.png)

Trade Fears Ease After US Supreme Court Signals Doubt on Trump Tariffs

Here’s your quick read to start the day: a chatty, no-fuss look at overnight moves, the big story, what’s on the docket, and the tickers you need to watch.

November 6, 2025 at 1:33 AM IST

GLOBAL MOOD: Cautiously Risk-on

Drivers: US Trump Tariff Case, US Government Shutdown

Global markets leaned risk-on as the US Supreme Court signalled skepticism over Trump tariffs, easing trade worries. Gains were tempered by US shutdown disruptions and aviation cuts, even as services data showed economic resilience.

TODAY’S WATCHLIST

- BoE Policy Decision

- Earnings: LIC, UPL

THE BIG STORY

Adding to market unease, Transportation Secretary Sean Duffy announced plans to cut 10% of flights at 40 major US airports starting Friday unless the 36-day federal government shutdown ends. The prolonged closure which is the longest in US history has forced over 63,000 aviation workers, including air traffic controllers and security agents, to work without pay, leading to widespread delays and staffing shortages.

Data Spotlight

US services activity accelerated to an eight-month high in October, reflecting steady demand despite ongoing trade-related uncertainty. The ISM nonmanufacturing PMI climbed to 52.4 from 50.0 in September, comfortably surpassing expectations of 50.8, and remaining well above the 48.6 threshold signalling economic expansion. The data confirmed that the services sector responsible for over two-thirds of US output continues to underpin growth, even as labour markets soften. The ADP Employment Report showed private payrolls rising 42,000, indicating modest job creation but lingering weakness in certain industries. Meanwhile, the EIA reported a 5.2-million-barrel build in crude inventories, countered by a sharp 4.7 million-barrel draw in gasoline stocks, hinting at resilient consumer demand.

Takeaway:

WHAT HAPPENED OVERNIGHT

- US Stocks gained on tech led rebound and strong data

- US stocks rebounded on Wednesday as concerns over stretched tech valuations eased and upbeat data bolstered sentiment.

- Momentum returned to big tech, with Alphabet (+2.4%), Meta (+1.4%), Broadcom (+1.8%), and Tesla (+2.7%) driving gains as the AI-led selloff paused.

- Solid ADP payrolls print of 42,000 and an ISM services index at an eight-month high supported the view of a resilient US economy.

- Palantir (−1.5%) and Super Micro Computer (−12.2%) lagged after weak guidance, showing selectivity in the rally.

- The Supreme Court’s skepticism toward the Trump tariff case reduced near-term trade risk, further aiding the risk-on mood.

- US stocks rebounded on Wednesday as concerns over stretched tech valuations eased and upbeat data bolstered sentiment.

- US Treasury yields edge higher on firm data and supply clarity

- The 10-year US Treasury yield climbed to 4.15%, marking its highest level in a month, as data pointed to ongoing economic resilience.

- The Treasury Department confirmed plans to borrow $125 billion in November, maintaining its previous issuance mix across maturities.

- The combination of firm data and steady supply boosted yields, reflecting reduced urgency for near-term policy easing.

- The 10-year US Treasury yield climbed to 4.15%, marking its highest level in a month, as data pointed to ongoing economic resilience.

- US Dollar steady near five-month peak on firm data

- The dollar index held firm around 100.16, close to its highest level since May, as stronger economic data eased worries over US growth and the labour market.

- The DXY index has climbed 1.5% over the past week following the Fed’s rate cut, with policymakers signalling limited room for further easing this year.

- The currency’s resilience highlights investor confidence in the US outlook, keeping the greenback well supported against major peers.

- The dollar index held firm around 100.16, close to its highest level since May, as stronger economic data eased worries over US growth and the labour market.

- Crude oil prices hits two-week lows on supply concerns

- Brent crude prices settled 1.43% lower at $63.52 a barrel, while WTI crude fell 1.59% to $59.60 a barrel.

- Prices dropped to two-week lows amid growing fears of a global supply glut and higher US crude inventories.

- The EIA report showed a build in US crude stocks last week, signalling that supply continues to outpace demand.

- Brent crude prices settled 1.43% lower at $63.52 a barrel, while WTI crude fell 1.59% to $59.60 a barrel.

Day’s Ledger

ECONOMIC DATA

- Japan Oct Composite and Services PMI

- India Oct Composite and Services PMI

- US Initial Jobless Claims

CORPORATE ACTIONS

- Jul-Sep Earnings: ABB India, Apollo Hospitals, Bajaj Housing, Cholamandalam Investment, Cummins India, Godrej Propero, LIC, Lupin, Mankind Pharma, NHPC, Ola Electric, UPL, Zydus Life

- Inter Globe Finance to consider fund raising

POLICY EVENTS

- BoE Interest Rate Decision

- ECB Schnabel Speech

- ECB Guindos Speech

- ECB Buch Speech

- Fed Barr Speech

- Fed Williams Speech

TICKERS TO WATCH

- SUN PHARMA Q2 net profit rises 2.5% to ₹31.18 billion on India, EM growth

- TEAMLEASE Q2FY26 results: Profit rises 12% to ₹275 million, revenue up 8%

- P&G HEALTH Q2 results: Profit rises 8% to ₹890 million, sales up 3%

- Indigo Q2FY26 results: Net loss widens by 161% on rupee depreciation

- SBI Q2 net profit rises 10% to ₹201.60 billion on Yes Bank stake sale

- CSB BANK Q2 profit rises 16% to ₹1.60 billion on strong income growth

- GRASIM Q2 profit up 76% on strong building materials, chemicals performance

- EMBASSY REIT profit drops 84% in Q2FY26 even as revenue rises 13%

- BEML Q2 results: Net profit declines 6% to ₹480 million on lower income

- M3M enters integrated township segment, to invest ₹72 billion in Gurugram

- PNGRB urges GAIL to phase out gas turbines, adopt electric motors

MUST READ

- Road, rail and defence lead FY26 capex surge; overall spend at 52%

- China bans foreign AI chips in state-funded data centres amid US tensions

- Musk's trillion-dollar temptation: Tesla faces a high-stakes shareholder vote

- Mutual fund equity buying hits six-month low in October at ₹177.78 billion

- Derivative turnover regains momentum, hits 12-month high in October

- Embattled Fed Governor Lisa Cook Voices Support for Recent Rate Cut

- US Hiring Rises for First Time Since July, ADP Reports

- Supreme Court Confronts Trump’s Power to Disrupt World Trade

- Govt to prioritise AI innovation, regulate only when needed

See you tomorrow with another edition of The Morning Edge.

Have a great trading day

Signals From the City

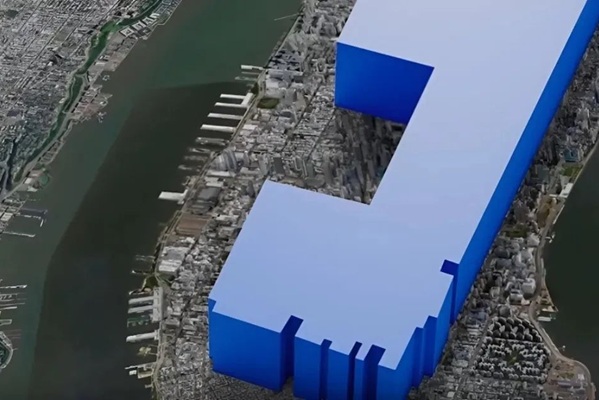

Zohran Mamdani’s surprising win in New York is more than a political upset, it reflects a deeper shift in how younger voters engage with leadership, policy, and representation. His campaign’s focus on affordability, public transport, and inclusivity resonated across age and community lines, signaling that disciplined messaging and genuine coalitions can win in a city weary of spectacle. As national politics braces for 2026, this win might offer a template for a new kind of politics.

Lt Gen Syed Ata Hasnain’s (Retd) writes, what does Mamdani’s victory say about Gen Z’s role in shaping electoral outcomes? Can this model of policy-first, cross-community leadership scale beyond urban centers? Will conservative politics respond with recalibration or deeper cultural entrenchment?