.png)

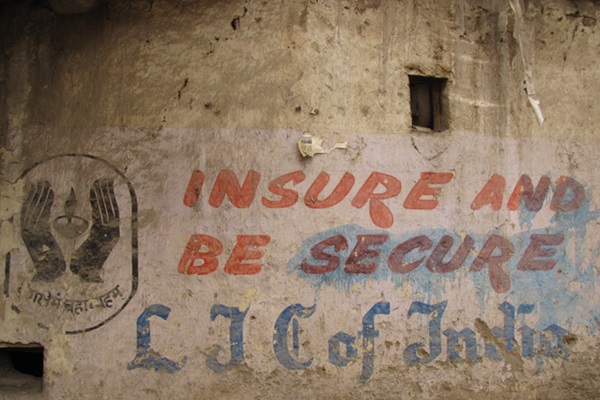

High Lapse Rate of Life Insurance Policies in India and Why It Matters

Nearly half of India’s life insurance policies lapse within the first five years. As the country pushes “insurance for all”, the money and protection lost through lapses remain largely unexamined.

Alpana Killawala has spent more than 25 years in the RBI shaping its communication policy. She likes to share whatever she has learnt while on the job. Her book “A Fly on the RBI Wall: An Insider’s View of the Central Bank” does just that.

January 30, 2026 at 5:22 AM IST

Recently, my house help asked me to check her life insurance policy. Unfortunately, the policy had lapsed. I also casually checked the amount she would have to pay to revive it. With the premiums and the interest due, the total amount to revive the policy came to nearly ₹100,000. The question for the house help now was whether to pay the overdue amount of ₹100,000 or let go of what she had already paid. She had only one choice. She had to forego the amount already paid, as there was no way she could have paid ₹100,000 in one go to revive the policy. That made me wonder how many life insurance policies lapse each year, and what must be happening to the money insurance companies receive in premiums while the policies are still in force?

Lapsed policies

The total number of new individual life policies issued annually is around 25-30 million.

And yet, India’s insurance penetration rate remains at a paltry 3.7%. Insurance penetration for the life insurance industry, in fact, declined from 2.8% in 2023-24 to 2.7% during 2024-25. The penetration rate is generally driven by growth in premiums collected. It does not take into account lapsed policies. If the penetration number is calculated net of lapsed policies, it could be even lower.

At a time when the government and insurance companies are making all-out efforts to bring more people, especially those in the low-income bracket, under insurance coverage, such a low penetration rate is alarming. The purpose of life insurance - term or endowment - is ultimately to offer some kind of social security to the insured. However, discontinuation of policies, for whatever reasons, defeats the very purpose of the ‘insurance for all by 2047’ drive.

Why do policies lapse?

Policies lapse when the insured misses a premium payment. Premiums are often missed due to financial difficulties such as job loss, debt, and hospitalisation. There are cases in which the insured finds the premium too high or considers the policy a worthless ‘expense’ because no return (interest or dividends) is received on it. This typically happens after the policy has run for a couple of years. And the reason behind this is mis-selling, a mismatch between the product and customer expectations and/or inadequate information about the policy and the consequences of non-payment of future premiums being shared with the insured by intermediaries. Further, the intermediaries often do not care to remind the insured of the premium due date because commissions are low.

How can the issue of lapsed policies be tackled?

Additionally, can there be a minimum qualifying criterion for appointing individual intermediaries, just as the mutual fund industry has a qualifying test for mutual fund agents? And once appointed, they should also be required to periodically update their knowledge. Some kind of licensing and renewal of licence.

Renewing the policy

One-time settlement?

Can the revival of the lapsed policy, for instance, be treated like the non-performing asset of a bank and be restructured? This may require insurance companies to forego interest and penalties, perhaps even some part of the premium due. Cases may also require reducing future premium amounts and extending the number of years for which premiums will have to be paid. In all deserving cases, like the house help’s case above, offering such restructuring would be worthwhile. The insured would not have to forego the amount already paid, would have a lower, more convenient premium to pay going forward, and would continue to be covered. The insurance companies, too, would not have to lose a customer. In case the insured does not wish to revive the policy, as a one-time measure, all premiums paid should be returned, with a token penalty if necessary, after asking the insured one final time whether they would wish to revive the policy with the conditions relaxed as suggested above.

Cases of non-payment of premiums are best viewed with empathy, especially when insurance is the only social security available to lower-income groups. The government should treat money involved in lapsed policies as unclaimed financial assets and bring them under the ‘aapka paisa aapka adhikar’ campaign. This would increase insurance penetration in a far more meaningful way.