.png)

Nilanjan Banik is a Professor at the School of Management, Mahindra University, specialising in trade, market structure, and development economics.

December 4, 2025 at 9:58 AM IST

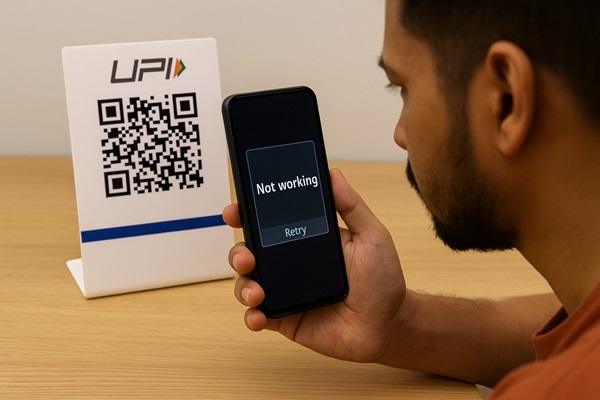

India's digital payment revolution, often hailed as a technological triumph, reveals a paradox: some of the country's wealthiest states are lagging behind in adoption. This counterintuitive finding, as shown in a recent study published in the Journal of Emerging Market Finance, ought to prompt policymakers to reassess their assumptions about financial inclusion and digital infrastructure.

According to the study, Telangana, Tamil Nadu, Maharashtra, Daman and Diu, and Andhra Pradesh lead in digital payment adoption. By contrast, states or regions such as Gujarat, Chandigarh, Karnataka, and Delhi are among those that lag behind. The presence of economically advanced regions in the lower-usage category challenges the conventional wisdom that prosperity automatically translates into technological adoption.

Why are affluent states falling behind? The study offers two compelling explanations. First, businesses in economically advanced regions typically engage in high-value transactions that exceed UPI's daily limit of ₹100,000 for most users. According to the India Digital Payments Report by Worldline, the average UPI transaction value declined 8% year-on-year in the first half of 2024 to ₹1,478, reflecting the platform's dominance in small-value, person-to-merchant transactions. The National Payments Corporation of India notes that 75% of retail transactions in India are below ₹100, and half of all UPI transactions involve amounts up to ₹200. Wealthier states, with their higher per capita incomes, naturally conduct fewer such micro-transactions.

The second explanation is more troubling—tax evasion. Vendors in certain sectors such as real estate, healthcare, and legal and accounting services often avoid digital payments to escape tax liabilities. This indicates that India's digital payment success story is built largely on small transactions, while the shadow economy continues to thrive in cash.

Beyond geography, the study exposes deeper demographic divides. Older citizens and women are less likely to use digital payments even when they possess bank accounts, smartphones, and internet access. Education emerges as the critical differentiator: individuals with higher secondary education are about 5.5% more likely to adopt digital payments than those without formal schooling, while graduates and postgraduates are about 16.2% more likely. However, education up to middle school shows no significant effect, suggesting that basic literacy alone is insufficient for digital financial inclusion.

The findings on electricity supply offer a silver lining. Bank branches and ATMs depend on continuous power, whereas mobile-based payments can operate on battery-powered devices, easing one long-standing barrier to access. Meanwhile, caste and religion appear to influence adoption only indirectly through their relationship with education and income.

Policy Implications

India's digital payment revolution is real, but it is incomplete.

Until we address the barriers of literacy, trust, and transaction limits, the benefits of this transformation will remain concentrated among the young, educated, and economically modest. True financial inclusion requires more than technology—it demands equity, education, and a social contract that makes transparency preferable to concealment.