.png)

US-China Trade Truce Talk Sparks Global Rebound, Boosts Risk Appetite

Here’s your quick read to start the day: a chatty, no-fuss look at overnight moves, the big story, what’s on the docket, and the tickers you need to watch.

Richard is an independent financial journalist who tracks financial markets and macroeconomic developments

October 27, 2025 at 1:58 AM IST

GLOBAL MOOD: Cautiously Risk-on

Signs that the US and China were nearing a trade deal triggered a cross-asset rally, lifting stocks and oil prices. The announcement of a “substantial framework” to avert new tariffs and delay China’s rare earth export curbs has eased fears of further trade escalation, boosting appetite for risk assets such as equities and commodities. The global mood has shifted to guarded optimism, with markets positioning for a potential breakthrough in trade talks while keeping a watchful eye on economic and policy headwinds.

TODAY’S WATCHLIST

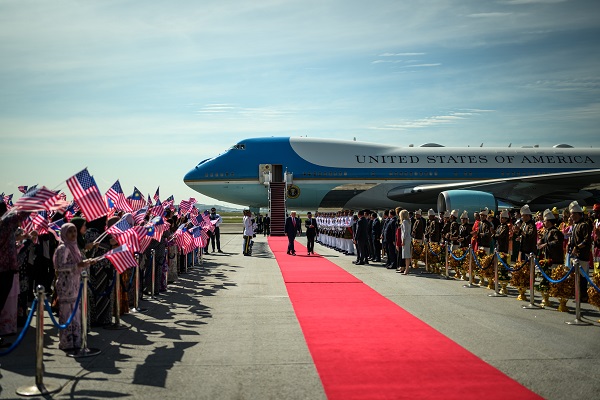

- Trump at Asean Summit,

- US-China Trade Talks

THE BIG STORY

The framework will form the basis of Trump and Xi’s upcoming talks, aimed at restoring stability to global trade and easing tensions that have roiled financial markets in recent months.

Data Spotlight

US consumer prices rose slightly less than expected in September, reinforcing expectations that the Federal Reserve will cut interest rates again this week. The Consumer Price Index increased 0.3% month-on-month, following a 0.4% rise in August, as a 4.1% jump in gasoline prices was offset by cooling rents and lower costs for airfares, hotels, and used cars. Despite data collection challenges from the government shutdown, the Labor Department said the CPI report remained representative, with missing data estimated through standard imputations.

Meanwhile, the S&P Global US Composite PMI rose to 54.8 in October 2025, the highest since July, signalling resilient private sector growth. Both manufacturing at 52.2 and services at 54.2 expanded, supported by stronger domestic demand, even as export orders declined.

Takeaway:

WHAT HAPPENED OVERNIGHT

- US Stocks hits record highs on cooler inflation and strong earnings

- All three major US indexes closed at record highs on Friday, boosted by softer inflation data and robust corporate earnings.

- Alphabet rose 2.7% after Anthropic expanded its deal to use up to one million of Google’s AI chips for training its Claude chatbot.

- Coinbase surged 9.8% following a JPMorgan upgrade to “overweight” from “neutral.”

- Ford jumped 12.2% and General Dynamics gained 2.7% after both companies beat Q3 earnings estimates.

- All three major US indexes closed at record highs on Friday, boosted by softer inflation data and robust corporate earnings.

- US Treasury yields steady as soft CPI reinforces Fed rate cut bets

- The 10-year US Treasury yield briefly dipped below 4% following the CPI release before edging back to 4%.

- Treasury yields were little changed to modestly higher on Friday as investors digested cooler-than-expected inflation data.

- Both headline and core inflation rose less than expected, bolstering confidence that the Fed will cut rates by 25 bps at this week’s policy meeting.

- The 10-year US Treasury yield briefly dipped below 4% following the CPI release before edging back to 4%.

- US Dollar eases as soft inflation cements Fed rate cut bets

- The dollar index slipped to 98.8 on Friday after cooler-than-expected inflation data strengthened expectations of two more Fed rate cuts this year.

- Traders are now pricing in a 25 basis points cut at the upcoming FOMC meeting, with similar odds for a second cut before year-end.

- The dollar index edged down 0.02% to 98.92, while the euro firmed 0.1% to $1.1629.

- The dollar index slipped to 98.8 on Friday after cooler-than-expected inflation data strengthened expectations of two more Fed rate cuts this year.

- Crude oil prices slips as doubts grow over US sanctions on Russia

- Brent crude oil prices eased on Friday as traders questioned the US administration’s resolve to fully enforce sanctions on Russia’s top oil producers, Rosneft and Lukoil, announced last week.

- Brent crude settled 0.1% lower at $65.94 per barrel, while WTI crude fell 0.5% to $61.50 per barrel.

- Brent crude oil prices eased on Friday as traders questioned the US administration’s resolve to fully enforce sanctions on Russia’s top oil producers, Rosneft and Lukoil, announced last week.

Day’s Ledger

Economic Data

- Euro Sep M3 Money Supply

Corporate Actions

- Jul-Sep Earnings: Adani Energy Solutions, Bata India, Chennai Petroleum Corporation, Indus Towers, Indian Oil Corporation, JK Tyre and Industries, Jubilant Ingrevia, KFin Technologies, Mazagon Dock Shipbuilders, PNB Housing Finance, Raymond, SRF, Sona BLW, Supreme Industries, Tata Investment Corporation

- D&H India to consider rights issue

- Sylph Technologies to consider bonus share issue

Policy Events

- ECB Elderson Speech

- ECB Tuominen Speech

- BoE Oakes Speech

TICKERS TO WATCH

- NOVARTIS nears deal to acquire Avidity Biosciences for over $70 per share

- LENSKART to launch IPO on Oct 31, aims to raise ₹21.50 billion via fresh issue

- VEDANTA raises $500 million via bond issuance to repay near-term obligations

- RELIANCE investments in AI infra may top $12-15 billion: Morgan Stanley

- JSW ENERGY looks to operationalise Pune's 5 GWh battery assembly unit in Q3

- UNILEVER, L'ORAL report strong growth from India's qcom, online channels

- ASHIANA HOUSING eyes ₹3.50 billion revenue from housing project in Jamshedpur

- NCC bags ₹68.28 billion order from Coal India arm to extract, transport coal

- BLACKSTONE to invest ₹62 billion crore for 9.99% stake in Federal Bank

Must Read

- Donald Trump strikes trade, critical minerals deals in Southeast Asia

- Steel industry flags price pressure from cheap imports ahead of key meet

- India cutting back Russian oil purchases 'completely': Donald Trump

- Agriculture needs more automation to make it a lucrative business

- US, China Sound Confident Note After Trade Talks

- Trump Says He Will Raise Tariffs on Canada by 10% Over Ontario Ad

- State Department Intelligence Agency Dissented Over Putin’s Appetite for Peace

See you tomorrow with another edition of The Morning Edge.

Have a great trading day.

When SEBI’s Discretion Overshadows Deterrence and Investor Trust

When Enforcement Looks Negotiable, Trust Becomes the Casualty

Indra Chourasia writes, SEBI’s settlement framework was meant to deliver swift justice, but growing discretion now risks diluting deterrence.