.png)

Sensex and Nifty Rebound as IT Strength Lifts Markets Ahead of Nvidia Earnings

An end-of-day recap of all that transpired in the Indian markets, highlighting the major price movements and the factors driving them

Dehuti Jani is an experienced project manager who also works as an independent financial journalist.

November 19, 2025 at 12:07 PM IST

Indian equities finished higher on Wednesday, with the Sensex and Nifty staging a strong rebound after a muted start, supported by renewed strength in IT stocks as global markets braced for Nvidia’s results amid mounting AI bubble concerns. Most sectors advanced, led by technology, with financials, healthcare, and consumer segments providing stability; weakness was minimal in select cyclical areas. The Sensex rose 0.61% to 85,186.47, and the Nifty50 climbed 0.55% to 26,052.65; meanwhile, the Nifty Midcap 100 edged higher as the Nifty Smallcap 100 slipped 0.40%, reflecting selective risk appetite across the broader market.

Top Movers of the Day

Infosys gained 3% to ₹1,531 after announcing that its ₹180 billion buyback opens on 20 November. The tender offer is priced at ₹1,800 per share and closes on 26 November, marking the company’s first tender-based buyback since 2017, with defined entitlements for retail and other shareholders.

Azad Engineering rose 5% to ₹1,724 after the company signed a major Master Terms and Purchase Agreement with Pratt & Whitney Canada for developing and manufacturing aircraft engine components seen as a significant validation of its aerospace capabilities.

Hero MotoCorp continued its strong run, hitting a fresh 52-week high of ₹5,916.60, rising 2% as investor confidence remained firm following the company's record Q2FY26 performance, supported by a timely GST cut.

Waaree Energies dropped 6% to ₹3,075 after Income Tax Department officials conducted investigations across multiple company facilities, prompting a sharp reaction from investors.

After a near-vertical rally since listing, Billionbrains Garage Venture Groww hit the 10% lower circuit, its first bout of selling pressure. The stock had previously surged over 90% above its IPO price, and analysts flagged stretched valuations and fatigue in the recent momentum.

Newly listed PhysicsWallah slumped over 8% to ₹143.28 on its second trading day. While still 34% above its IPO price, analysts cited intensifying competition in edtech, regulatory uncertainties and the challenge of sustaining profitability during expansion as key risks weighing on sentiment.

Futures & Options

Bonds

Forex

The rupee closed nearly unchanged at 88.5600 per US dollar on Wednesday, as importer demand offset earlier gains from stronger exporter flows and a slightly positive interbank trend. The currency hit 88.4250 early but eased due to import bids and modest portfolio outflows. Offshore traders, inspired by Wall Street banks, are using options to bet on a rupee rebound linked to a potential US–India trade deal.

Crypto

Bitcoin hovered near seven-month lows at around $91,200, down 4% over the past 24 hours, as traders remained cautious ahead of US jobs data and further Fed cues. The drop below the $92,000 support level sparked over $20 billion in derivatives liquidations, deepening a pullback that has erased much of Bitcoin’s 2025 gains from its October peak above $126,000. While a hammer candle hints at possible short-term stabilisation near $90,000, broader sentiment stays fragile, even as Ethereum edged up 1% to $3,027.24 and select altcoins showed pockets of resilience.

US Stock Futures

US Treasury Notes

US Treasury yields traded steady to marginally lower as investors await the Fed's minutes of the October policy meeting for insights about dissents. If the Fed cuts interest rates in December, there could easily be four dissenting votes, Standard Chartered Bank said , adding that if the Fed holds, there are likely to be three, or possibly more, dissenting voices.

Top News

- Reliance makes pet bet to take a bite of Godrej, Emami's market

- RPSG Ventures to acquire 40% of FSP Design for ₹455 crore in luxury push

- Reliance Jio unlocks Gemini 3 access, extends free Pro plan to all 5G users

- Oil India, TotalEnergies ink deepwater exploration pact covering Andaman, Mahanadi and KG offshore blocks

- KEC International barred from Power Grid Corporation tenders for 9 months

- SC questions "friendly" investigations, SEBI’s "double standards" in IHFL case

- Bajaj Auto takes full control of KTM in €800 million deal after EU approval

- Income Tax officials conduct probe at Waaree Energies' offices, facilities

- Ashok Leyland partners with FAMCO Qatar to boost presence in Gulf markets

- India may lose tech edge unless big firms scale up AI spending: MeitY

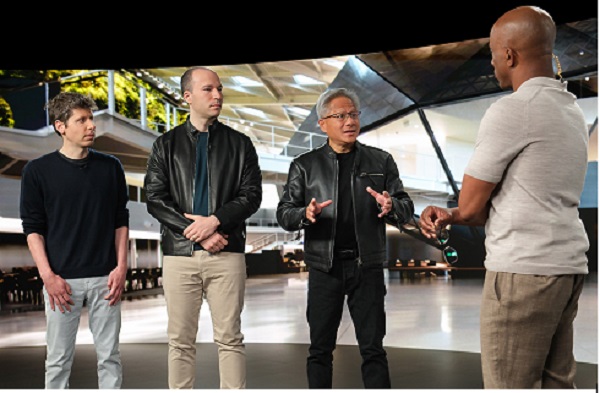

- Bubble or breakout? Nvidia earnings put AI boom under the microscope

- Modi ally and political scion fuels investment boom in southern Indian state

- Volkswagen pares India EV development costs amid hunt for partner

- Crude oil imports from Russia strong at around 1.8-1.9 Mbd between Nov 1-Nov 18: Kpler

- Foreign holdings of US treasuries near record high in September

- China raises $4.6 billion in euro bonds on strong investor demand

- Americans avoid challenging physical work: Elon Musk on H-1B visa row