.png)

Varun Beverages: Margins defended for now, but a CampaCoke assault lurks

Varun Beverages posts strong numbers for the March quarter, but rising pressure from Campa Cola and a recharged Coca-Cola could test its margin defense in India’s fizzy drinks war.

By Dev Chandrasekhar

Dev Chandrasekhar advises corporates on big picture narratives relating to strategy, markets, and policy.

May 3, 2025 at 7:54 AM IST

Varun Beverages Ltd, PepsiCo’s largest bottler in India, is selling more bottled fizz than ever. It is seemingly defying gravity in a market where new challengers are slashing prices and aggressively courting distributors.

The January-March results don’t reveal much about the shifting battlefield in India's increasingly competitive bottled beverages market, where a two-front assault is brewing.

VBL's consolidated sales volumes jumped 30.1% year-on-year to 312.4 million cases and revenue rose 29% to ₹55.67 billion. EBITDA margins for India improved by 111 basis points.

It’s a feat that might be increasingly difficult to sustain as competition intensifies.

Reliance Industries-backed Campa Cola deploys aggressive pricing straight from the Jio Telecom's playbook – 200ml bottles for ₹10 versus Pepsi's ₹20, and distributor margins that are said to be 6-8% compared with PepsiCo's typical 3.5-5%. This approach has already yielded results, with reports indicating that Campa Cola has secured approximately 10% market share in what was previously a saturated cola market dominated by Coca-Cola and PepsiCo.

Meanwhile, following a strategic shift aligned its global asset-light model, Coca-Cola announced in December a 40% stake sale in its wholly-owned India bottling business to Jubilant Bhartia Group—the amount wasn’t disclosed, but media reports put it at ₹100 billion. Much of this might be channeled into a substantial marketing war chest, with plans to significantly increase advertising spend across digital platforms and traditional media. Jubilant will bring spending heft of its own.

VBL Chairman Ravi Jaipurya acknowledged during the earnings call that both Campa and the revitalised Coke present "formidable competition."

He also said that, going by the financials, VBL's defense strategy is working.

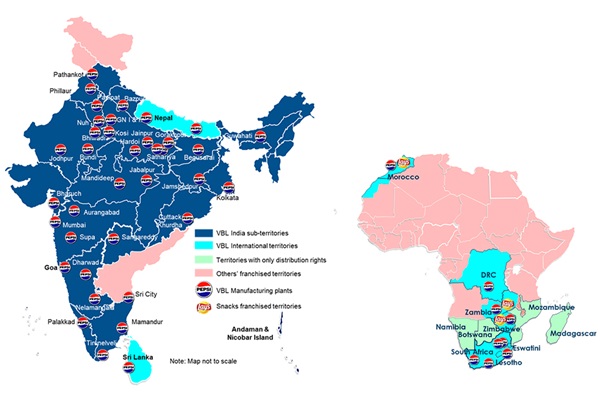

The company's multi-pronged approach begins with sheer scale. As PepsiCo's second-largest non-US franchisee globally, VBL controls 90% of its India sales volumes through 38 domestic production facilities and a distribution network of over 130 depots reaching over 4 million outlets.

While competitors chase volume at any cost, VBL is playing a different game. It's balancing larger pack sizes at competitive price points with smaller, higher-margin CSD packs. Product mix evolution is telling – low sugar or sugar-free products now comprise 59% of sales volumes, up from previous quarters.

Backward integration investments in Prayagraj and Democratic Republic of Congo are yielding dividends too. By controlling more of the supply chain, VBL is insulating itself from the margin compression hitting others in the industry.

Financial discipline provides another pillar. After debt repayment through the proceeds of their QIP, finance costs in India are now negligible, with interest income of ₹108 million actually boosting the bottom line. This helped drive PAT up 33.5% at ₹7.31 billion, outpacing revenue growth.

The margin story isn't uniformly positive, though. Consolidated gross margins declined 171 basis points to 54.6% year-on-year, dragged down by South Africa operation's 14.4% EBITDA margin. International expansion provides volume but dilutes profitability.

VBL's expansion investments create another tension. Depreciation has indeed increased significantly, rising by 45.3% due to several factors including the commissioning of new plants in Supa, Gorakhpur, and Khordha; along with the consolidation of operations in South Africa and the DRC. New production units in Kangra and Prayagraj, and additional greenfield plants in Bihar and Meghalaya are on track for the 2025 season.

The payoff lies in the future, but costs hit margins now.

The marketing approach reveals another dimension. While Coca-Cola appears to be loading its marketing arsenal following its bottling divestments, and Campa splurges on IPL cricket and Kumbh Mela sponsorships, VBL has opted out of certain high-profile events. This selective engagement preserves near-term margins but may risk brand equity longer-term.

Behind the numbers, industry observers question whether VBL's margins can withstand sustained pricing pressure from both fronts.

The company's five-year margin expansion – EBITDA margins growing from 20.3% to 23.5% and PAT margins doubling from 6.6% to 13.2% – suggests structural advantages rather than cyclical luck, but the combined threat from a cash-rich Coca-Cola and an aggressively priced Campa presents unprecedented challenges.

Analysts remain cautiously optimistic. As per Trendlyne, among 23 analysts covering the stock, the consensus is bullish with a target price of ₹641, an upside potential of nearly 23% from current levels. The earnings expectations outpace revenue projections, implying continued margin expansion despite competition.

The forecast aligns with VBL's historical pattern – from 2019 to 2024, while revenue grew at a CAGR of 22.9%, PAT grew nearly twice as fast at 41.0%. This persistent gap between revenue and profit growth underscores the effectiveness of VBL's margin defense playbook, even as it continues acquiring territories and investing in production capacity.

Investors impressed by VBL's volume surge would be wise to watch the margin line in coming quarters. The beverage market is increasingly splitting into three camps: Reliance's Campa pursuing market share through aggressive pricing, Coca-Cola rebuilding its marketing muscle through strategic divestments, and VBL balancing growth with margin protection. As this three-way battle intensifies, VBL's balancing act faces its toughest test yet.