18 months tell the story. The RBI has alternated between heavy buying and selling of dollars, often trading more than the commercial market itself. The outcome has been a rupee guided into narrow daily ranges, but with a structural downward bias. Analysts have labelled this “dictated depreciation.”

Opacity is not without consequences. In the absence of a clearly articulated framework, firms, exporters, and investors must rely on inference. This reliance magnifies uncertainty, as participants constantly second-guess the central bank’s priorities. Even seasoned corporates admit that their treasury strategies are shaped more by RBI’s day-to-day footprints than by fundamentals. In effect, India’s most crucial price—the exchange rate—is being set by guesswork around central bank intentions.

Erosion of Credibility

Central banks live or die on credibility. For centuries, their trustworthiness has oscillated, strong under the pre-1914 gold standard, weak in the inflationary decades after, partially rebuilt in the 1980s. Credibility today is not defined by rigid rules but by consistent communication and trust that the bank will not be capricious.

India’s pattern of two-sided, large-scale interventions over prolonged periods has undermined that credibility. Market participants now see the rupee as a managed instrument, not a market-driven one. Trust, once weakened, corrodes slowly. And with it comes a broader questioning of institutional quality.

This credibility erosion carries a broader macroeconomic cost. When investors doubt the consistency of currency policy, they begin to question the reliability of monetary policy more broadly. It becomes harder for the RBI to persuade markets that inflation targets, liquidity management, or interest rate guidance are sacrosanct. A wobble in exchange rate credibility can thus ripple across the entire monetary framework.

This reputational risk is not theoretical. The US Treasury has in the past placed countries on its “monitoring list” for alleged manipulation. While India has avoided formal designation, the persistence of one-way depreciation leaves it vulnerable to criticism. Such charges, even if not enforced, can colour perceptions of India’s openness and tilt investor sentiment.

Stability vs Growth

Moreover, when the exchange rate policy is divorced from monetary policy, credibility can suffer. A central bank that sterilises interventions while claiming monetary independence invites accusations of currency manipulation. By leaning so heavily on intervention, India risks being seen as managing competitiveness through policy engineering rather than underlying economic fundamentals.

The private sector pulls back

Evidence shows that appreciation of domestic currencies eases financial conditions by lowering credit spreads, fuelling investment. Depreciation, even modest and steady, has the opposite effect. It interacts with leverage, dampens risk appetite, and reduces capital expenditure.

India’s experience bears this out. Private sector capex has slowed steadily, falling to 11.2% of GDP in 2023–24, below pre-Covid averages, and is expected to drop further. The one-way slide of the rupee appears to have contributed to this malaise by disincentivising leveraged investment.

Executives quietly acknowledge that predictable depreciation has reshaped boardroom strategy. Firms avoid long-term foreign borrowing, fearing that steady rupee weakness will inflate liabilities. Others prefer to keep expansion conservative rather than risk balance-sheet mismatches. Over time, this conservatism translates into lower growth and lost opportunities. The rupee’s managed decline is not merely a currency story—it is an investment story.

Higher Risk Premiums

Capital inflows have decelerated. “Sudden stops” loom as a risk, particularly when investors perceive the policy framework as opaque and tilted against them. Allowing greater market determination could reduce the risk premium, stabilise inflows, and support growth.

The cost of higher risk premiums is visible in borrowing spreads. Indian corporates pay noticeably more in overseas markets than peers in economies with freer exchange rates. Sovereign borrowing costs are also subtly elevated. These incremental costs, compounded over years, represent billions of dollars of lost efficiency—an invisible tax on growth.

Communication Vacuum

The RBI’s reliance on state banks for intervention, combined with its reluctance to articulate objectives, leaves the market guessing. Yet if the RBI were to announce tomorrow that it would move to a free float, markets might barely react—so entrenched is the belief that the rupee is already guided downward.

Effective communication about objectives, strategy, and risks reduces surprises and anchors expectations. Without it, India risks being caught in a cycle where dictated depreciation becomes self-fulfilling.

Other central banks offer useful contrasts. The Bank of England publishes detailed minutes explaining currency-related decisions. The European Central Bank holds press conferences where exchange rate implications are often debated openly. Even the People’s Bank of China, despite its opaque reputation, has increased communication about yuan management. The RBI’s silence stands out in this global context, leaving Indian markets uniquely reliant on inference rather than guidance.

A Guided Fall

“Follow the leader” is the implicit message. The RBI sets the direction, markets comply, and macro fundamentals fade into the background. Yet an exchange rate policy that relies so heavily on opacity and control risks being unsustainable.

In the end, dictated depreciation buys stability at the expense of dynamism. India’s challenge is to restore credibility, rebuild investor trust, and allow market forces a greater role in setting the rupee’s path. Without this course correction, the exchange rate will remain less a reflection of India’s fundamentals and more a mirror of the RBI’s instincts. That may keep crises at bay, but it also risks shackling the economy’s long-term potential.

*Views are personal.

BasisPoint Briefing — Explainers from seasoned practitioners for readers who want more than the basics.