.png)

Alok Kumar Mishra is a professor at the University of Hyderabad, researching financial economics and public policy. Akash Das and Soumili Sen are Master of Financial Economics students working with Mishra for their dissertation.

March 24, 2025 at 9:38 AM IST

Purchasing stocks that have performed well recently and selling those that have performed poorly are two components of the momentum investing method. It is predicated on the idea that assets that have historically performed well would do so again in the future, and vice versa. Usually, this approach is based on past returns and price trends over predetermined periods of time, such as six or twelve months. In order to sell at a higher price, momentum investors hold onto the belief that the rising price momentum will last for a little longer.

Thanks to developments in algorithmic trading and data analytics, momentum investing is becoming more popular in India. Large datasets are processed by sophisticated algorithms to find equities with strong trends, enabling quick trade execution. Furthermore, predictive models that adjust to changing market conditions are being improved by machine learning and artificial intelligence, which raises the precision of momentum signals.

Additionally, momentum techniques are being supported by regulatory advancements. In an effort to democratise sophisticated trading tools that were previously only available to institutional players, SEBI is looking into extending algorithmic trading access to individual investors.

Why Momentum Works in the Indian Market?

Momentum investing thrives in India due to a combination of structural inefficiencies and behavioral factors. The market’s heavy retail participation often leads to delayed reactions to news and earnings, creating price trends that momentum strategies exploit. Mid- and small-cap stocks, which dominate the market, face liquidity constraints and information asymmetry, further amplifying momentum effects as prices adjust slowly.

Empirical evidence shows that momentum portfolios, particularly in sectors like IT and consumer goods, consistently outperform broader indices, especially during bull markets. This is driven by positive investor sentiment reinforcing trends. Additionally, the rise of institutional investors using advanced algorithms and retail participation through momentum-based ETFs has strengthened the strategy’s effectiveness. Regulatory support from SEBI, aimed at improving transparency and liquidity, has also fostered a conducive environment for momentum investing.

Further, there is an increasing concern of huge losses in future and options trading for retail investors. According to SEBI, nine out of ten investors lose money in F&O. This is because major focus has mostly been on minimising diversifiable risks leaving little scope for studying the extent of mitigating the non-diversifiable risks. Momentum investing strategies provides the scope to study further the volatility patterns and price movements that can help researchers tailor hedging strategies that can be efficiently applied to momentum portfolios and generate returns even in economic downturns.

Data-Driven Strategies for Identifying Momentum Stocks

The MSCI Momentum indices provide as an example of the methodical, data-driven approaches used to choose momentum equities. Among the crucial actions are:

• Selection of the Universe: Stocks are selected from an MSCI Index parent.

• Momentum Score Calculation: To minimise volatility, the most recent month is excluded from the calculation of six-month and twelve-month price momentum (adjusted for risk-free rates).

• Risk Adjustment: Annualised volatility is used to standardise momentum scores and account for risk. To lessen the impact of outliers, extreme values are winsorised.

• Weighting and Security Selection: The stocks with the highest momentum z-scores are chosen. Diversification is ensured through weighting based on market capitalization and momentum score.

• Rebalancing and Buffer Rules: To reduce turnover and improve stability, buffer rules are implemented and the index is rebalanced every six months.

This methodical procedure guarantees that, while preserving liquidity and risk management, the MSCI Momentum Index successfully reflects the momentum component.

Momentum Investing: Navigating Risks and Challenges

Even while momentum investing is appealing, there are inherent risks involved:

• High Volatility: During downturns, momentum stocks are vulnerable to abrupt corrections. Because of this volatility, mutual funds that track the NIFTY 200 Momentum 30 Index are categorised as "very high risk."

• Sector Concentration: Momentum portfolios frequently favour underperforming industries (such as IT and FMCG), which raises exposure to risks unique to such industries.

• Market Cycles: While momentum techniques perform well in trending markets, they may not be as effective in sluggish or consolidating markets, which could result in poor performance or increased trading expenses.

The Road Ahead for Momentum Investing in India

In India's ever-changing financial landscape, momentum investing has become a popular tactic thanks to equities' propensity to maintain their current trends. This strategy can generate significant revenues if it is implemented with strong data analytics and strict risk management.

Top 10 Momentum Stocks Based on the Latest Data

In order to demonstrate the use of momentum investing, we examined the performance of every stock chosen for our momentum index and chose the top 10 stocks using a methodical process that gives priority to cumulative returns, low volatility, and high momentum scores. The analysis is based on the daily data spanning from Jan 3, 2022, to Mar 13, 2025.

[Note: While the methodology follows established principles of momentum index construction, the results are subject to limitations such as data constraints, model assumptions, and potential biases in stock selection. Given the dynamic nature of financial markets, these rankings are not absolute and may fluctuate based on future price movements and volatility patterns.]

Backtesting Momentum Strategies: Evaluating Performance and Predictability

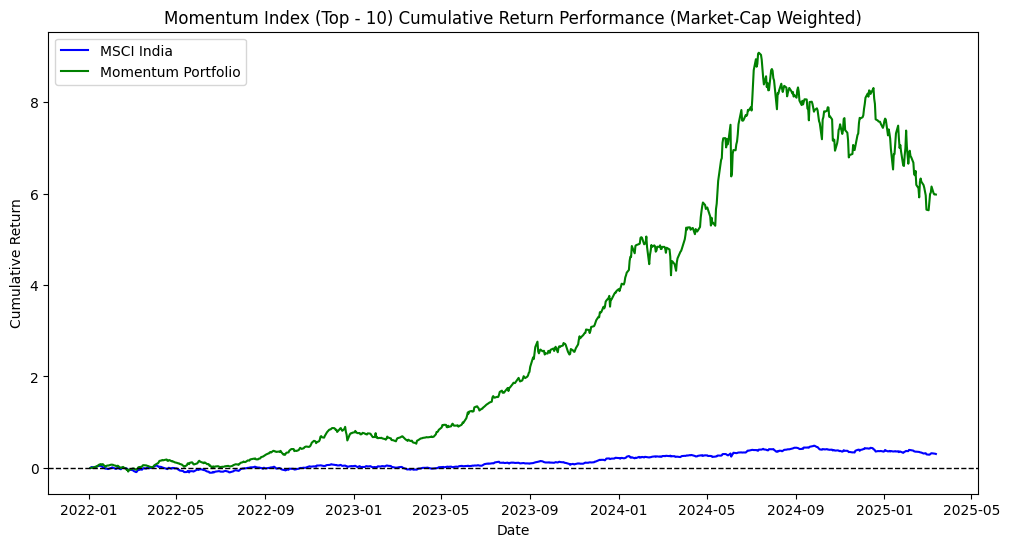

The performance comparison between the momentum portfolio and the MSCI India Index (in both cases the top 10 stocks were considered) highlights the significant return potential of a systematic momentum strategy in Indian equities. The momentum portfolio exhibits strong outperformance, particularly from early 2023 onward, where it sharply diverges from the MSCI India Index and reaches cumulative returns exceeding eight times the initial investment by mid-2024.

This suggests that high-momentum stocks have delivered exceptional gains in recent years, likely fueled by bullish market conditions and investor risk appetite. However, the momentum portfolio also shows increased volatility, with notable drawdowns in late 2024 and early 2025, indicating the inherent risks of trend-following strategies.

The MSCI India Index, in contrast, maintains a stable and gradual upward trajectory, reinforcing its role as a broad-market benchmark with lower volatility. The divergence between the two portfolios suggests that momentum investing captures a distinct return profile, benefiting from strong uptrends but also being vulnerable to rapid reversals. This performance pattern underscores the importance of risk management in momentum strategies, as their high return potential comes with increased exposure to market fluctuations.

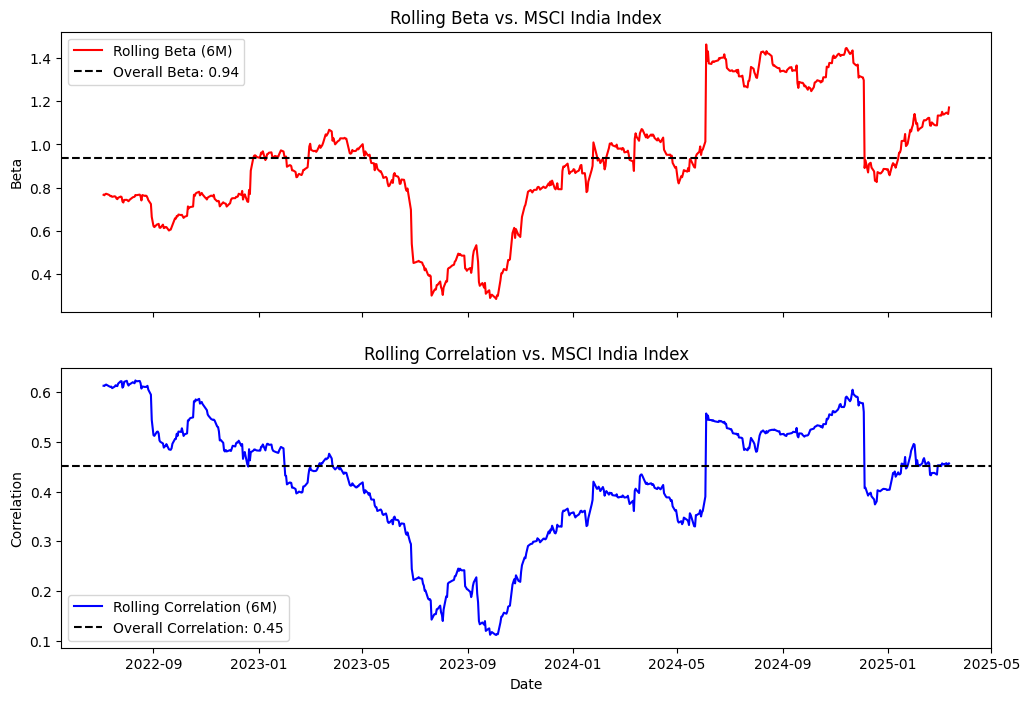

The rolling beta and correlation analysis highlight the adaptability and potential diversification benefits of the momentum portfolio relative to the MSCI India Index. The overall beta of 0.94 suggests that, on average, the portfolio maintains a balanced exposure to market movements, neither excessively aggressive nor overly defensive. The fluctuations in rolling beta demonstrate the strategy’s ability to dynamically adjust to different market conditions, with lower beta periods offering downside protection and higher beta phases capturing strong uptrends.

The rolling correlation further emphasises the distinct nature of the momentum portfolio. While the overall correlation remains moderate at 0.45, there are extended periods where correlation declines significantly, particularly in 2023.

This suggests that the portfolio moves independently of the broad market at times, making it a valuable tool for diversification. As correlation recovers in 2024, the portfolio aligns more with broader market trends, potentially benefiting from bullish sentiment and sustained momentum. These findings reinforce that momentum investing is not only capable of delivering strong returns but also offers periods of differentiated performance, making it a compelling strategy for investors looking to enhance portfolio efficiency and capture market trends.

| Investment | Initial Value | Final Value | Total Profit/Loss | Return |

| Momentum Portfolio | ₹ 100.00 | ₹ 698.01 | ₹ 598.01 | 598.01% |

| MSCI India Index | ₹ 100.00 | ₹ 130.53 | ₹ 30.53 | 30.53% |

The backtest results reveal a striking outperformance of the momentum portfolio compared to the MSCI India Index over the investment horizon. A ₹100 investment in the momentum portfolio on Jan 3, 2022, would have grown to ₹698.01 by Mar 13, 2025, delivering a total profit of ₹598.01, reflecting the strong compounding effect of momentum-based investing.

In contrast, the same ₹100 investment in the MSCI India Index would have yielded a final value of ₹130.53, resulting in a modest profit of ₹30.53. This stark difference underscores the potential of momentum strategies in capturing high-performing stocks and sustaining superior returns over time, significantly outpacing the broader market. The results further highlight the robustness of a systematic momentum approach in generating alpha, particularly in the evolving landscape of the Indian equity market.

Integration of AI and Machine Learning

Stock selection procedures have been completely transformed by the development of artificial intelligence and machine learning. With the use of these tools, large datasets may be analyzed to find trends and make more accurate stock movement predictions. Leading Indian firms, such as Tata Elxsi and Tech Mahindra, are creating AI-powered solutions for a range of sectors, which in turn affects investment plans.

Strategic Insights for Investors: Key Considerations for Smart Investing

Even though momentum investing has enticing returns, diversification and thorough risk management are essential when using this method. Potential downturns in particular areas can be lessened by diversifying across industries and asset classes. Furthermore, using AI and ML techniques can improve decision-making and risk assessment, resulting in investment portfolios that are more resilient.

To sum up, investors have exciting potential when momentum investing and cutting-edge technologies are combined. But as our stock selection exercise showed, constant improvement, verification, and adjustment to market conditions are essential to optimizing the efficacy of this approach.

The views expressed in this article are those of the authors alone. This article is for informational purposes only and does not constitute investment advice or recommendations. Readers should consult a SEBI-registered advisor before making investment decisions.