.png)

Budget 2026–27: How the Rupee Comes and Goes Signals Continuity

A close of How the Rupee Comes and Goes at the Union Budget 2026–27 reveals stability, with modest shifts in direct taxes, steady borrowing, and a gradual tilt towards defence and centrally run schemes rather than abrupt fiscal change.

February 1, 2026 at 8:58 AM IST

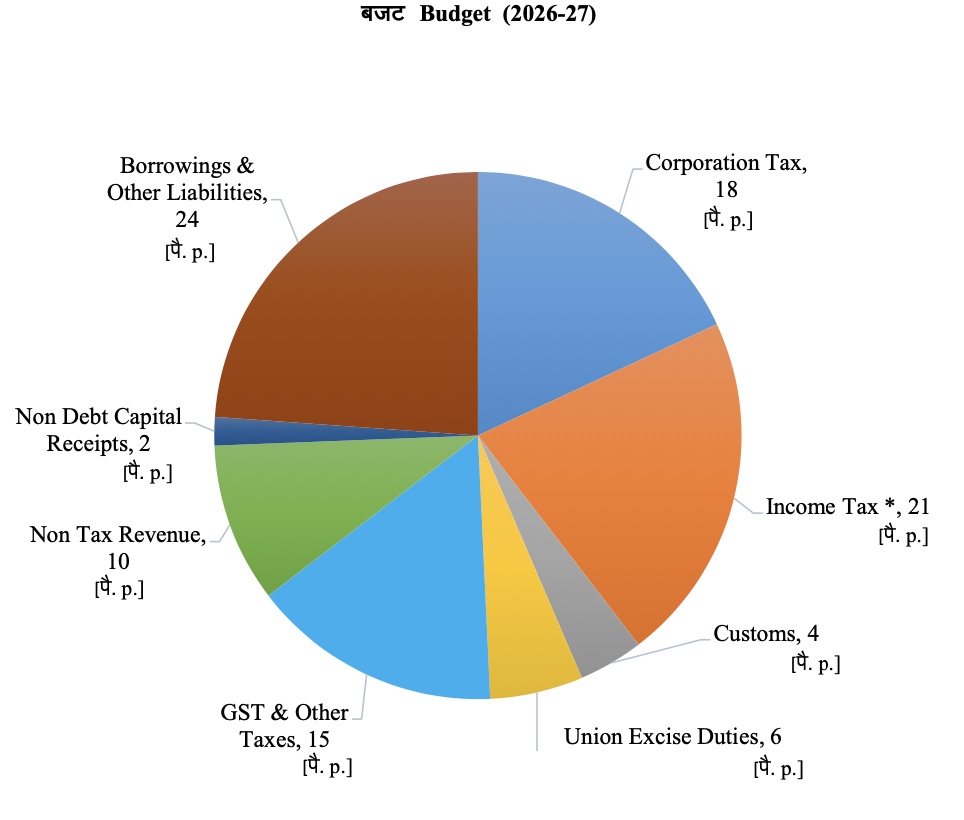

Budget 2026–27 pegs total receipts at ₹53.47 trillion. A comparison of how a rupee comes in and where it goes, based on the Union Budget 2026–27 charts, points to continuity rather than disruption.

On the receipts side, the overall structure remains stable, with taxation and borrowing continuing to dominate. Direct taxes, though, show a subtle shift in composition. Income tax accounts for 21% of total receipts in 2026–27, down from 22% in 2025–26, while corporation tax rises to 18% from 17%, signalling confidence in corporate profitability and compliance-led buoyancy.

Indirect taxes display marginal rebalancing. GST and other taxes soften to 15% from 18%, while customs duties remain unchanged at 4%. Union excise duties edge up to 6% from 5%, suggesting selective reliance rather than broad-based rate hikes. Non-tax revenue is budgeted at 10%, up from 9%, reflecting conservative assumptions on dividends and surplus transfers relative to the previous year.

Borrowings and other liabilities remain steady at 24%, underlining that fiscal consolidation is being pursued through gradual deficit reduction rather than abrupt cuts to borrowing. Non-debt capital receipts stay modest at 2%, again pointing to cautious expectations from disinvestment and asset monetisation.

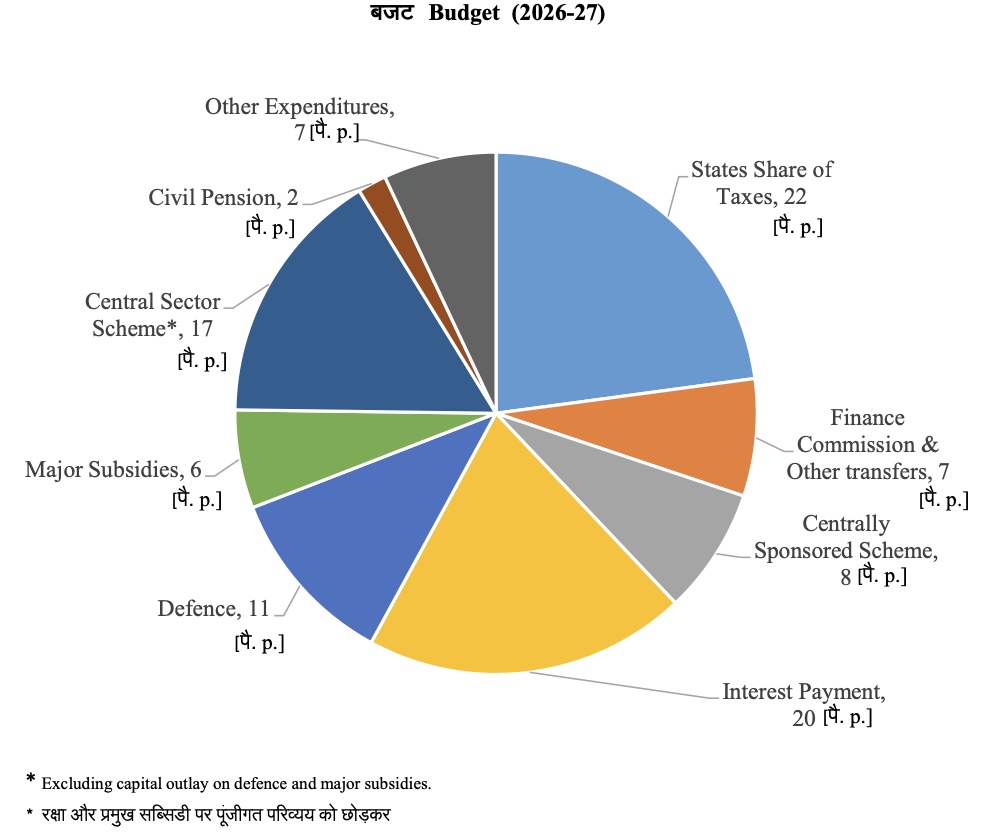

On the expenditure side, the most notable feature is stability in transfers to states. States’ share of taxes remains at 22%, reflecting continued adherence to Finance Commission devolution principles. Finance Commission and other transfers decline to 7% from 8%, indicating mild consolidation in discretionary transfers as statutory devolution takes precedence.

Interest payments are unchanged at 20%, highlighting the persistent drag of legacy debt despite improving deficit ratios. Defence expenditure rises to 11% from 10%, marking a clear upward tilt in security-related spending.

Spending on central sector schemes increases to 17% from 16%, reinforcing the Centre’s preference for directly implemented programmes. Centrally sponsored schemes remain unchanged at 8%, signalling no material shift in shared programme design.

Major subsidies stay flat at 6%, confirming that subsidy rationalisation achieved in earlier years is being maintained. Civil pensions remain stable at 2%, while other expenditure declines to 7% from 8%, creating fiscal space for higher capital outlay.

Overall, the year-on-year comparison shows a budget that favours predictability over sharp course correction. Incremental strengthening of direct taxes, steady borrowing, disciplined subsidies, and slightly higher defence and central scheme spending define how the rupee comes and goes in 2026–27.